- Aave Horizon RWA deposits surpassed $1 billion, doubling since January.

- AAVE trades near $123, supported around $115-$120, with $135–$140 as key resistance.

- Aave DAO revenue rose to $142 million in 2025; governance and Grayscale ETF filing are potential catalysts.

Aave announced that its Horizon marketplace hit $1 billion in real-world assets on February 19, doubling in value from January, making it the only decentralized lending application to achieve this milestone in tokenized bonds and treasury-like assets.

The announcement follows the Aave DAO’s publication of preliminary figures for 2025, which reported revenue of about $142 million, and now discusses a proposal to allocate product revenue to the treasury and fund Aave Labs for the development of Aave V4, transferring all relevant intellectual property.

The inflow of real-world assets (RWAs) into Aave can significantly increase the lending application’s loan limit and revenue capture, reinforcing its treasury and development agenda.

Market participants are watching for developments that may develop into catalysts for the Defi token, including Grayscale’s S-1 filing to convert an Aave trust into a spot exchange-traded fund (ETF) and the protocol’s successful management of some $450 million in liquidations between January 31 and February 5 without any accrual of bad debt, which they see as a vote of confidence in the protocol’s risk management.

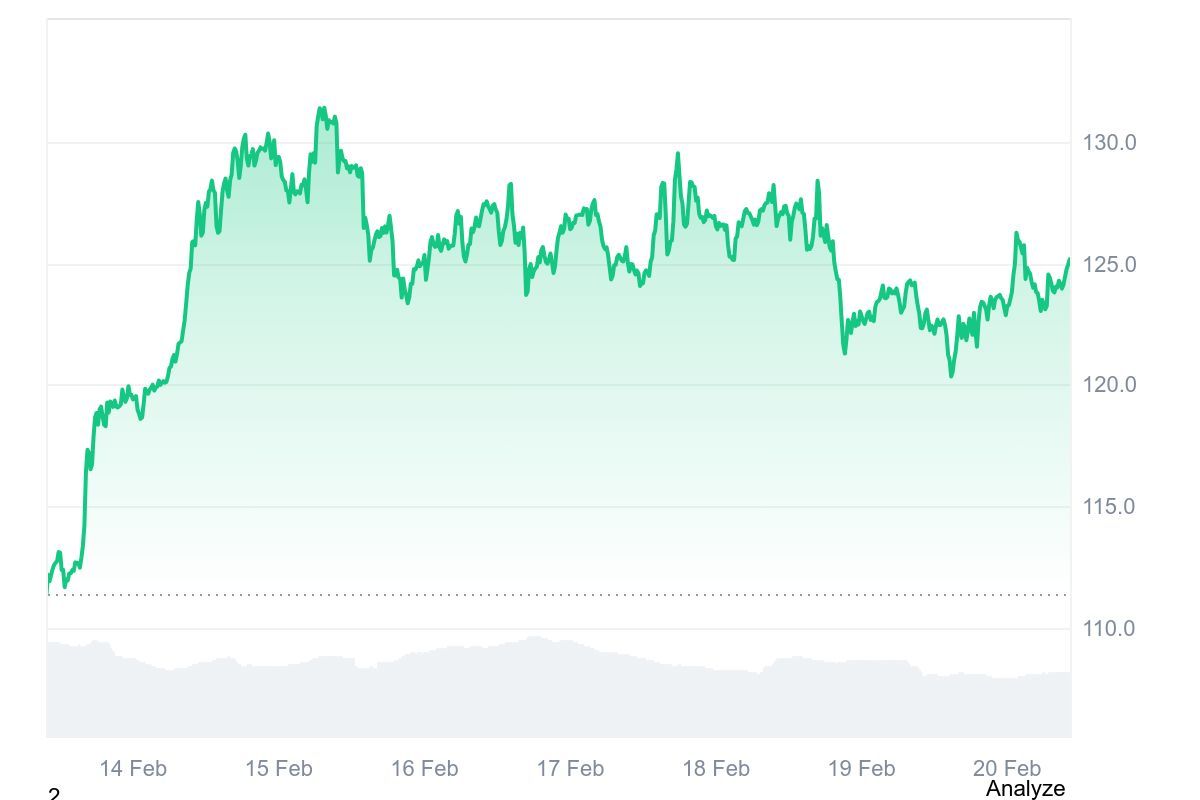

On-chain metrics present a mixed picture. AAVE’s price is trading near $125, up about 10 percent from a week ago but down around 21 percent from a month ago.

Spot volume for the cryptocurrency has dropped to around $327 million over the past 24 hours, while futures volume is also trending downward, as open interest shows signs of increasing as traders take positions on the platform.

Technical indicators for the token show some support in the $115 to $120 range, but any serious bullish move will only emerge when the Aave token closes above the $135 to $140 range for a day.

READ MORE: Top 3 Reasons the S&P 500, Nasdaq 100, and Dow Jones are Falling Today