Coinbase stock remains in a deep bear market after plunging 45% from its peak last year. This crash may continue despite the recent upgrade by Bank of America and Goldman Sachs analysts, as activity in the Base L2 network plummets.

Base L2 Activity Has Plummeted

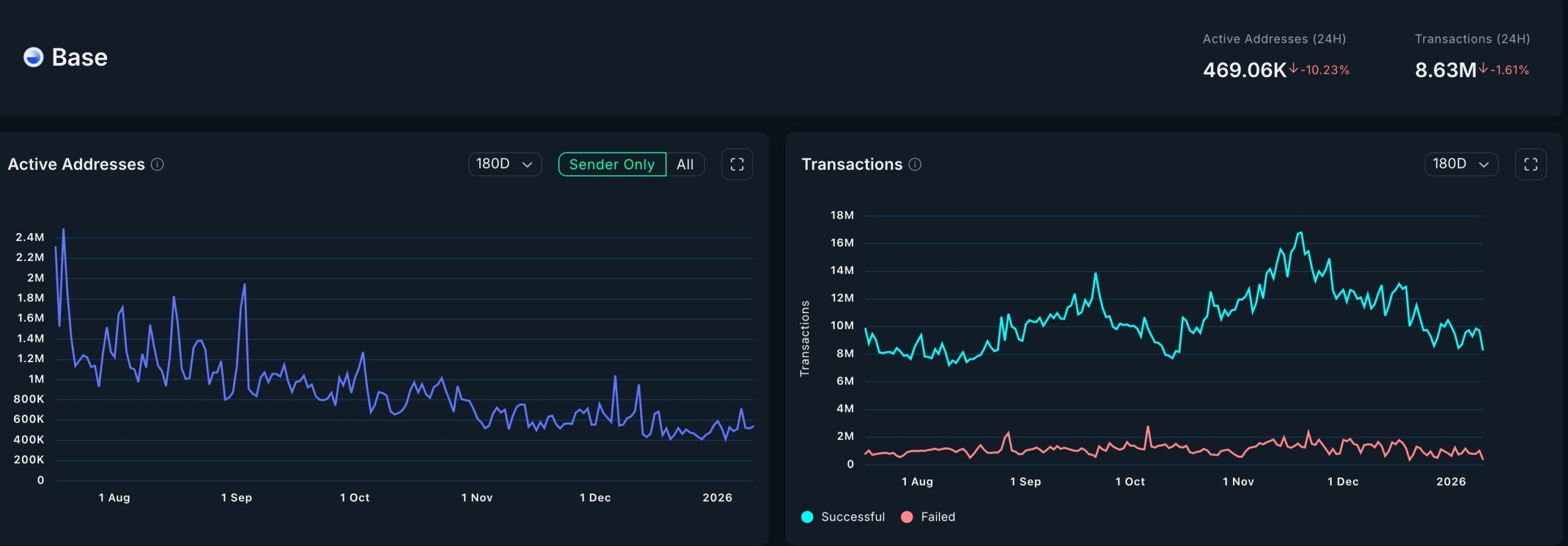

Third-party data show that activity on Base, the layer-2 network the company launched in 2023, has continued to decline over the past few months.

Data compiled by DeFi Llama shows that monthly DEX volume has continued to fall over the past few months, a sign of weak activity. The network processed transactions worth over $26 billion in December, down sharply from the $53 billion it handled in October.

The volume has dropped in the last three consecutive months as the crypto market crash continued. However, some networks, such as Polygon and Solana, experienced robust activity during the month.

Meanwhile, Nansen data show that the number of transactions in Base plunged by 24% over the last 30 days to 312 million, while fees and active addresses dropped by 47% and 21%, respectively. They dropped to $2.7 million and $6.9 million, respectively. On the other hand, Polygon’s addresses rose by 20% to 14.9 million, while its active fees rose by 161% to $2.1 million.

The deteriorating activity on Base may affect Coinbase over time. For example, it means that the upcoming $BASE token will not perform well if the community members feel that the network is not doing well.

READ MORE: Top Crypto to Watch This Week: Polygon, Binance Coin, Pi Network

Coinbase stock may also remain under pressure ahead of its upcoming financial results, scheduled for February 25 this year. These results will likely show a significant deterioration in its revenue and profits due to the crypto crash. The average estimate is that its revenue dropped by 15% in the last quarter, while its earnings per share fell to $1.18 from $4.68.

Coinbase is betting on several strategies to grow its revenue over time. It has entered the booming predictions business and is betting on tokenized stocks. In an interview, Brian Armstrong, the CEO, noted that these assets will boost fractional share trading, global access, perpetual futures, and real-time settlement.

Coinbase Stock Price Technical Analysis

The daily timeframe chart shows that the COIN stock price has been in a strong downward trend in the past few months. It has crashed from a high of $445 in 2025 to the current $240.

The stock has formed a death cross pattern, as the 50-day and 200-day Exponential Moving Averages (EMAs) crossed below each other. It also remains below the Supertrend indicator.

Therefore, the stock will likely continue falling as sellers target the next key support level at $200. However, the risk to the bearish outlook is that it has formed a falling wedge pattern, which could lead to more upside.

READ MORE: Crypto Price Prediction Ahead of CPI, SCOTUS Ruling: XRP, Pepe, Cardano