NVIDIA stock price rose by 1.2% on Wednesday as the US equities market rebounded after suffering a major drop in the past two days. NVDA stock traded at $180, down sharply from its all-time high of $212. Still, technicals suggest that it may crash to $128 in the coming weeks as the earnings season continues.

NVIDIA Stock Price Technical Analysis Points to a Crash

The daily timeframe chart shows that NVDA stock peaked at an all-time high of $212 and has since pulled back to its current level of $180.

It has continued to underperform the broader stock market, while the top indices, such as the S&P 500 and the Nasdaq 100, are hovering near all-time highs. Other popular AI stocks, including Adobe, Salesforce, and ServiceNow, have all plunged recently.

The chart below shows that the stock has formed a highly bearish head-and-shoulders pattern. In this case, the head is at the all-time high of $212, while the shoulders are at $192.

The stock is now nearing the neckline for this pattern at $170, which coincides with the lowest level in July, September, November, and December last year.

READ MORE: Here’s Why the Stock and Crypto Markets are Going Down Today

The price target in a head-and-shoulders pattern is estimated by measuring the distance from the head and the neckline, and then the same distance from the neckline. In this case, the distance brings the target to $128, about 30% below the current level.

The bearish Nvidia stock price forecast will become invalid if it moves above the key resistance level at $192, which is the right shoulder.

Nvidia’s Crash Could be a Good Buying Opportunity

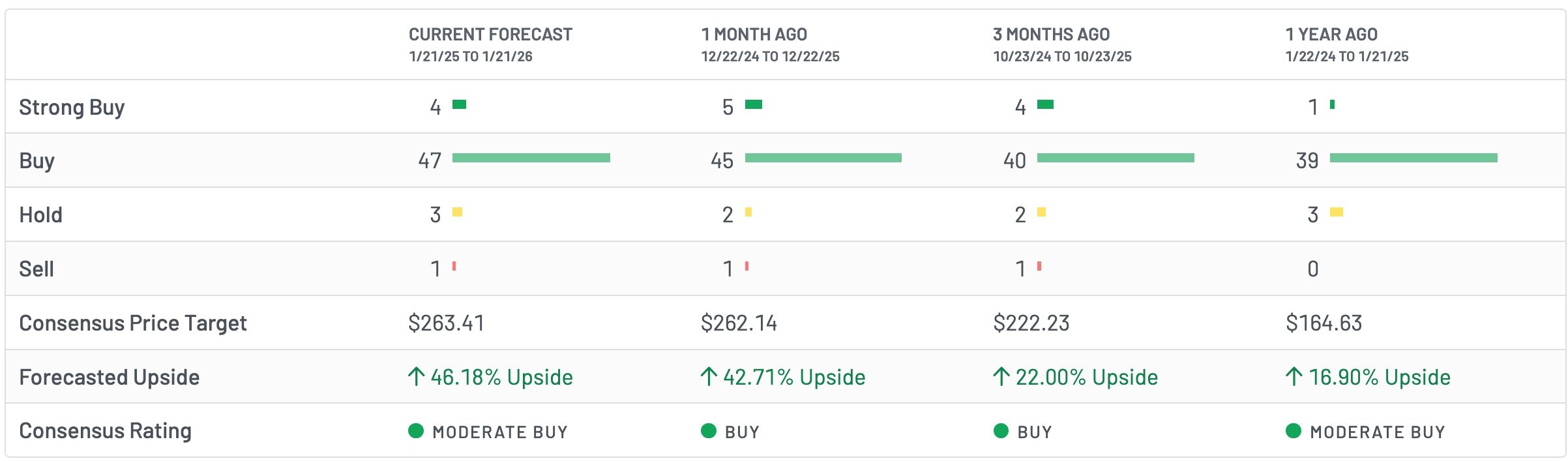

There are signs that the potential Nvidia stock price crash would be a good buying opportunity, as the company has numerous catalysts. For one, as the chart below shows, the consensus analyst estimate is $263, a 48% increase from the current level. 12 months ago, the target price among analysts was $164.

That said, the most important catalyst for Nvidia’s stock price is strong demand for its GPUs, which are widely used by companies like OpenAI and Anthropic to train AI models.

In a statement at the World Economic Forum, the company’s CEO noted that all GPUs were now sold out, even as Taiwan Semiconductor continues to boost its production.

The tight supply conditions give Nvidia pricing power, which explains why analysts expect its revenue and profitability to accelerate. Data shows that the average estimate is that its annual revenue rose by 64% in 2024 to $213 billion. The estimate for this year is that its revenue will grow by 51% to $322 billion, a trend that will continue in the coming years.

At the same time, the company has become a bargain, with its forward price-to-earnings ratio falling to 37, well below its five-year average of 45.50.

In contrast, Tesla, which is no longer experiencing growth, has a forward price-to-earnings (PE) ratio of 256, while Palantir’s multiple is 232. Amazon has a multiple of 32. NVIDIA is growing faster than these companies and boasts higher profit margins, indicating that it deserves a premium valuation.

At the same time, the company has a potential catalyst: it may restart selling its H200 chips there. According to Reuters, the company has received orders for 2 million chips, valued at over $54 billion.

Additionally, Nvidia is much further ahead of potential competitors such as AMD, MetaX, and Intel. One of its main advantages is the Compute Unified Device Architecture (CUDA), which allows developers to use its GPUs for general-purpose computing. CUDA has the biggest market share, which is hard to replicate.

READ MORE: Billionaire Novogratz Delivers His Bitcoin Price Prediction and a Major Warning