The stock and crypto markets are tanking today, February 3, as investors react to the rising geopolitical tensions and fears that the artificial intelligence (AI) bubble was popping.

Stocks and Crypto Markets Crashed Today

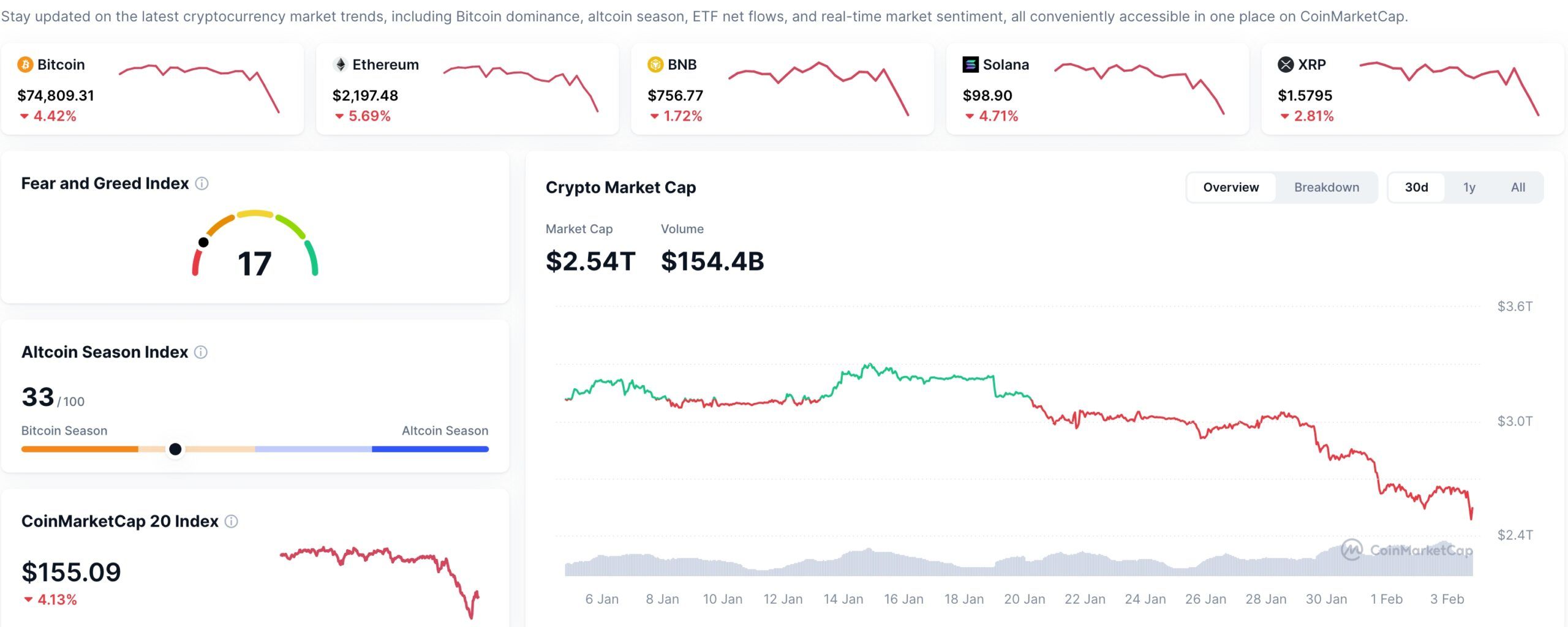

Bitcoin price crashed to $73,000, erasing all the gains made after Donald Trump won the election. Ethereum price plunged to $2,200, while the market capitalization of all coins fell by 3.5% to $2.5 trillion. Some of the top laggards in the crypto market were Chiliz, Canton, Optimism, Arbitrum, and Dash.

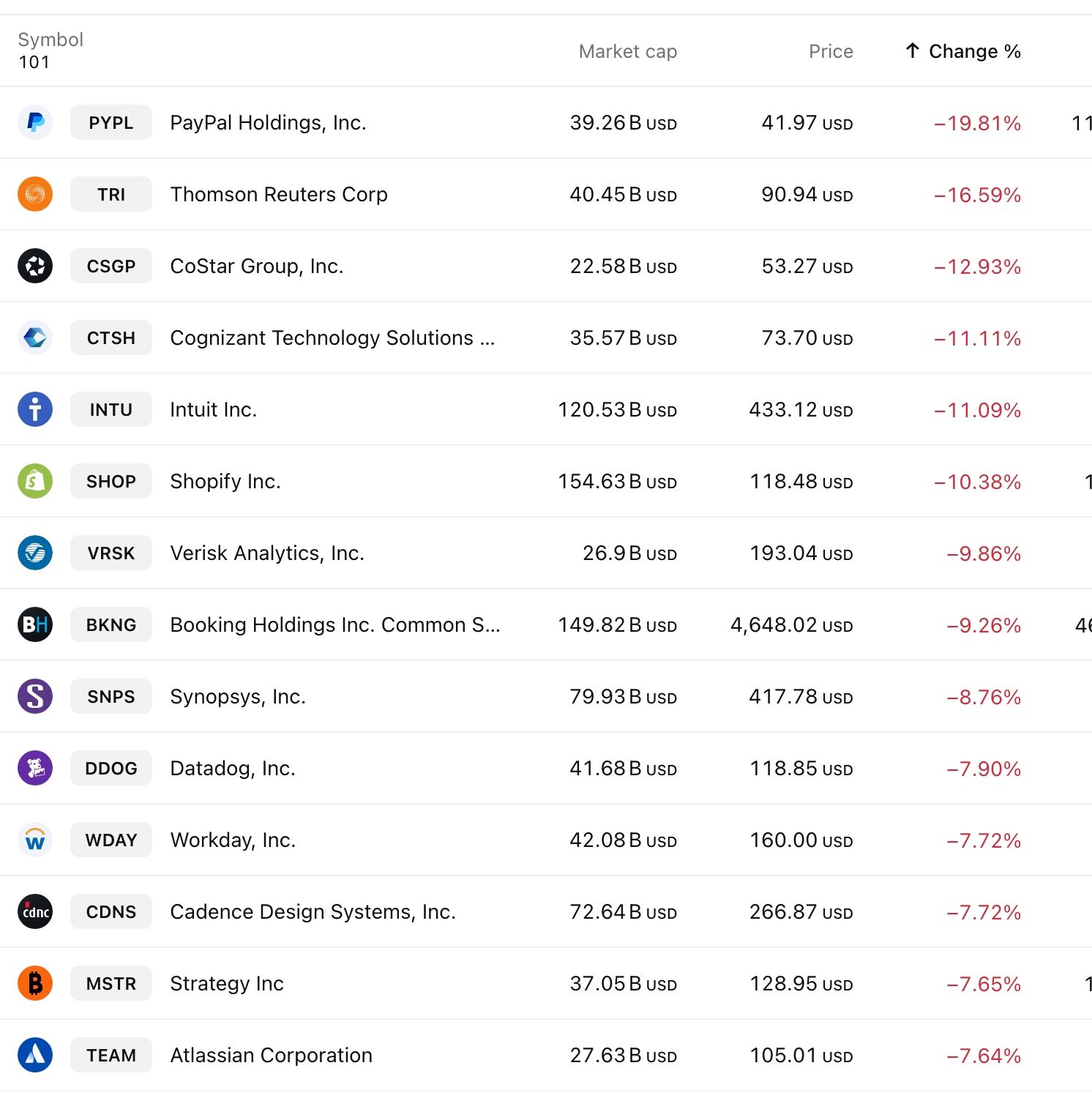

The stock market also tanked, with the tech-heavy Nasdaq 100 Index falling by 500 points and the S&P 500 falling by 1.35%. The top laggards in the index were companies like PayPal, Thomson Reuters, Intuit, Cognizant Technologies, Shopify, and Booking Holding.

These technology stocks are plunging as investors remain concerned about the AI industry. For example, Thomson Reuters and Verisk stocks dropped after Anthropic released a major update on legal help.

PayPal stock price crashed after publishing weak financial results and downgraded its forward guidance. Companies like Intuit, Workday, and Atlassian dropped as investors remained concerned about disruption by AI tools.

On the other hand, the top gainers in the Nasdaq 100 Index were companies like Western Digital, Palantir, PepsiCo, Fastenal, and Wal-Mart, whose market capitalization crossed the $1 trillion mark for the first time ever.

READ MORE: Solana Chain Fees are Soaring as it Closes the Gap With Justin Sun’s Tron

Geopolitical Risks are Elevated

The stock and crypto markets are concerns about geopolitics after the US military shot down an Iranian drone in the Middle East.

Most analysts believe the upcoming talks between the US and Iran will not be successful because the gaps between the two sides are so big. The US is pushing Iran to stop funding proxies in the region, to end its ballistic missile program, and to curtail its civilian nuclear program. Iran will not agree to these limits.

At the same time, President Trump is facing substantial pressure from top neocons like Mike Pompeo, Lindsey Graham, Marco Rubio, and Mark Levin who have argued that it was useless to negotiate with Iran.

A new war in the region will have major implications, with crude oil prices rebounding. Data shows that Brent and West Texas Intermediate (WTI) rose to $67 and $65, respectively. Gold and silver prices also rebounded as investors moved to safe-haven assets.

Bitcoin and the crypto market have proven that they are not safe haven assets. These assets have always dropped when risks rose. At the same time, liquidations in the crypto market rose to over $670 million.

READ MORE: Pi Network Coin Sits at All-Time Low: Buy the Dip or Sell the Rip?