Shiba Inu Coin price fell by nearly 70% in 2025, erasing billions of dollars in value. It lagged behind other top cryptocurrencies like Bitcoin, Ethereum, and Solana. This article explores the top reasons SHIB crashed this year.

Shiba Inu Coin Price Crashed as Meme Coins Hype Dropped

The main reason the SHIB price plunged is that meme coins lost favor with investors throughout the year. Data compiled by CoinGecko shows that the market capitalization of all meme coins plunged to $39 billion, down from the year-to-date high of over $100 billion.

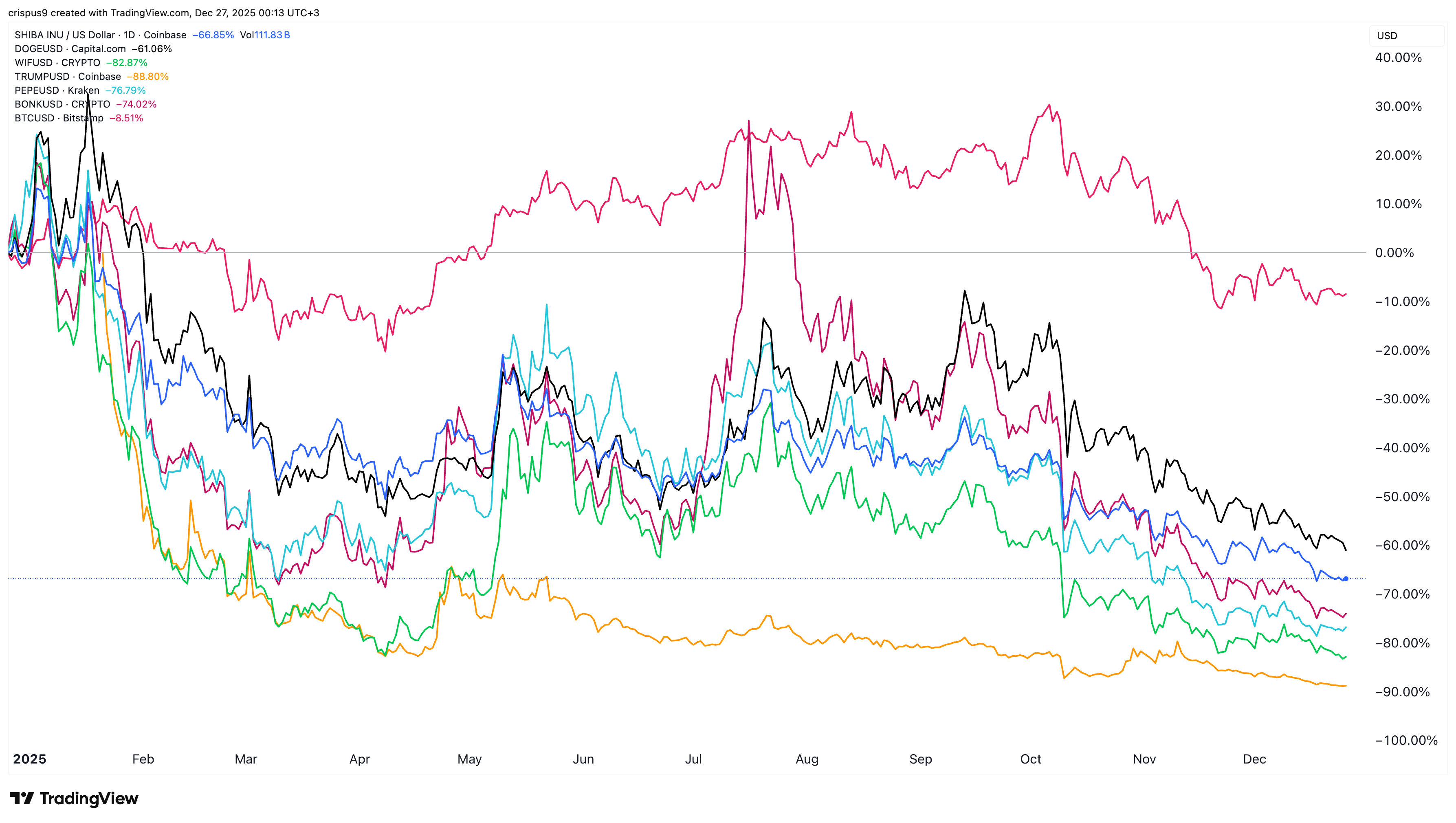

As the chart below shows, top meme coins like Dogecoin, TRUMP, Dogwifhat, Pepe, and Bonk all plunged by over 60% this year. In contrast, Bitcoin price dropped by less than 10%, while its dominance in the crypto market rose.

READ MORE: Here’s Why the Crypto Market Crashed Suddenly Today

Shibarium Woes Escalated

Meanwhile, the Shiba Inu price also plunged as the Shibarium network’s woes escalated. Shibarium, its layer-2 network, has not gained momentum since its launch a few years ago.

For example, data compiled by DeFi Llama shows that the network has attracted just 18 developers. Its total value locked (TVL) has plunged by 18% in the last 30 days to $1.45 million.

The TVL figure is so low, which suggests people are using it and that developers are not interested in the network. For example, its numbers are much lower than those of other newer networks like Canton, Monad, and Plasma.

Shibarium’s woes escalated in September when it was hacked, resulting in between $2.3 million and $4.1 million in losses. The attacker used a flash loan to acquire 4.6 million BONE tokens, then temporarily delegated them to control the validator keys.

Other Reasons Why the SHIB Token Crashed

There are other reasons the SHIB token crashed, including the fact that no company applied for an ETF spot during the year. Instead, these companies filed for ETFs on other meme coins like Dogecoin, TRUMP, and other meme coins like Bonk.

Another reason why it dropped is that it experienced low volume and futures interest, a sign that demand waned. For example, SHIB had a 24-hour volume of $112 million on Friday, much lower than Dogecoin’s $1.14 billion, Pepe’s $211 million, and TRUM’s $147 million. Its futures open interest is largely non-existent.

READ MORE: Polygon Price Prediction: Rare Bullish Pattern Forms as Key Metrics Soar