The CLARITY Act will be in focus this month as the US Senate conducts a markup, where it will be reviewed, debated, and amended. Its passage will be the second major regulatory milestone for the crypto industry, following the passage of the GENIUS Act last year. This article explores whether the market structure bill will boost crypto prices.

What is the CLARITY Act?

The Digital Asset Market Clarity Act of 2025, popularly known as the CLARITY Act, is a significant piece of legislation that aims to end the longstanding differences between the SEC and the CFTC.

Its goal is to share oversight responsibilities between the two regulators and provide clarity on the industry. The CFTC will be given oversight on digital commodities and intermediaries, including exchanges and custodians.

On the other hand, the SEC will be granted oversight of crypto transactions such as fundraising. By so doing, the act will provide a structured regulatory framework, which will reduce uncertainty for businesses and traders.

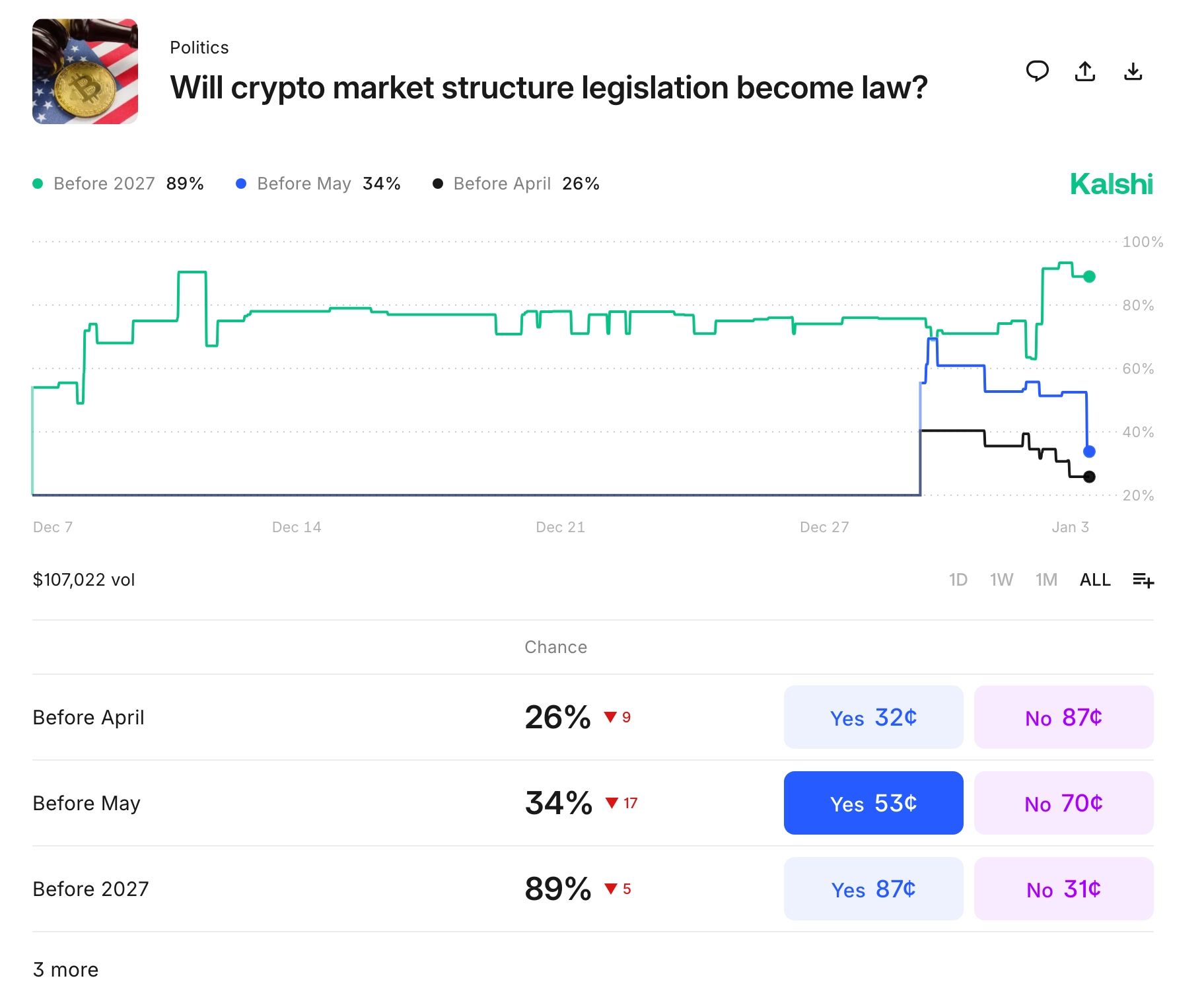

The CLARITY Act has already passed in the House of Representatives, and Kalshi traders believe that it will become law this year, with the odds steady at 89% at the time of writing.

The act comes a few months after the US passed the GENIUS Act, which aimed to regulate stablecoins. Stablecoins have become highly popular, with their market capitalization soaring to over $308 billion.

Will the CLARITY Act Boost Crypto Prices?

The CLARITY Act comes at a time when other supportive policies are in place in the United States. Donald Trump is pushing for a $2,000 stimulus check and a large tax refund, which could drive up prices in the crypto and stock markets.

READ MORE: Will Pi Network Price Rally in 2026? Yes, If These Things Happen

At the same time, the Federal Reserve is expected to continue cutting interest rates as consumer inflation falls. All this will lead to a surge in US M2 money supply, which is conducive to a crypto market rally.

However, the CLARITY Act alone will not lead to higher crypto prices this year. For one, the most significant regulatory events occurred last year, and prices continued to fall.

For example, the XRP price continued falling after the SEC allowed Ripple ETFs and ended the lawsuit. Other tokens, such as UNI, IMX, and AAVE, also dropped after the SEC filed lawsuits against their companies.

Most importantly, while the CLARITY Act is important, it may not lead to more crypto demand than exists today. Besides, companies like BlackRock, PayPal, Vanguard, Fidelity, and Schwab have already deepened their presence in the crypto industry. Therefore, while crypto prices may rise before the CLARITY Act vote, the immediate benefit may be brief.

READ MORE: Will Pi Network Price Rally in 2026? Yes, If These Things Happen