The crypto crash stalled on Monday as Bitcoin and most altcoins suddenly stopped falling as the possibility of a war between the United States and Iran rose. Bitcoin price rose to $78,000 from this week’s low of $74,000, while Ethereum rose to $2,300.

The market capitalization of all cryptocurrencies rose from $2.6 trillion to over $2.83 trillion. This rebound mirrored the performance of American equities, which jumped by over 0.50% on Monday.

Crypto prices also rebounded after Tom Lee, the millionaire founder of FundStrat and BitMine’s Chairman, predicted that they had bottomed. Most importantly, the Crypto Fear and Greed Index dropped to the extreme fear zone of 17. In most cases, crypto prices rebound when the fear gauge crashes.

Still, there are three main reasons why the crypto market crash has more room to go. First, the ongoing crypto rebound could be part of a dead-cat bounce (DCB). A DCB happens when crypto prices rebound briefly during a crash. These events have been highly common during the ongoing crypto market crash.

READ MORE: NVIDIA Stock Price Catalysts This Week: Crash or Rally Ahead

Second, there are signs that investors are staying on the sidelines. Data compiled by CoinGlass shows that the Long/Short ratio stands at 49:52, meaning that there are still more sellers than buyers.

Bitcoin Price Technical Analysis Suggests More Downside Ahead

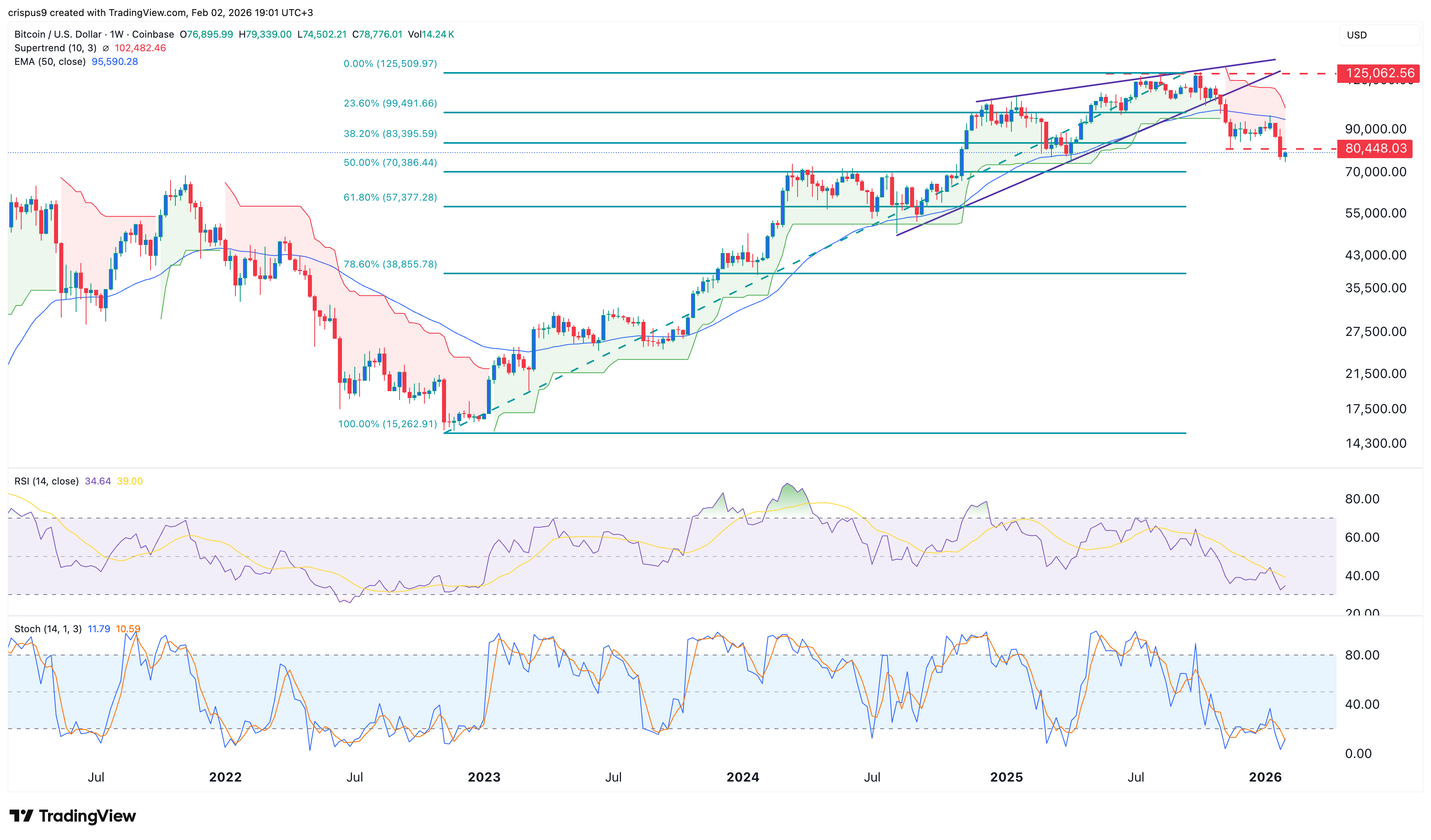

The other main reason why the crypto market crash has more room to go is based on technicals. Data compiled by TradingView shows that the Bitcoin price has remained below all moving averages and the Supertrend indicator.

The weekly chart shows that the coin formed a large rising wedge and a bearish flag pattern, which all lead to more downside. Also, the coin dropped by over 70% the last time that the Supertrend indicator turned red.

Therefore, the most likely scenario is where Bitcoin continues falling in the coming weeks or months. If this happens, the coin will drop to the Ultimate Support of the Murrey Math Lines tool at $50,000.

As Michael Novogratz predicted recently, a complete rebound will be confirmed when the Bitcoin price jumps above the key resistance level at $100,000 and $103,000. Such a move will lead to more upside among other cryptocurrencies.

READ MORE: PayPal Stock Price is in a Freefall: Will it Have a Relief Rally After Earnings?