The crypto market is going down today, January 30, with Bitcoin and most altcoins being in the red. Bitcoin price dropped to $84,00, while Ethereum (ETH) fell to $2,800. Other top altcoins like XRP and Solana (SOL) fell to $1.80 and $11, respectively.

The market capitalization of all tokens plunged by 4.75% in the last 24 hours to $2.8 trillion. This decline happened even as the Senate Agriculture Committee advanced the CLARITY Act, raising the possibility that it will pass. It also happened after Donald Trump and Republicans inked a deal to avoid a government shutdown.

Crypto Going Down Because of Geopolitical Risks

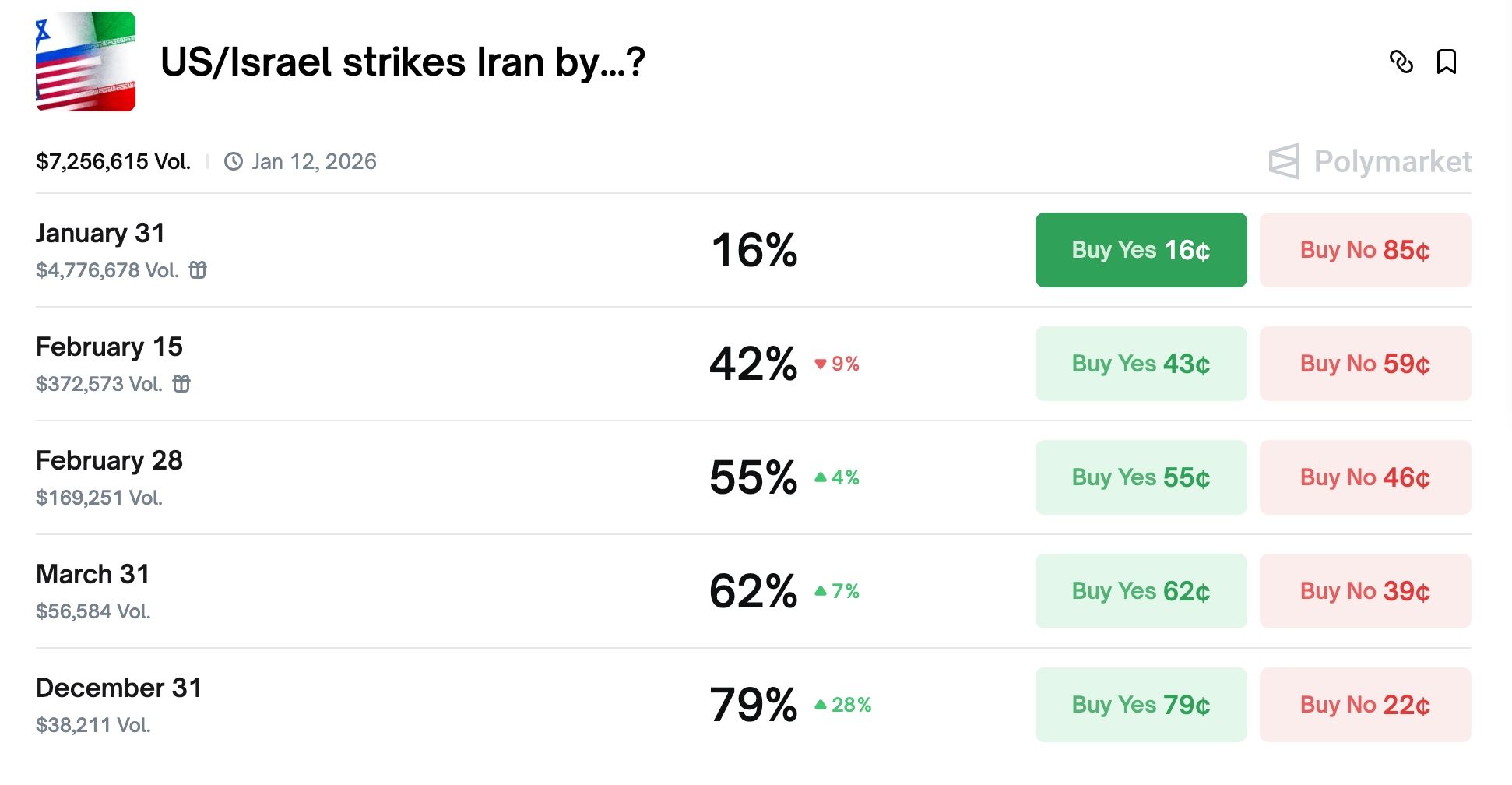

The crypto is going down today because of the rising concerns about geopolitics as a big armada arrives in the Middle East. Donald Trump has warned that he may attack Iran soon, and the odds of this happening have jumped on Polymarket and Kalshi.

The probability of an attack happening before June 30 has jumped to 79% on Polymarket. This explains why the price of crude oil has soared, with Brent jumping to $71 for the first time in months. It also explains why gold and the Swiss franc has jumped as investors move to safe-haven assets.

Bitcoin and the crypto market are down because, contrary to popular opinion, the latter is not a safe-haven asset. History shows that the Bitcoin price always drops whenever risks are rising. A good example of this is what happened on October 10, when the crypto market crashed, and liquidations rose after Trump warned of China tariffs.

READ MORE: SLV ETF Stock Analysis as Silver Price Jumps and Outflows Rise: Buy or Sell?

The ongoing crypto crash accelerated as the futures open interest dropped by 1.1% to $132 billion. Liquidations jumped by over 320% to nearly $1 billion, with Bitcoin, Ethereum, XRP, and Solana being the most affected. Bullish liquidations accelerate the crypto crash by shutting down leveraged positions.

Additionally, the crypto market is going down in line with what Michael Novogratz predicted recently. He warned that the weakness will remain as long as Bitcoin remains below $100,000.

Technicals are also contributing to the ongoing crypto market crash. For example, as the chart above shows, the Bitcoin price remains below all moving averages and the Supertrend indicators.

It has also formed a bearish flag pattern, pointing to more downside in the coming weeks or days. A Bitcoin price crash often leads to more weakness across the crypto market. Ethereum price has also formed similar risky patterns.

READ MORE: GME Stock Price Outlook: Reasons GameStop is Soaring and What Next