Bitcoin price continued its strong crash this week, reaching its lowest level since 2024. It was trading at $76,250 on Wednesday morning, a few points above the year-to-date low of $73,000. This article explores why the BTC price will bounce back and potentially hit a record high once this crash ends.

The Bullish Case for Bitcoin Price

Bitcoin price remained under intense pressure this week as it erased all the gains it made during the Trump administration. This crash happened even as the stock and precious metals markets remained near their all-time highs.

Still, there are several reasons whythe Bitcoin price will bounce back and possibly hit the all-time high later this year.

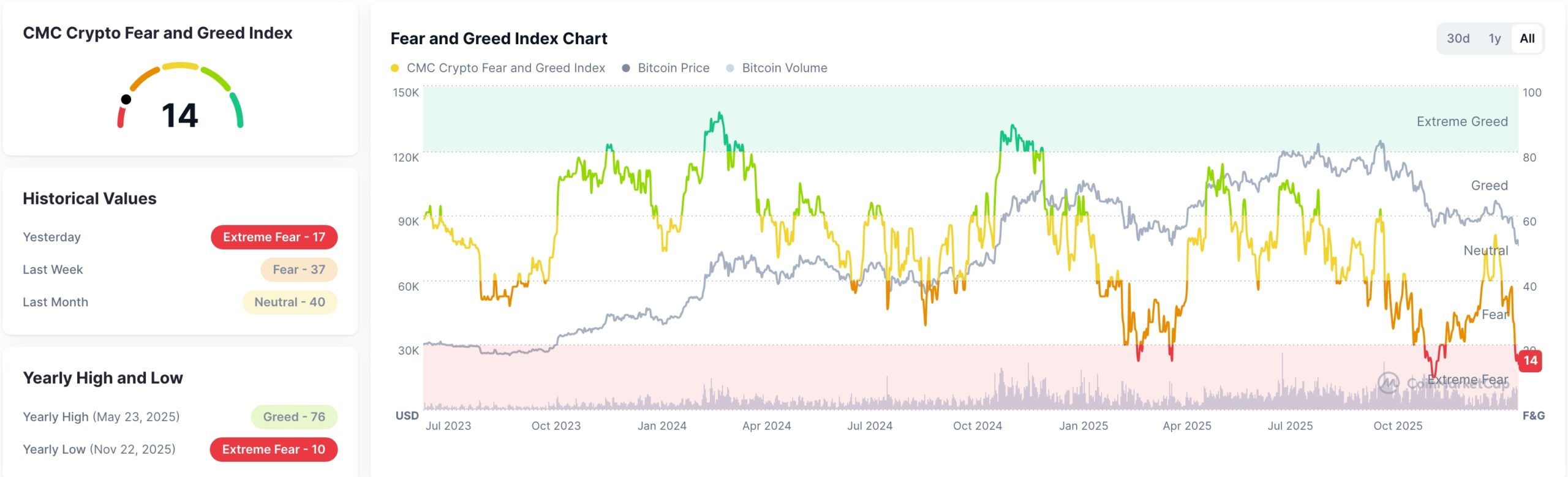

First, the Crypto Fear and Greed Index has moved to the extreme fear zone of 14, a few points above last year’s low of 10. In most cases, crypto market rallies start when the index plunges.

For example, Bitcoin and the crypto market rebounded early this year when the index dropped to the extreme fear zone of 10.

A closer look shows that the index is repeating the same pattern it did last year. It dropped to the extreme fear zone of 15 in March, bounced back to 34 and then retreated to the extreme fear zone of 17 in April. It then bounced back as Bitcoin jumped to a record high.

The same pattern has happened recently. It dropped to 10 in December last year, rebounded to 54 in January, and then retreated to 14. Therefore, it will likely drop further and then bounce back, which will push Bitcoin to above $100,000.

BTC History is Made Up of Crashes and Rebounds

Second, the history of Bitcoin is made up of spectacular bull runs followed by large dips and recoveries. For example, the Bitcoin price has dropped by over 30% from its peak several times in the future. It dropped from $108,930 in January last year to $74,380 in April and then rebounded to a record high a month later.

READ MORE: Pi Network Coin Sits at All-Time Low: Buy the Dip or Sell the Rip?

Similarly, Bitcoin dropped from $74,157 in May 2024 to $48,900 in August 2024, and then bounced back a few months later. Most importantly, it moved from $69,284 in 2021 to $15,600 in December 2022 and then rebounded. This crash coincided with numerous crashes, including FTX, Celsius, and OKX. In a statement on Tuesday, Michael Novogratz said:

“I do think we are at the lower end of the range. What I would say is we have been here before, anyone who has been in crypto for more than five years realizes that part of the ethos of this whole industry is pain.”

The most likely Bitcoin price prediction is that it drops further as the crisis in Iran escalates, and then starts rebounding.

BTC Price Prediction: Technical Analysis

The weekly chart shows that the Bitcoin price continued to drop this week. This retreat happened after the coin formed a giant rising wedge pattern, which is made up of two ascending and converging trendlines.

The coin also slipped after forming a bearish flag pattern, which is made up of a vertical and a channel.

A closer look shows that the Relative Strength Index (RSI) is nearing the oversold level of 30. The last time it got oversold was in June 2022, which marked a bottom that pushed it to a record high a few years later.

Therefore, the Bitcoin price will remain under pressure for a while and then rebound as investors start buying the dip.

READ MORE: Solana Chain Fees are Soaring as it Closes the Gap With Justin Sun’s Tron