XRP price was flat on Thursday, mirroring the performance of other cryptocurrencies, as investors reacted to the latest US non-farm payrolls (NFP) data. Ripple token was trading at $1.3795 as focus now shifts on the upcoming US consumer inflation report.

XRP Price Pressured After US Jobs Report Despite Aviva Deal

Ripple price dropped after the United States published a strong jobs report. Data compiled by the Bureau of Labor Statistics (BLS) showed that the economy created over 130k jobs in January, higher than the median estimate of 70k.

The unemployment rate dropped to 4.3%, while the wage growth continued rising during the year. Looking forward, the next important catalyst for the XRP price and other assets is the upcoming US inflation report on Friday.

Economists polled by Reuters expect the data to show that the headline Consumer Price Index (CPI) data retreated to 2.5%, while the core CPI moved to 2.6%. If this is correct, this report will push the Fed to cut interest rates more times than expected this year, which is a good thing for the crypto market.

READ MORE: Pi Network Coin Price Prediction as Top Whale Restarts Buying

The XRP price also retreated as Ripple emerged as a major player in the Real-World Asset (RWA) tokenization industry. The company reached a deal with Aviva, a top British company with over $349 billion in assets. This deal will see Aviva tokenize some of its assets on the XRP Ledger, a move that will create more utility for XRP and token burns.

Data compiled by RWA shows that the amount of money locked in XRPL’s tokenized assets has continued soaring in the past few months to over $1.7 billion. The Ripple USD (RLUSD) stablecoin recently crossed the $1.5 billion asset mark.

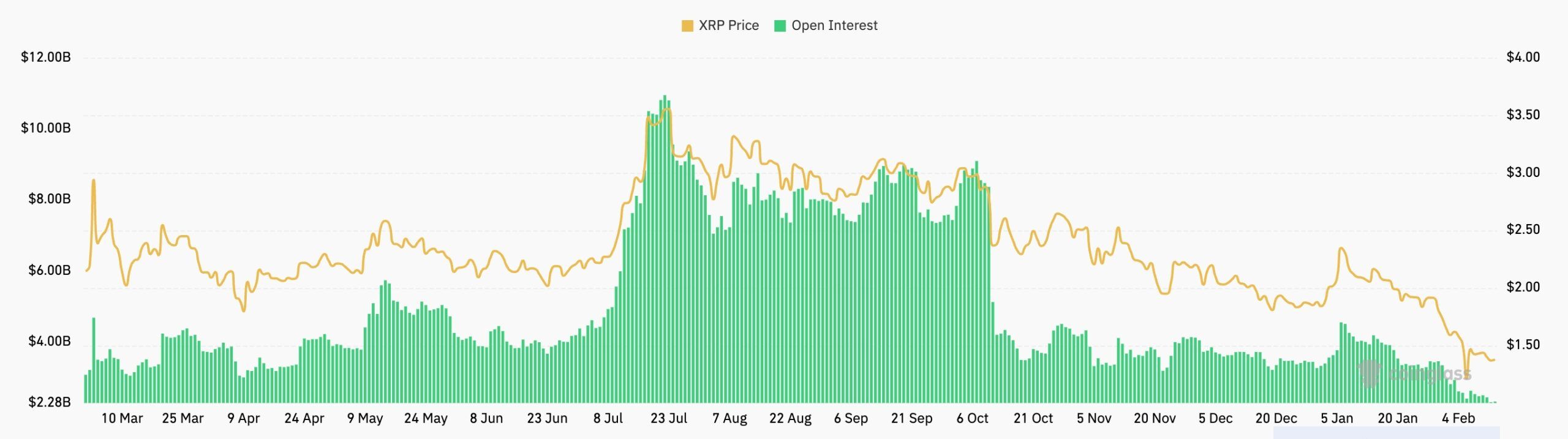

Therefore, XRP price has dropped because of the ongoing crypto market crash, which has affected Bitcoin and most altcoins. Also, demand from the futures market has continued falling this week. It dropped to $2.2 billion, down sharply from last year’s high of over $10 billion.

Ripple Price Prediction: Technical Analysis

The daily timeframe chart shows that the XRP price remains under pressure this year, continuing a downward trend that started in July last year when it jumped to a record high of $3.6650.

It has remained below all moving averages, while the Relative Strength Index (RSI) has continued falling, moving from a high of 73 to the current 33. Also, the Average Directional Index (ADX) has soared to a high of 54, a sign that the downtrend continues.

Therefore, the token will likely continue falling, potentially to the key psychological level of $1, which is about 30% below the current level.

READ MORE: Solana Price Analysis: SOL Crashes Despite Booming Ecosystem Growth