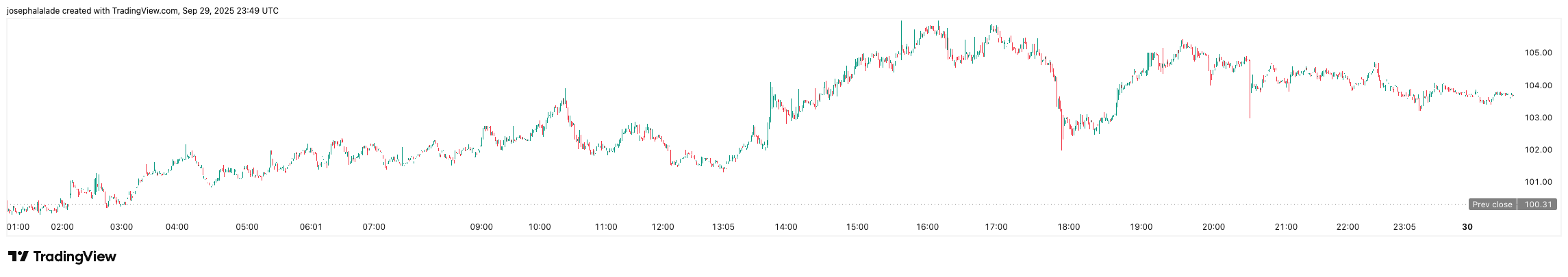

Quant price (QNT) surged roughly 15% in the past 7 days, climbing from lows near $86 on September 26 to around $103.7 today. The rally coincides with the launch of QuantNet, a programmable settlement infrastructure that allows banks to connect digital assets and tokenized money without replacing their existing systems.

CEO Gilbert Verdian described it as a defining moment in financial history, removing the “fragmented systems and manual processes” that have long slowed innovation in banking.

Community sentiment quickly turned bullish, with analysts highlighting that major UK banks are already using QuantNet in live environments, validating its readiness for global adoption. This real-world utility positions Quant as a backbone for the projected $30 trillion tokenized asset markets by 2030.

Quant Price Prediction Amid Banking Adoption

Quant’s role in the UK’s tokenized sterling deposits pilot, which includes six major banks such as HSBC and Barclays, adds a powerful fundamental catalyst.

The initiative, set to run until mid-2026, validates Quant’s enterprise credentials and could extend its reach to European central banks through existing ECB partnerships.

The QNT coin is currently trading at $103.7, remaining above the key level of $100, thanks to strong trading volume that has increased by nearly 78% over the past 24 hours.

Indicators show a positive outlook. The Relative Strength Index (RSI) is at 56, indicating room for further gains, and the moving averages are signaling a buy. In the short term, resistance is between $106 and $114, with a chance to rise to $125 if the momentum continues.

If the Quant price drops below $100, QNT could test $95 or even $86, where it previously bounced back. Traders are closely watching whether today’s rally can consolidate above $100 to establish a stronger bullish base.

READ MORE: Pump Fun Coin Jumps 10% as Fitell Adds $PUMP to Treasury