The crypto market rally continued on Monday, Jan. 5, with Bitcoin and most altcoins rising sharply, and the market capitalization of all coins surpassing $3.12 trillion.

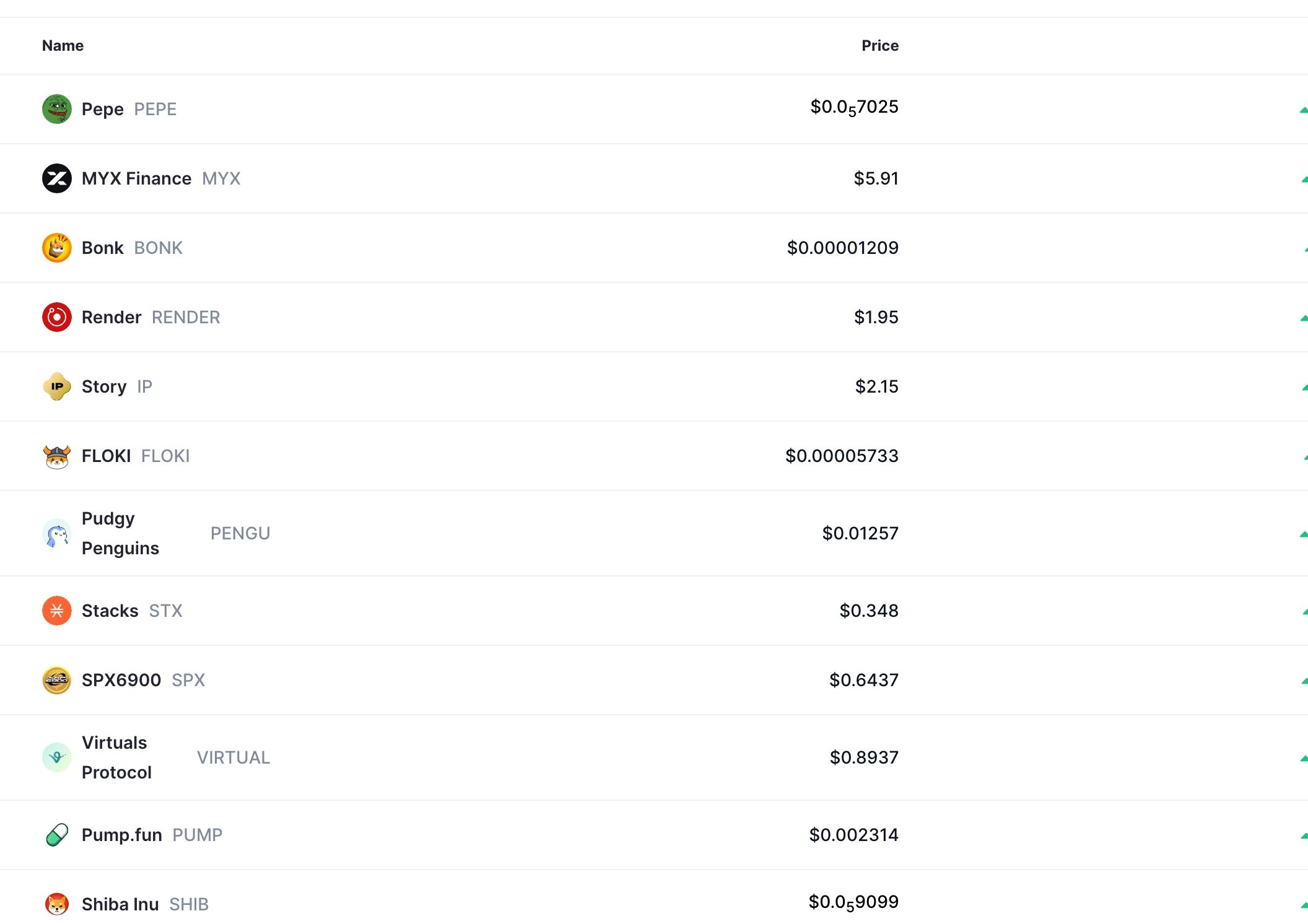

Most of this rally is being driven by meme coins, which have outperformed popular utility coins like Ethereum, Polkadot, and Solana. Pepe Coin price jumped by 70% in the last seven days, while Bonk, Floki, Pudgy Penguins, and SPX6900 rose by over 30% in this period.

The crypto market rally is happening because of the so-called January Effect, a phenomenon in which investors buy assets in January after selling them in the last weeks of December for tax purposes. This January Effect can take a few weeks or even a month.

Crypto Market Rally Continues as Risk-On Sentiment Continues

Crypto prices are rising as investors embrace a risk-on sentiment. One of the key indicators of this is the closely-watched Crypto Fear and Greed Index, which has moved from the extreme fear zone to the neutral level of 42. This means that the index will likely jump to the greed zone soon, a move that will be bullish for the crypto market.

READ MORE: XRP Price is Sending Mixed Signals: Will Ripple Rally or Crash?

Another sign that investors are embracing risk is that futures open interest has continued to rise over the past few days. Data shows that the open interest rose by 4% on Monday to over $138 billion, while shorts liquidations soared to over $210 million.

Meanwhile, investors are anticipating major catalysts for the industry, including the upcoming market structure bill (CLARITY), which is expected to be passed this year. This bill will provide more clarity for the industry by separating the roles between the SEC and the CFTC.

Additionally, analysts expect the Federal Reserve to cut interest rates more aggressively this year, now that inflation has continued to fall and the labor market is struggling, with the unemployment rate rising to 4.6%.

Still, as we have seen in past crypto market rallies, the enduring risk is that this is a bull trap, also known as a dead-cat bounce. A bull trap is a situation in which crypto prices rally briefly and then resume the downward trend.

READ MORE: Here’s Why the Shiba Inu Coin Price is Going Parabolic