Sei Coin has risen about 6.7% in the past 24 hours and is trading near $0.1329. Trading volume is up 41.46% to $84.82 million, showing more activity. The key question now is whether the SEI price can stay above the $0.1257 resistance level and move higher, as an analyst has noted.

SEI Price Tests Resistance as Trader Maps Key Levels

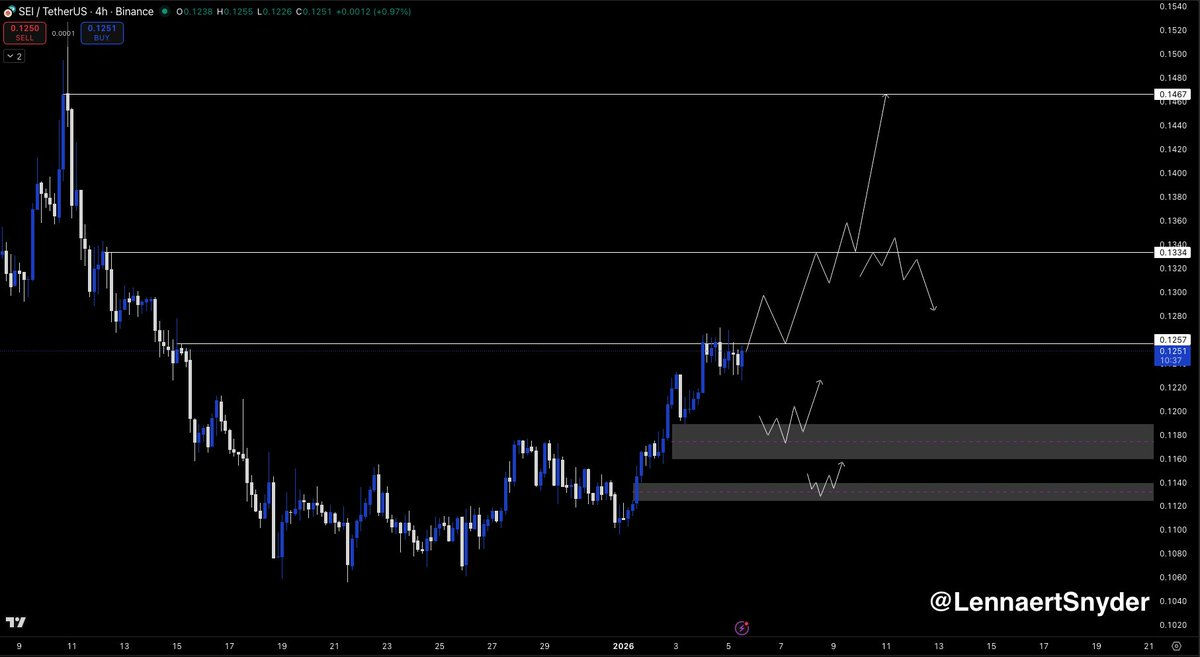

The key market reference is analyst Lennaert Snyder, whose chart maps the active technical structure. SEI price had been trading beneath the $0.1257 resistance level and is now pressing and reclaiming around that zone.

A move above former resistance is typically significant, as it converts a prior selling area into potential support. At current prices of $0.132, SEI Coin sits between the reclaimed level and the next resistance band Snyder identifies near $0.1334.

His roadmap establishes a clear bifurcation in outcomes. If SEI holds above $0.1334, upside toward $0.1467 opens. If price rejects at current levels, attention shifts to the $0.118 support box, with the $0.113 imbalance as the next downside area of interest for potential reversal.

The analyst added, “Volume is still very nice on Sei Network.”

That observation aligns with current market data showing 41.46% growth in 24-hour trading volume. Increasing volume near resistance indicates active participation rather than passive drift.

Sei’s 2025 Metrics Demonstrate Scale, Liquidity, and Real-World Usage

The fundamental backdrop surrounding Sei remains anchored in its 2025 positioning as institutional-grade infrastructure. The 2025 Sei Report describes the network evolving “from early-stage to institutional-grade,” with performance characterized by parallelized EVM execution, ~400 ms finality, and scaling targets reaching 200,000+ transactions per second.

The report notes that Sei became the “#1 EVM chain by active wallets” in 2025 and processed up to 4.5 million daily transactions, with over 82 million total wallets by year-end. That establishes a distribution base and usage profile consistent with liquidity depth. Additional institutional validation is reflected through validators such as Binance, Kraken, and Anchorage Digital, as well as native USDC and PayPal PYUSD availability.

For the Sei price analysis, these elements help explain ongoing participation and liquidity depth around SEI Coin.

READ MORE: Bitcoin Cash Price Eyes Upside As Analysts Flag Repeating Pattern