The XRP price continued its downtrend today, January 26, moving to a low of $1.8500, its lowest level since January 1. Ripple has retreated by 25% from its January 6 high and by 50% from its July 2021 high. This article explores the top reasons the Ripple price is crashing.

XRP Price is Crashing as Technicals Disappoint

One major reason why the XRP price is falling is that technicals are not supportive. For example, the weekly timeframe chart shows that the coin formed a double-top pattern at $3.3900 and a neckline at $1.6082.

The coin has remained below the Supertrend indicator and the 50-week and 100-week Exponential Moving Averages (EMAs), indicating that bears have remained in control over the past few months.

Additionally, the coin has formed a series of lower lows and lower highs, a sign that bears are coming in whenever it attempts to rebound.

Therefore, the next important level to watch will be at $1.7750, a level it has failed to move below three times since October last year. Therefore, a drop below that support level will signal further downside, potentially to the 61.8% Fibonacci Retracement level at $1.6200, which is about 12% below the current level.

Ripple Price Has Dropped Because of the Broader Crypto Market Crash

The XRP price has remained under pressure because of the fading demand in the futures market. Data compiled by CoinGlass shows that futures open interest has continued to fall over the past few months.

It dropped to a low of $3.38 billion on January 26, down from last July’s high of $10.9 billion. Falling futures open interest is a sign that investors are reducing their bets on the coin.

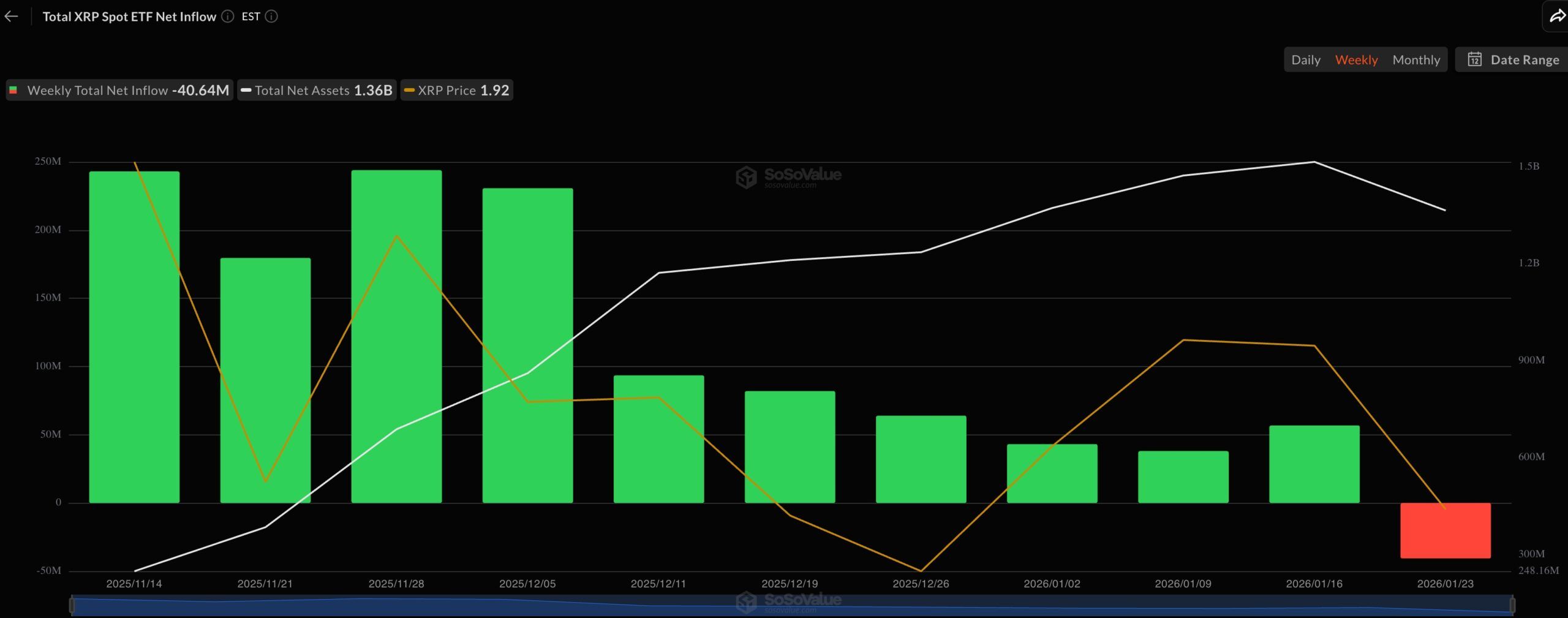

More data show that demand for spot XRP ETFs has continued to wane over the past few weeks as investors focus on other, higher-yielding assets. According to CoinGlass, spot XRP ETFs added $3.43 million in assets on Friday. However, the funds lost over $40 million in assets last week, bringing the cumulative total inflows to $1.28 billion.

The ongoing XRP price plunge is due to the crypto market crash that has affected Bitcoin and most altcoins. Bitcoin has dropped from the all-time high of $126,300 to $90,000, while the market capitalization of all coins has moved below $3 trillion.

In a statement last week, Michael Novogratz predicted that Bitcoin will fully rebound if it moves above the key resistance levels at $100,00 and $123,000. Such a move will also benefit other cryptocurrencies, including Ripple’s XRP.