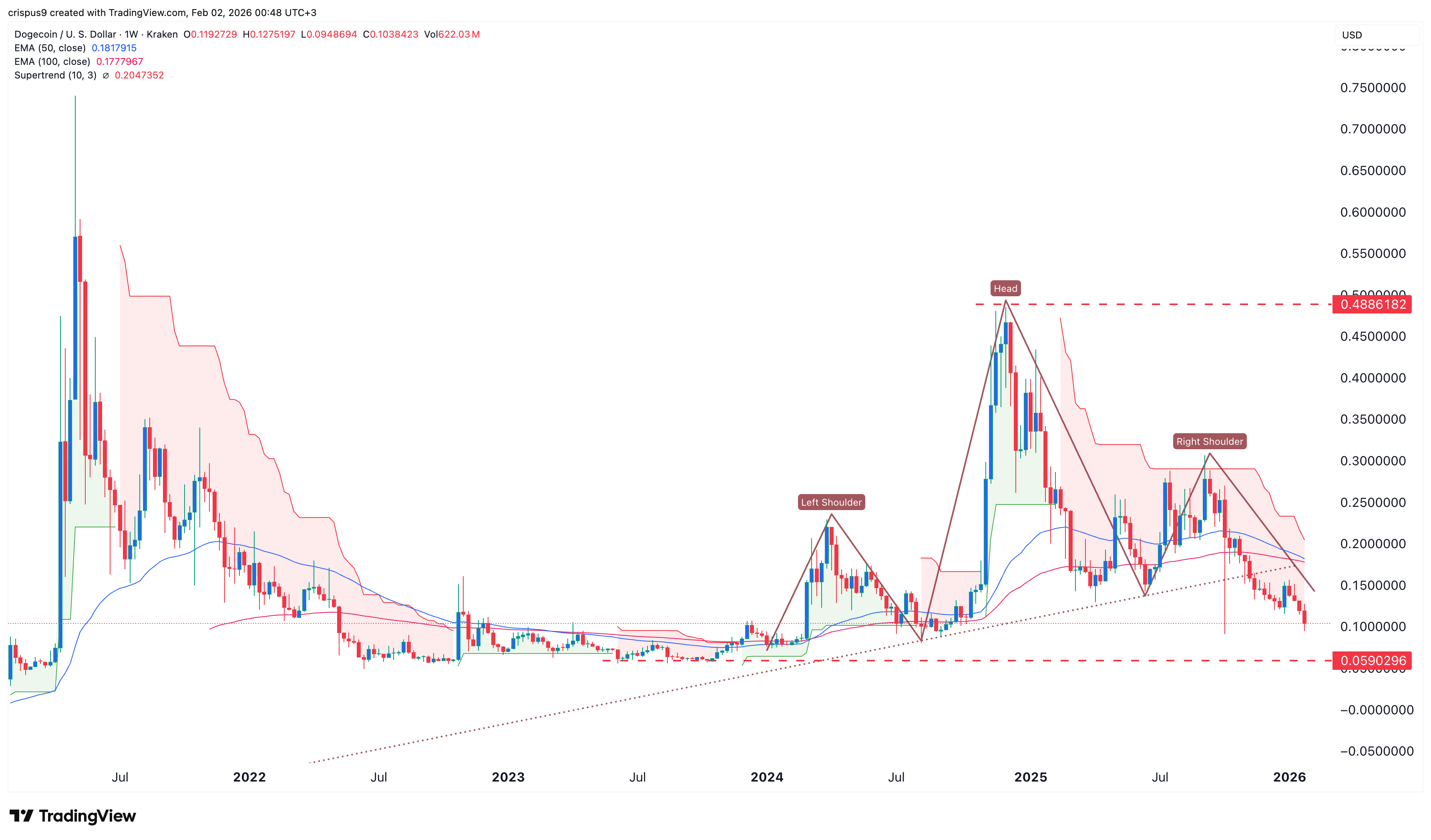

Dogecoin price continued its strong downward trend on Monday as the crypto market decline intensified. DOGE dropped for the fourth consecutive week, reaching its lowest level since October 2025. It has also formed a large head-and-shoulders pattern, indicating further downside in the near term.

Dogecoin Price Prediction: Technical Analysis Points to More Downside

The weekly timeframe chart shows that the DOGE price has crashed in the past few months, moving from a high of $0.4885 in November 2024 to the current $0.1.

A closer look shows that the coin is about to form a mini death cross, which happens when the 50-week and 100-week Exponential Moving Averages (EMA) cross each other.

The token has also formed a giant head-and-shoulders pattern, which is made up of two shoulders, a head, and a neckline. It has already moved below the ascending trendline, confirming the bearish outlook.

The DOGE price has also remained below the Supertrend and Ichimoku Cloud indicators, while the Relative Strength Index (RSI) and MACD continue to decline.

READ MORE: Silver Price at Risk of a Steeper Crash as SLV ETF Outflows Surge

Therefore, the most likely scenario is that the Dogecoin price will continue to fall as sellers target the next key support level at $0.05900, its lowest level in August 2023.

Dogecoin ETF Inflows Have Waned

The main reason why Dogecoin price may continue falling is the ongoing broader crypto market crash, which has affected Bitcoin and other altcoins.

This decline has been driven by several factors, including the recent nomination of Kevin Warsh as the next Federal Reserve Chair, geopolitical risks, and the lack of safe-haven qualities of cryptocurrencies.

Another reason why the Dogecoin price has declined is that demand for meme coins has continued to fall over the past few months. Data shows that the market capitalization of all meme coins has dropped from over $100 billion in 2025 to over $37 billion today. A closer look shows that most meme coins have declined by double digits in the past few months.

Meanwhile, demand for DOGE ETFs has waned in the past few days. The three funds by Grayscale, 21Shares, and Bitwise have not had any inflows in the past few days. The three funds have recorded only $6.4 million in net inflows and now hold $10 million in assets under management.

READ MORE: Here’s Why Ethereum Price is Crashing Despite Soaring Network Metrics