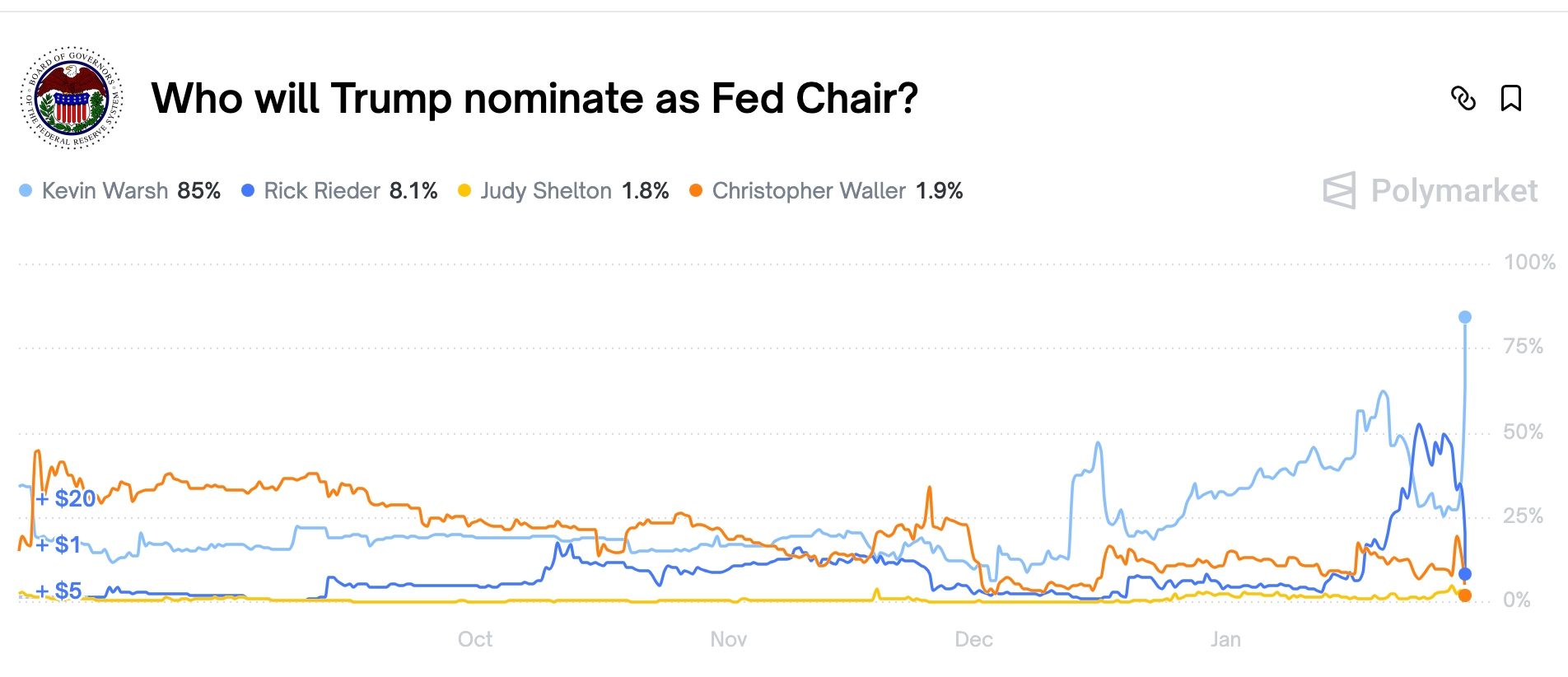

Kevin Warsh is surging and flipping Rick Rieder on Polymarket ahead of Donald Trump’s Federal Reserve Chairman announcement.

Odds of him announcing Kevin Warsh jumped to 85% as Rick Rieder’s probability moved to just 7%. This is a big reversal as Rieder was seen as the favorite early this week.

In a statement, Donald Trump noted that he would announce on Friday morning. Historically, Polymarket odds have been accurate in predicting a potential outcome of major events. A good example of this is what happened during the Nobel Peace Prize announcement in 2025.

READ MORE: GME Stock Price Outlook: Reasons GameStop is Soaring and What Next

Kevin Warsh is an economist who has a history at the Federal Reserve, where he served as a governor between 2006 and 2011. He currently serves as a visiting fellow at the Hoover Institution.

Warsh will replace Jerome Powell who Donald Trump nominated during his first term. His tenure will be characterized with Trump’s obsession with low interest rates. On Thursday, he blasted Powell and called him a moron for not cutting rates in the last meeting on Wednesday.

Still, chances are that Trump will get frustrated with Warsh because he will not have the final say on interest rates at the Fed. For example, Stephen Miran and Christopher Waller voted to cut interest rates in this week’s meeting, with the other Fed officials voting to leave them unchanged between 3.50% and 3.75%. Therefore, Warsh’s vote would not have been enough to cut rates.

Kevin Warsh has Criticized Crypto in the Past

Kevin Warsh is seen as a pro-crypto economist. However, his views on the industry are less supportive than Rick Rieder. For example, he blasted Bitcoin’s volatility in a 2018 opinion piece in the Wall Street Journal. He also blasted the industry, including stablecoins in his other pieces.

On the positive side, a Federal Reserve Chair has little say on the crypto industry, with regulations being handled by top regulators like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

A Fed Chair typically influences crypto prices by interest rate cuts. Historically, a dovish Federal Reserve has boosted the crypto market by making cash cheaper.

READ MORE: SLV ETF Stock Analysis as Silver Price Jumps and Outflows Rise: Buy or Sell?