Solana price is hovering around $125, but recent price behavior suggests downside risk is increasing. A weakening support retest has shifted attention toward the $107 level, even as SOL ETF inflows continue to cushion broader selling pressure.

Support Retest Weakens as Structure Softens

On the 4-hour chart, well-known cryptocurrency analyst Ali Charts, with over 160k followers on X (Twitter), notes that Solana appears to be retesting a prior channel breakdown zone rather than reclaiming it.

The price has struggled to hold above the $124–$125 area, and momentum has failed to follow through on recent rebounds. This type of retest often determines whether a breakdown is invalidated or confirmed. In this case, the lack of strength increases the probability of a lower continuation, with $107 identified as the next major downside level if support gives way.

Bitcoinsensus, another chartist, places this short-term weakness in a broader historical context. Their chart shows Solana price consolidating again after a long sideways phase, similar to the structure that preceded its last major rally.

However, while previous consolidations resolved higher, the current range is now being tested from above. Until price reclaims the upper portion of the range, consolidation alone does not negate near-term downside risk.

Liquidity Skew Favors Upside, But Solana Price Hasn’t Triggered It

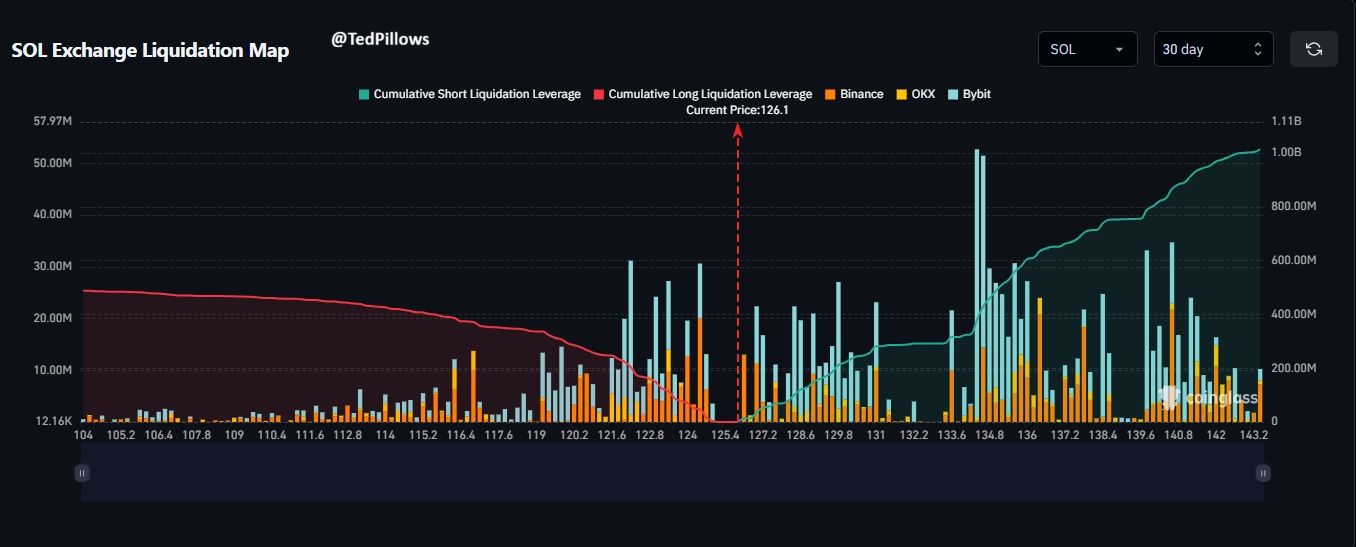

Derivatives data from shows that liquidation pressure is heavily skewed to the upside. According to recent data shared by Ted Pillows, 15% rally in SOL price would trigger roughly $1.06 billion in short liquidations, compared with $474 million in long liquidations on a 15% drop.

This imbalance suggests that any sustained move higher could accelerate quickly. However, liquidation pressure only activates after price moves. For now, Solana price remains pinned below resistance, leaving the downside technically exposed.

Solana ETF Inflows Stabilize, Retail Activity Diverges

Spot Solana ETFs continue to absorb supply. Over the past week, ETFs recorded $35.18 million in net inflows, extending a 33-day streak totaling $946.78 million since October 2025 as of December 19, according to data.

Bitwise’s BSOL leads with $645 million in assets under management. These inflows help explain why the Solana coin has not broken sharply lower despite a weakening price structure.

At the same time, daily active wallets have fallen by 87% since January, suggesting reduced retail participation. This divergence points to the fact that institutions are providing stability, but not enough demand to reverse short-term technical weakness.

READ MORE: Bitcoin Price Prediction: Here’s Why a BTC Crash is Coming