Sei coin price has been moving higher earlier in the week before slipping back into consolidation. The token is trading around $0.1195, down 1.24% over the past 24 hours, with the weekly change slightly negative at 0.33%. Price action has stayed tight after several sessions of upside attempts that failed to extend. The pullback comes as traders reassess structure while network usage continues to build beneath the surface.

Payments Activity Accelerates as Network Metrics Hit Records

Sei price action is unfolding alongside a sharp expansion in network usage. Payment activity has accelerated, with P2P stablecoin supply held in wallets for direct transfers rising 152% over six months and approaching $100 million.

That increase has coincided with faster settlement and near-zero transaction fees, with average fees around $0.0001, roughly 40 times lower than Sui and about 80 times lower than the next major EVM chain. Over the past month, Sei has processed activity at scale while maintaining the lowest transaction costs among major blockchains.

Usage growth has been broad. Daily active addresses have climbed above 1.5 million, doubling in four months and pushing network activity to an all-time high. Capital is also moving through the ecosystem. Yei Finance has reached $685 million in cumulative volume, with total protocol revenue at $7.3 million. Arbitrage activity has picked up as well, with Carbon DeFi’s Arb Fast Lane volume rising 29% week over week on Sei.

Furthermore, Sei Labs has outlined the roadmap toward Sei Giga, including upcoming EVM upgrades, while rolling out a new Tooling & Infrastructure System as part of its Market Infrastructure Grid. Additional research on quantum security has also been published.

Sei Coin Finds Support After Recent Pullback

Sei coin price structure is drawing close attention from technical traders. Lennaert Snyder noted that price has swept liquidity twice and broken short-term market structure, with $0.1169 identified as the key level buyers need to hold. As long as that area remains intact, he views long exposure as valid, while flagging $0.128 as a serious resistance zone and $0.136 as the next upside reference if momentum builds.

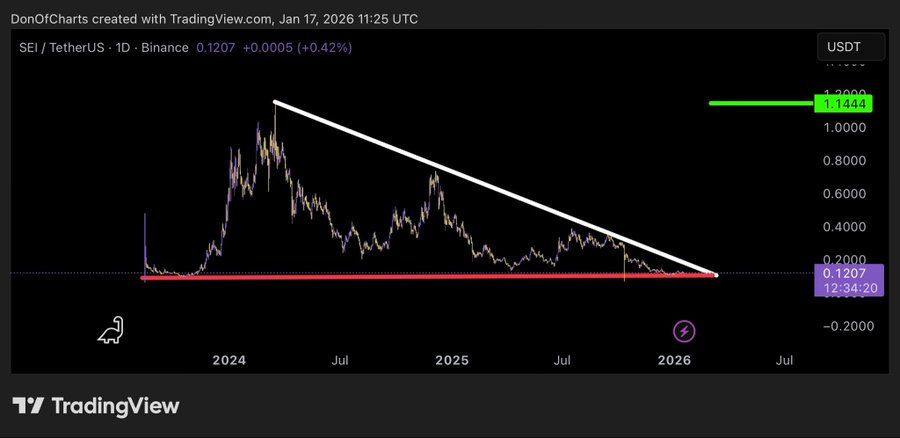

Broader chart work from Don shows Sei crypto compressing into a long-term descending wedge, with price pressing against support near $0.12. That structure has kept downside contained, but upside attempts have stalled repeatedly under the trendline. A longer-dated overhead reference near $1.1444 remains far above the current price, underscoring how compressed the market has become.

Momentum indicators are conflicted. On the daily timeframe, RSI sits near 47, keeping conditions neutral. MACD and short-term momentum have flipped to buy signals, suggesting selling pressure has eased. At the same time, most moving averages, from the 10-day through the 200-day, remain in sell territory, with longer-term trend signals still pointing lower.

For now, the Sei price continues to trade in balance. Buyers are stepping in near support, sellers remain active in resistance, and the market is waiting for confirmation.

READ MORE: Here’s Why the Dash Crypto Price Has Gone Parabolic