Bitcoin price is stuck below the important $90,000 level, with buyers remaining on the sidelines. BTC was trading at $88,275, down sharply from the year-to-date high of $126,300. This weakness may continue as ETF inflows drop and options expiry looms.

BTC Options Expiry Nears as ETF Outflows Continue

Bitcoin price remained on edge as demand for the coin in the exchange-traded fund (ETF) industry waned. Data compiled by SoSoValue shows that the funds shed over $497 million last week.

This outflow erased all the gains made in the previous week when they added over $286 million. Cumulative inflows have slipped by over $5 billion in a few months to the current $57 billion. Top ETFs by companies like BlackRock, Fidelity, and Grayscale have all shed assets in the past few months.

Bitcoin price could come under pressure this week if ETF inflows remain elusive. This is a possibility as many investors will likely be in holiday mode.

Meanwhile, traders will focus on the upcoming Bitcoin options expiry of about $23.6 billion, which is scheduled for Friday. Data shows that calls are clustered between $100k and $120k, while puts are concentrated at $85,000.

The maximum pain, the position where most trades expire worthless, is $96,000. Historically, Bitcoin prices tend to underperform the market ahead of an upcoming options expiry.

Meanwhile, some analysts maintain a bearish outlook for the coin. For example, in a recent note, Jurrien Timmer, a top analyst at Fidelity, warned that the coin may drop to $65,000.

He explained that the year-to-date high of $126,300 was the record in both price and time. He expects that the coin will drop in 2026 and then rebound in 2027.

Other analysts also have mixed opinions on Bitcoin. For example, in a recent report, Coinbase Institutional predicted that the Bitcoin price will perform sluggishly next year and then rebound later in 2026.

Still, it is worth noting that most annual predictions, including those from the best investors, rarely come true. Also, Bitcoin often does well when most analysts are bearish.

Bitcoin Price Technical Analysis

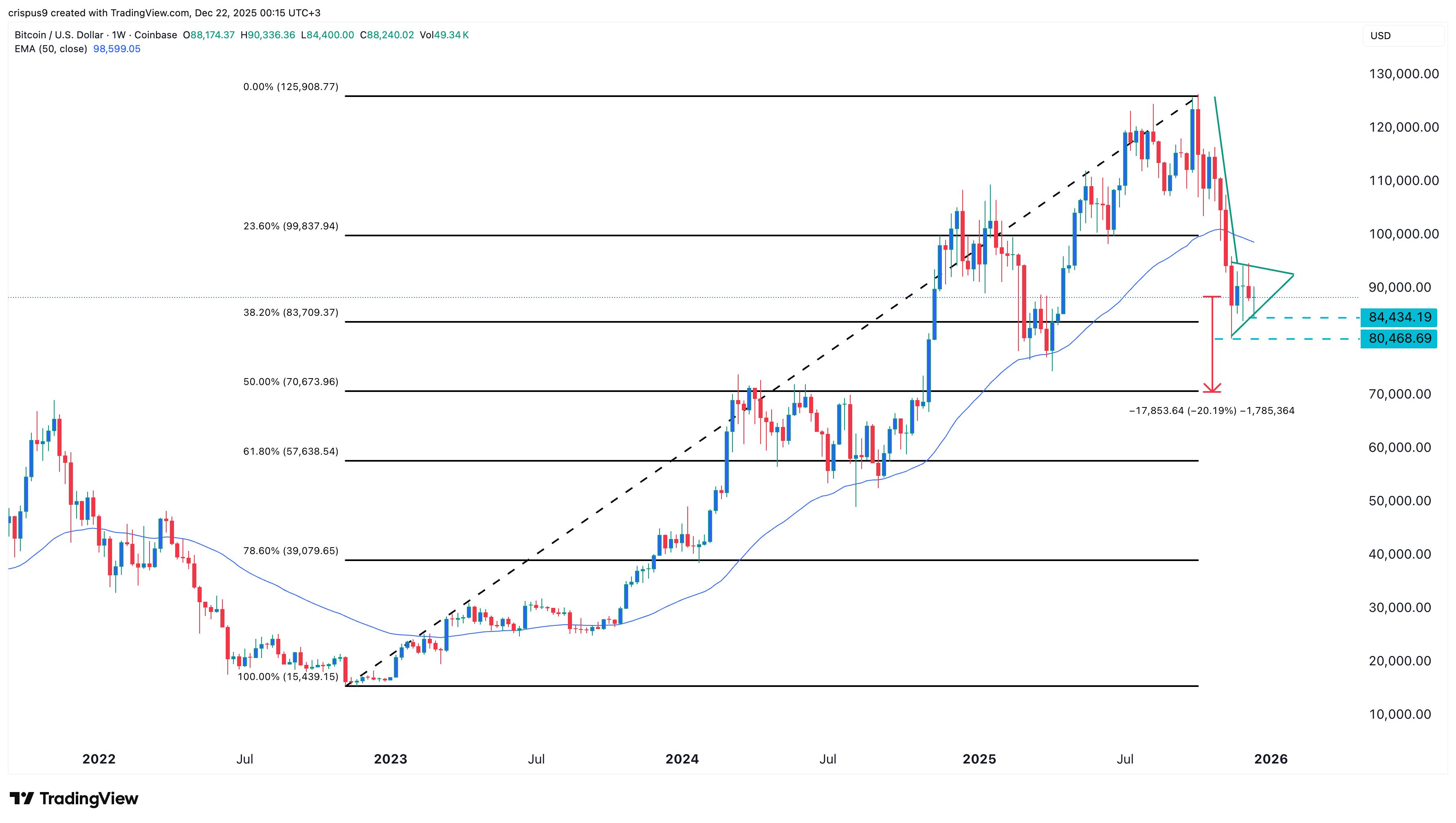

The weekly chart shows that the BTC price has crashed in the past few months, moving from a high of $126,300 to the current $88,250. It has formed a giant bearish pennant pattern, consisting of a vertical line and a symmetrical triangle.

The coin is hovering near the 38.6% Fibonacci Retracement level. It has also dropped below the 50-week Exponential Moving Average (EMA).

Therefore, the coin will likely have a strong bearish breakout, potentially to the 50% retracement level at $70,693, which is about 20% below the current level.

READ MORE: Silver Price Surged and Beat Gold, Crypto in 2025: Is a Crash Coming?