Jasmy Coin price was pumping on Thursday even as the crypto market tumbled. It jumped to a high of $0.010, up by over 85% from its lowest level this year. It is hovering at its highest point since November 11 last year.

The ongoing Jasmy price pump happened in a high-volume environment. Data compiled by CoinMarketCap shows that the 24-hour volume jumped to over $107 million, a notable amount for a crypto project with a market capitalization of over $474 million.

READ MORE: WLFI Price Prediction as World Financial Applies For a Banking Charter

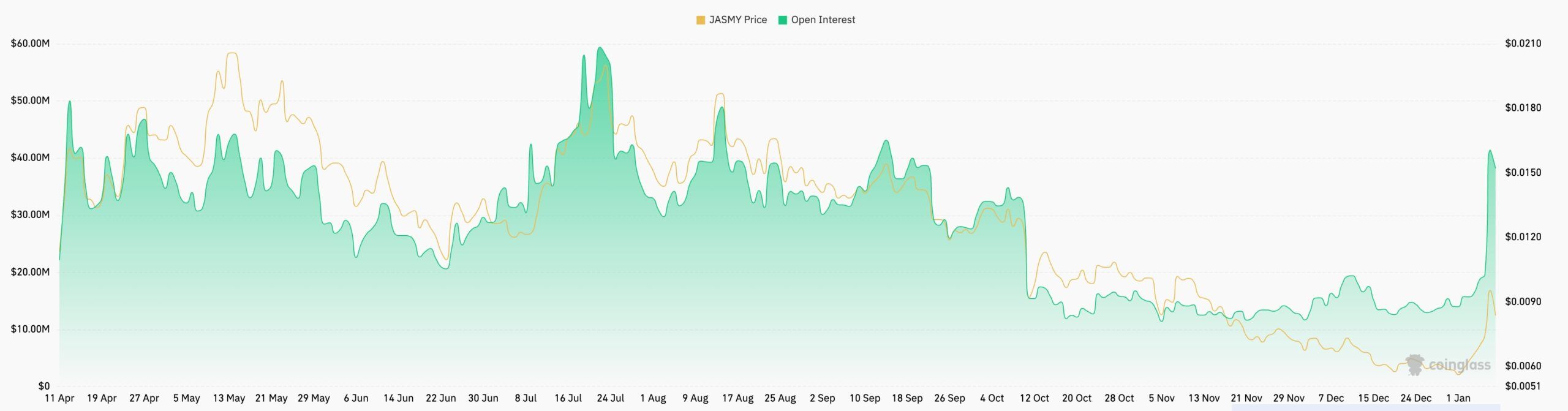

More data compiled by CoinGlass shows that the coin’s futures open interest has risen to its highest level in months. It jumped to a high of $41 million, up sharply from the December low of $12.6 million. Soaring open interest in the futures market indicates that investors are accelerating their purchases.

The Jasmy Coin rally has also coincided with the falling exchange balances, a sign of increased accumulation. Its supply stood at 7.9 billion tokens, down sharply from last year’s high of 12 billion. More Nansen data shows that whales and smart money investors have been accumulating the token.

Looking ahead, the next potential catalyst for the Jasmy price will be the US non-farm payrolls (NFP) data, which will provide more information on what to expect from the Federal Reserve. A weak jobs report will be bullish for Jasmy and other coins.

For starters, Jasmy was once one of the most popular coins in the crypto industry. Popularly known as Japan’s Bitcoin, the network is at the intersection of artificial intelligence and the Internet of Things (IoT).

Jasmy Coin Price Technical Analysis

The daily chart shows that the JasmyCoin price has rebounded in the past few days. This rebound happened after the token formed a giant falling wedge pattern. This pattern consists of two descending, convergent trendlines. A rebound normally happens when the two lines are about to converge, which is what happened recently.

Jasmy price has rebounded and moved to a high of $0.01025, its lowest level in June last year. It is now forming what resembles a bullish flag or a bullish pennant pattern.

Therefore, the token will likely continue rising as bulls target the next key resistance level at $0.01307, which is along the 50% Fibonacci Retracement level. This target is about 40% above the current level.

However, the risk is that the coin has formed a break-and-retest pattern by moving back to the key resistance level at $0.01024. This retest is one of the most common continuation signs in technical analysis.

READ MORE: Why Is Crypto Down Today? Bitcoin Rejection, Profit-Taking, and Altcoin Pain Explained