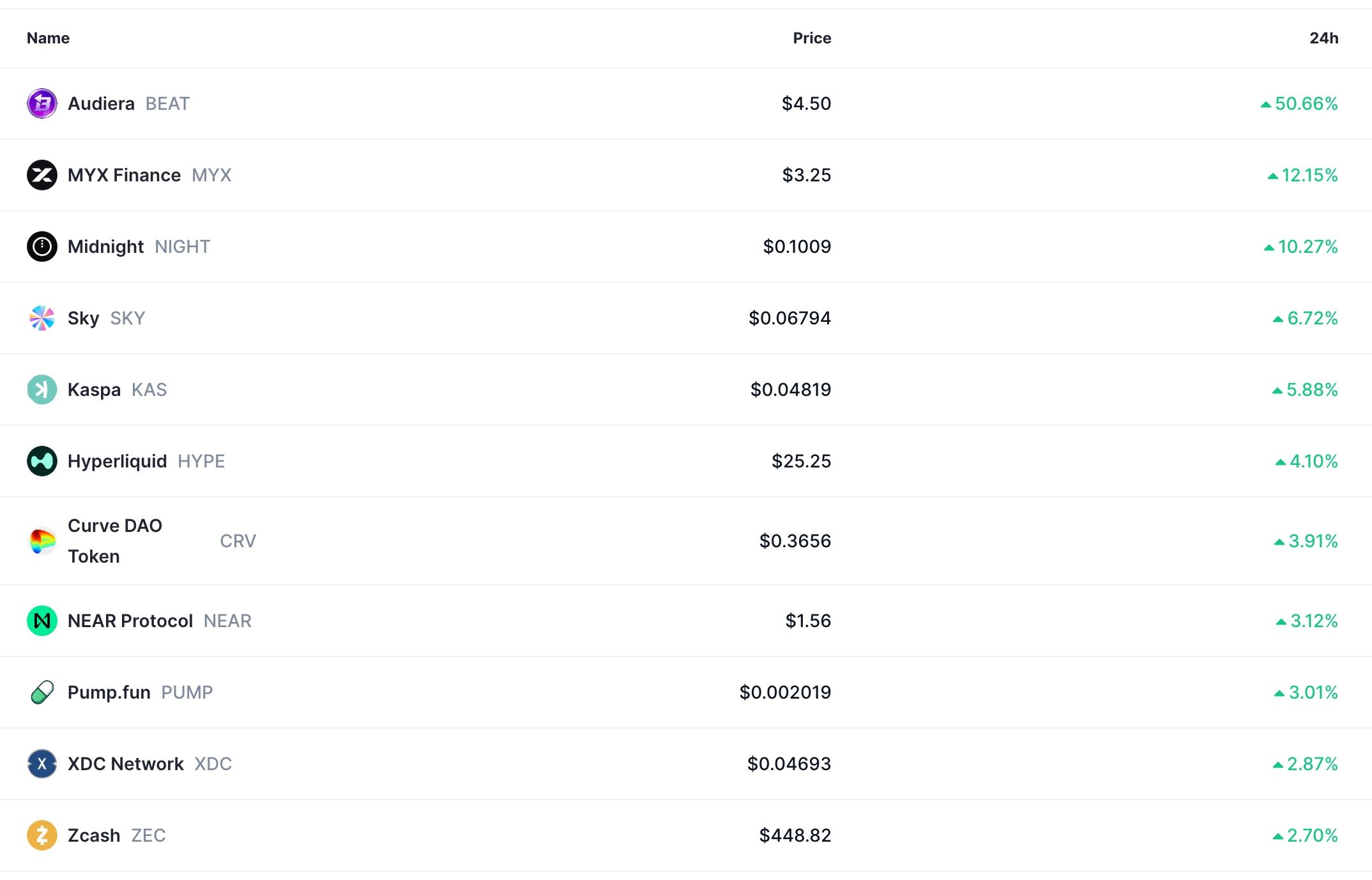

The crypto market is up today, with Bitcoin and top altcoins continuing the bull run that began over the weekend. Bitcoin jumped to $90,000, while Midnight (NIGHT) surged by 11%, with its 24-hour volume hitting $8 billion.

Other top leaders in this crypto market rally included Avantis (AVNT), Audera (BEAT), and Meteora.

Crypto Market Going Up Amid Santa Claus Rally Hopes

One main reason behind the ongoing crypto market rally is the rising hopes of a Santa Claus rally. This rally is defined as a situation where Bitcoin, cryptocurrencies, and other assets jump a few days before Christmas Day.

Historical data on whether this rally occurs are mixed, with some reports suggesting it does. Others dispute it, pointing to periods when the stock and crypto markets plunged during the Christmas season.

Still, the rally may be due to investors buying coins, hoping the bull run will resume.

READ MORE: AVAX Price Prediction: Avalanche Eyes Record Low Despite Bullish Catalysts

Buying the BoJ Rate Hike Decision

The crypto market is rising as investors continue to buy amid the BoJ interest rate hike. As was widely expected, the bank decided to hike rates by 0.25%, pushing them to the highest level in three decades. Most importantly, the bank sent mixed signals on what to expect in the coming year.

While the BoJ rate hike is bearish for Bitcoin and other cryptocurrencies, it was already priced in. Indeed, Polymarket data showed that the odds of a rate hike were 99%.

Therefore, assets that dropped before the rate hike have rebounded. For example, the Nikkei 225 Index jumped by over 1% today, while the Japanese yen retreated.

Rising Futures Open Interest

Meanwhile, the crypto rally is underway as the industry’s futures open interest continues to rise. Its interest rose by 60 basis points on Monday to over $130 billion. Bitcoin’s open interest has rallied to $60 billion, while Ethereum’s figure rose to over $38 billion.

Soaring futures open interest is a sign that bulls are starting to deploy leverage in the crypto industry, driving more demand. At the same time, short liquidations jumped by 146% to $200 million.

Still, as we have seen in the past crypto rallies, this rebound could be a dead-cat bounce or a bull trap. A dead-cat bounce is a situation in which investors buy an asset in free fall, only for it to resume the downtrend.

READ MORE: NIGHT Crypto Price Prediction as Cardano’s Midnight Token Hits $6B Milestone