The crypto crash resumed today, with Bitcoin and most altcoins being deeply in the red, as traders waited for the upcoming meeting between Donald Trump and Benjamin Netanyahu. Bitcoin price slipped to $66,600 from the year-to-date high of nearly $100,000, while Ethereum dipped to $1,942.

Crypto Crash Continues Ahead of Trump-Netanyahu Meeting

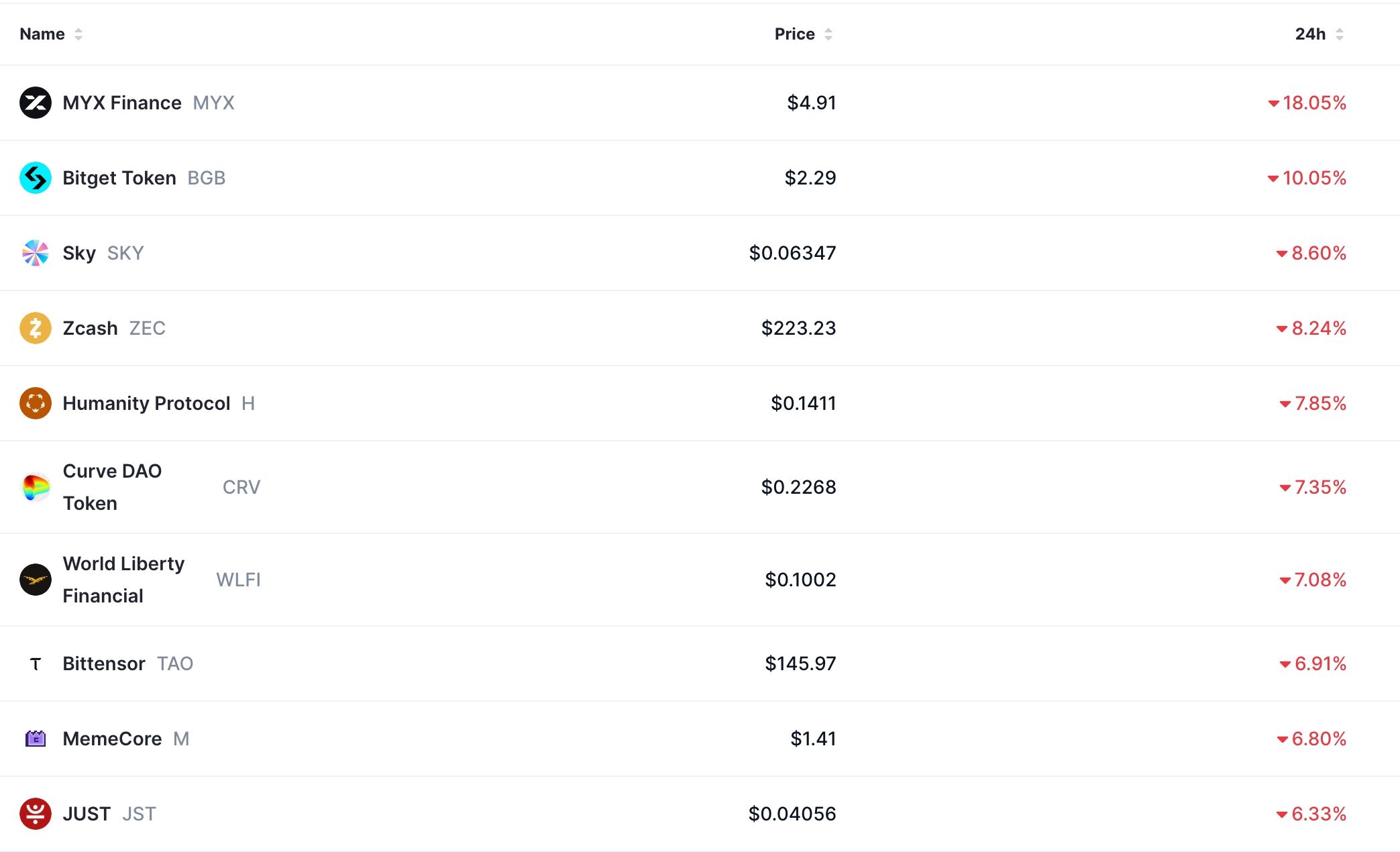

The market capitalization of all tokens dropped by over 3% to $2.27 trillion, while the Crypto Fear and Greed Index slumped to 9. Some of the top laggards in the crypto market were altcoins like MYX Finance, Bitget Token, Sky, Zcash, and Humanity Protocol.

The crypto crash happened as investors waited for the upcoming meeting between Donald Trump and Benjamin Netanyahu. Netanyahu hinted that his main goal is to press the United States as the talks with Iran continue.

While Trump wants to negotiate on nuclear, Netanyahu is pressing the US to include other details, including Iran’s ballistic missile program and its support for proxies like Hezbollah, Hamas, and Houthis. Iran has insisted that those other measures are not up to debate.

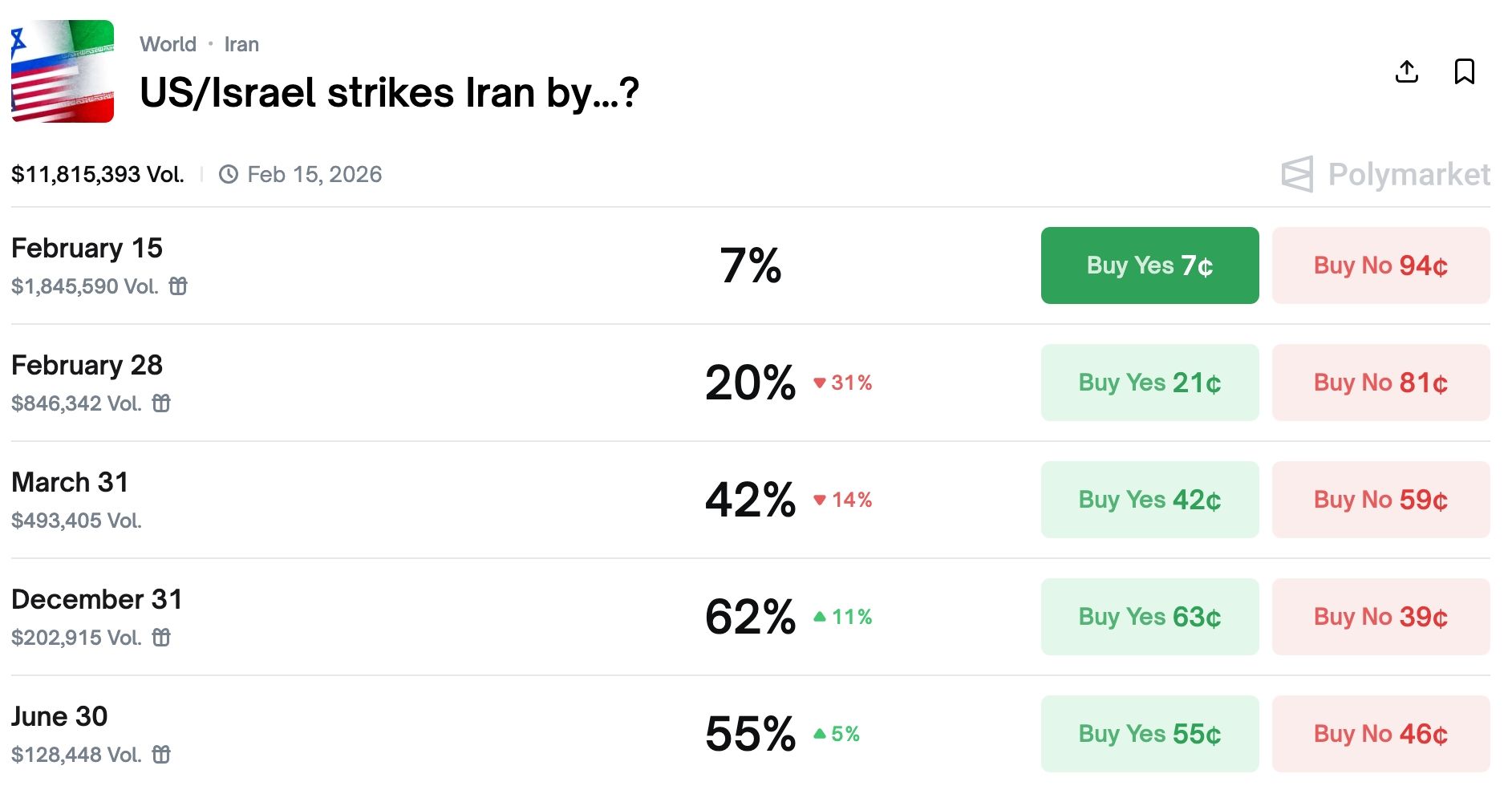

Therefore, there is a risk that Trump will attack Iran soon. Indeed, data on Polymarket shows that the odds of an attack happening before December 31 rose to 62% on Polymarket. An attack happening before June 30 rose to 55%. Also, gold, a common safe-haven, and crude oil jumped. Iran has hinted that it will disrupt oil flows at the Strait of Hormuz.

Crypto Crash Happened After White House Meeting

The other main reason for the crypto crash is that the White House meeting with officials from banks and crypto companies did not generate the desired result.

The three sides did not reach an agreement on the major gaps in the CLARITY Act. Banks insist that crypto companies should not provide stablecoin rewards, arguing that this will lead to outflows from their institutions.

A deal will lead to the passage of the CLARITY Act, the most important crypto regulation after the GENIUS Act.

The other main catalyst for the crypto crash is the upcoming macro data, including the US non-farm payrolls (NFP) on Wednesday and the latest US consumer inflation report on Friday this week. These numbers will help the Federal Reserve determine when to cut interest rates.

Technicals also explain why the crypto market crash is happening. For example, Bitcoin price remains below all moving averages and the Supertrend indicator, a sign that the downtrend is gaining momentum.

READ MORE: PayPal Stock Has Imploded: Will the New CEO Turn Around the Fallen Angel?