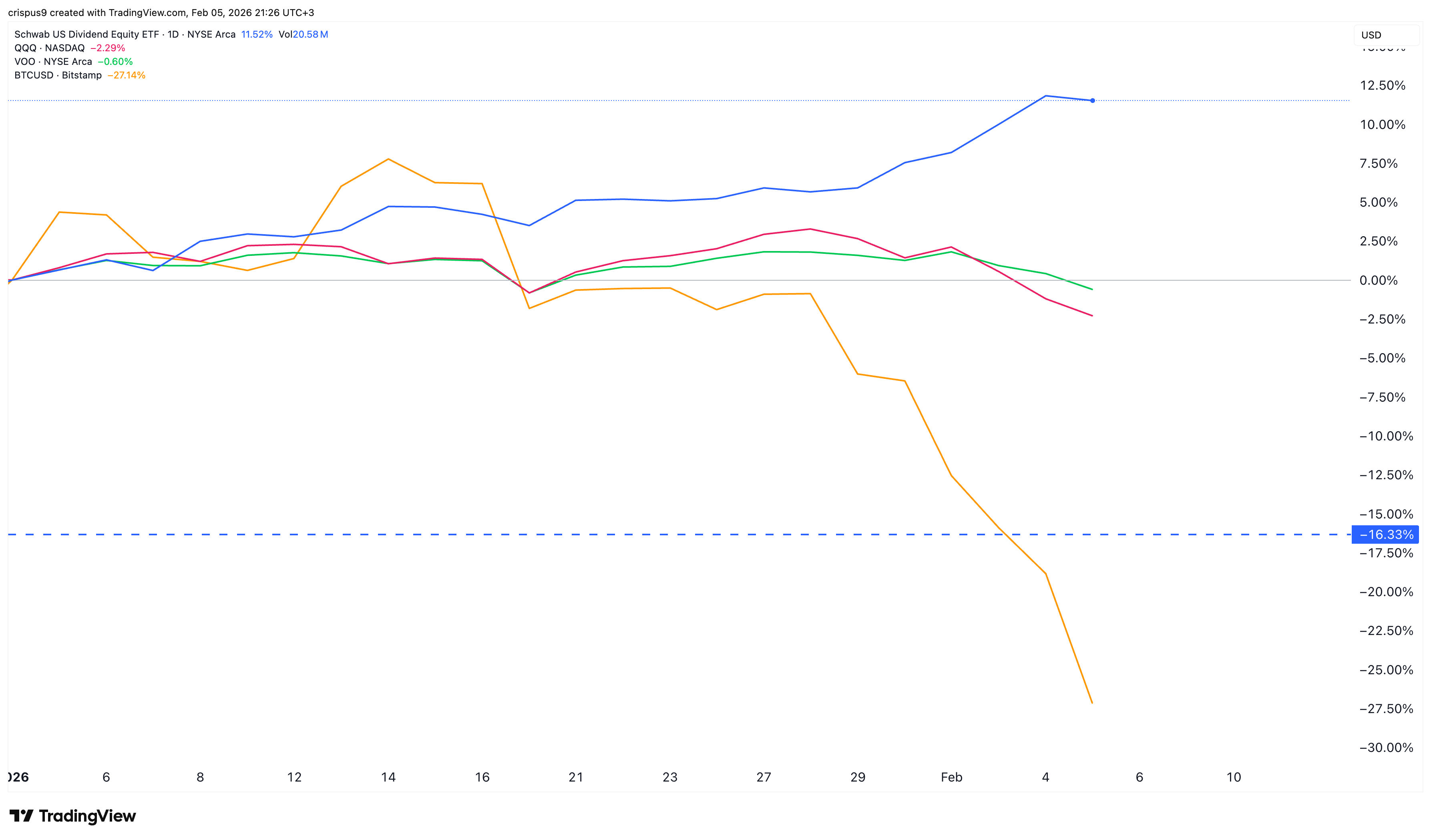

The Schwab US Dividend Equity ETF (SCHD) is firing on all cylinders this year as the S&P 500 (VOO), Nasdaq 100 (QQQ), and the crypto market dip. SCHD has jumped by over 12% and is hovering at its all-time high.

On the other hand, the QQQ ETF has dropped by over 2.27%, while the VOO has dropped by 0.60%. Bitcoin price dropped below $68,000, while the market capitalization of all coins dropped to $2.3 trillion.

SCHD ETF is Soaring as Investors Rotate From Growth to Value

The main reason why the SCHD stock is beating the broader stock market is that investors are rotating from growth to value. Most growth stocks that drove the equities market in the past few years have slumped.

Microsoft stock price plunged to $400 from the all-time high of $565. Similarly, NVIDIA has moved into a bear market after falling by over 20% from its highest point in November. AMD and Palantir stocks crashed despite reporting strong financial results this week.

READ MORE: IREN Stock Price Forecast Ahead of Earnings: Buy the Dip?

The worst performers are software companies like Atlassian, ServiceNow, Intuit, and Salesforce that have plunged by over 60% from their all-time highs. The Nasdaq 100 Index is mostly made up of technology companies, while the S&P 500 consists 30% tech companies.

SCHD stock is thriving because it has little exposure to the technology industry. Technology stocks account for about 8% of its fund. This includes old-school technology companies like Texas Instruments and Cisco.

Instead, its biggest constituents are companies like Lockheed Martin, Texas Instruments, Chevron, ConocoPhillips, Verizon, Bristol Myers Squibb, and PepsiCo.

Energy companies account for almost 20% of the fund. These companies are doing well as crude oil and natural gas prices jump because of the ongoing tensions in the Middle East.

The other large companies in the ETF are in industries like consumer staples, healthcare, industrials, and financials. Most of these companies do well when risks are rising.

Schwab US Dividend Equity ETF is Cheaper

The other main reason why the SCHD is beating the broader market is that it is a cheap fund with a high dividend. Data shows that it has a price-to-earnings ratio of 17, lower than the S&P 500’s 22 and the Nasdaq 100 Index’s 30.

Therefore, investors are moving from the highly overvalued tech names to the cheaper value stocks. Two of the best examples of this are Palantir and Tesla, which have a price-to-earnings ratio of over 150. Palantir justifies this valuation by pointing to its revenue growth and its commercial segment traction.

Tesla, on the other hand, spots a high valuation despite its business going through a major slowdown. Its valuation is based on the Elon Musk premium and its entry into the AI and robotics industry.

Meanwhile, the crypto market crash happened as investors remained concerned about the industry. In a long X post, Nouriel Roubini warned that a crypto apocalypse was coming, noting that these coins were valueless.

READ MORE: Could a Trump Strike on Iran Trigger a Crypto Market Rally and Recovery?