Ethereum price has crawled back over the past few weeks, rising from a low of $2,610 in November to the current $3,340. It remains in a 32% below its all-time high. This ETH forecast explores what to expect amid highly bullish fundamentals.

Ethereum Network Activity is Growing

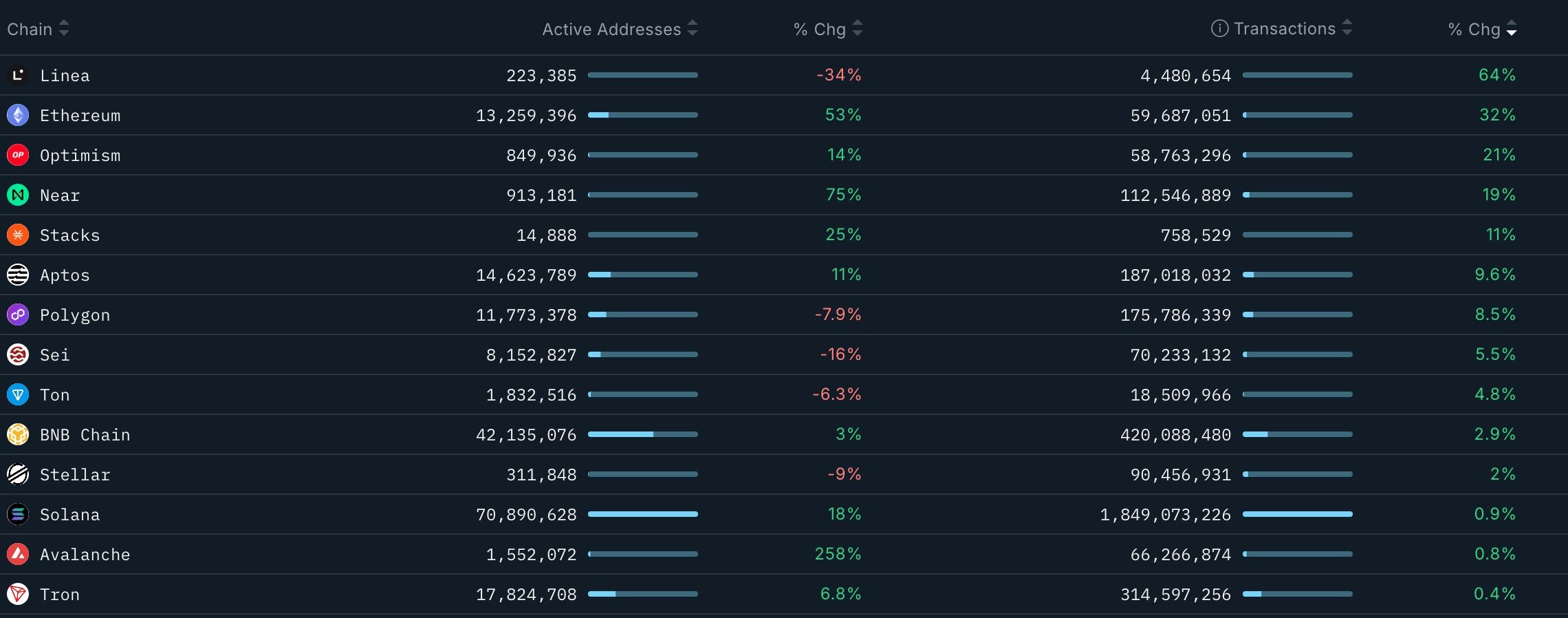

Data compiled by third-party platforms shows that Ethereum’s network growth has exploded after the Fusaka upgrade. Data reveals that the number of Ethereum transactions jumped by 32% in the last 30 days to nearly 60 million. Only Linea, the chain owned by Consensys, had a faster growth rate.

More people are using Ethereum and its applications. The active addresses in the network jumped by 53% in the last 30 days to over 13.25 million. It had fewer than 500k active addresses at its lowest level in December last year.

This growth will likely continue growing in the coming months now that the average transaction costs on the network have plunged. As such, there are concerns about the need for layer-2 networks in the future. Aerodrome Finance, a top DEX network on Base Blockchain, has announced plans to expand to Ethereum.

The falling Ethereum transaction fees mean it will likely start taking market share from Tron in stablecoin transactions. Tron handled over $605 billion in stablecoin transactions in the last 30 days, much lower than Ethereum’s $945 billion.

TokenTerminal data shows that Ethereum is the biggest chain in the Real-World Asset (RWA) tokenization industry. Ethereum’s RWA assets, including stablecoins, rose to over $202 billion, much higher than Tron’s $82 billion. It leads in tokenized assets, including stablecoins, stocks, and treasuries.

READ MORE: Bitcoin Price Prediction: Will BTC Hit $90k or $100k First?

At the same time, demand for Ethereum is rising. BitMine has bought over 4.1 million ETH tokens in the last few months and has over 1.9 million more to buy as part of its strategic ETH reserves. The staking queue has continued to rise and is now at a record high, while demand for ETH tokens on exchanges has dropped.

Ethereum Price Prediction: Technical Analysis

Our recent ETH price forecast on short-term timeframes showed the coin may be at risk of a pullback, as it has formed a rising wedge pattern.

However, a closer look at the three-day chart shows that it has formed an inverted head-and-shoulders pattern, a common bullish reversal sign. It recently rebounded above this pattern’s right shoulder.

The coin has moved above the 25-day Exponential Moving Average (EMA) indicator. Also, the Awesome Oscillator has moved close to the zero line, and it may turn positive soon.

Therefore, the most likely scenario is that the ETH price continues to rise in the near term as bulls target the key resistance level at $4,000. This view will be confirmed if it moves above the $3,487 resistance.

READ MORE: Dogecoin Price Forms an Alarming Pattern as DOGE ETF Inflows Dry