Solana price dropped to a crucial support level as the crypto market crash gained steam. SOL token was trading at $118 on Saturday, down by 20% from its highest point this year. Will it rebound as the number of transactions,, fees, and active addresses surge?

Solana Active Addresses, Fees, and Transactions are Soaring

Solana’s network is doing well even as its price remains in a deep bear market. The same is happening with Ethereum, whose price has dived despite the booming growth after the Fusaka upgrade.

Nansen data shows that more companies and developers are embracing the network. For example, just this week, WisdomTree, a company with over $150 billion in assets, migrated to the network.

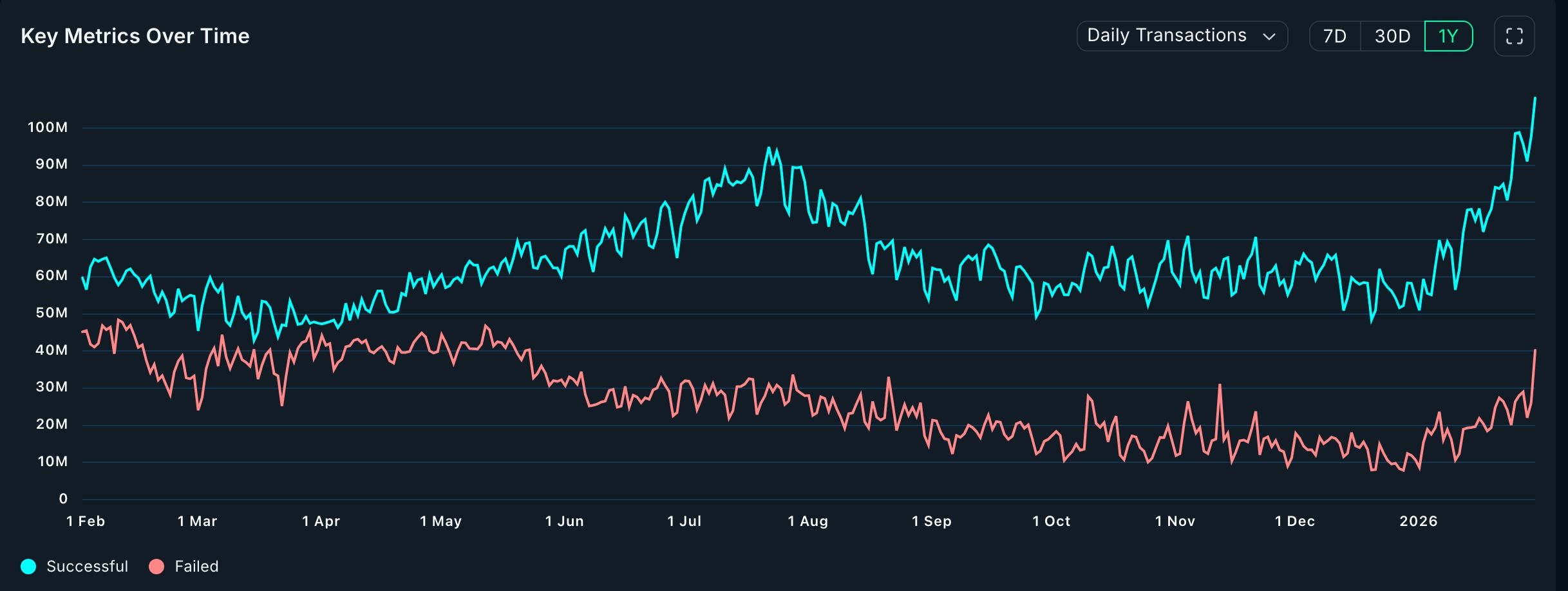

The date shows that Solana’s transactions jumped by 30% in the last 30 days to over 2.29 billion, much more than other chains combined. BNB Chain handled over 453 million transactions in the same period.

READ MORE: Will Crypto Recover as the Fear and Greed Index Sinks?

Meanwhile, Solana’s active addresses have continued soaring in the past few weeks, rising by 62% in the last 30 days to nearly 100 million. BNB Chain had over 40 million active addresses, while Tron, Aptos, and Ethereum had over 17 million, 12 million, and 14 million, respectively.

This growth has led to substantial fee growth in the network. It grew by 81% in the last 30 days to over $25.6 million and is nearing Tron’s $28 million. Solana made twice the money that Ethereum made in the same period.

A closer look shows that Solana’s network is growing across all industries. For example, stablecoin volume jumped to over 372 billion as the number of transactions rose to 287 million. Also, its stablecoin addresses jumped to 4.8 million.

The same is happening in the decentralized exchange (DEX) industry, where it is dominating other chains. Its DEX volume jumped to over $112 billion in the last 30 days, much higher than Ethereum’s and BNB’s $49.9 billion and $49.8 billion.

Solana has become a major player in the real-world asset tokenization industry, where its tokenized stocks have soared to $184 million, higher than Ethereum’s 174 million.

Most notably, Solana ETFs are doing better than Bitcoin and Ethereum this year. They have had over $104 million in inflows, while Ethereum and Bitcoin have had outflows.

Solana Price Technical Analysis

The daily timeframe chart shows that the SOL token crashed to a low of $111 on Friday as the crypto market crash accelerated. It formed a doji candlestick, which often leads to a rebound.

Solana formed a double-bottom pattern at $117 and a neckline at $148, its highest swing this year. Therefore, the combination of a doji candlestick and a double-bottom points to a rebound, potentially to the psychological level at $150.

However, a drop below the lower side of the doji candle at $111 will invalidate the bullish outlook and point to more downside, potentially to the key support level at $100.

READ MORE: Bitcoin Price Prediction: BTC Risks Drop Toward $70K