JasmyCoin price has crashed into a bear market this year by falling more than 67% from its highest level in December last year. This crash has led to a $1.83 billion wipeout as its market cap has dropped from over $1.84 billion in November to $974 million.

JasmyCoin CEX Balances are Falling

Jasmy, popularly known as Japan’s Bitcoin, has two potential catalysts that may push its price higher in the coming weeks.

First, there are signs that Jasmy holders are not selling their coins. This view is supported by the fact that the amount of JASMY coins in exchanges has continued to fall. Data by CoinGlass shows that JASMY balances have dropped to 8.47 billion, the lowest level in months. They have been in a strong downtrend since they stood at over 11.67 billion in March last year.

Falling CEX balances are a sign that investors are holding onto their cryptocurrencies and are not selling them. In most periods, CEX balances rise when investors move their coins from their wallets to exchanges to sell them.

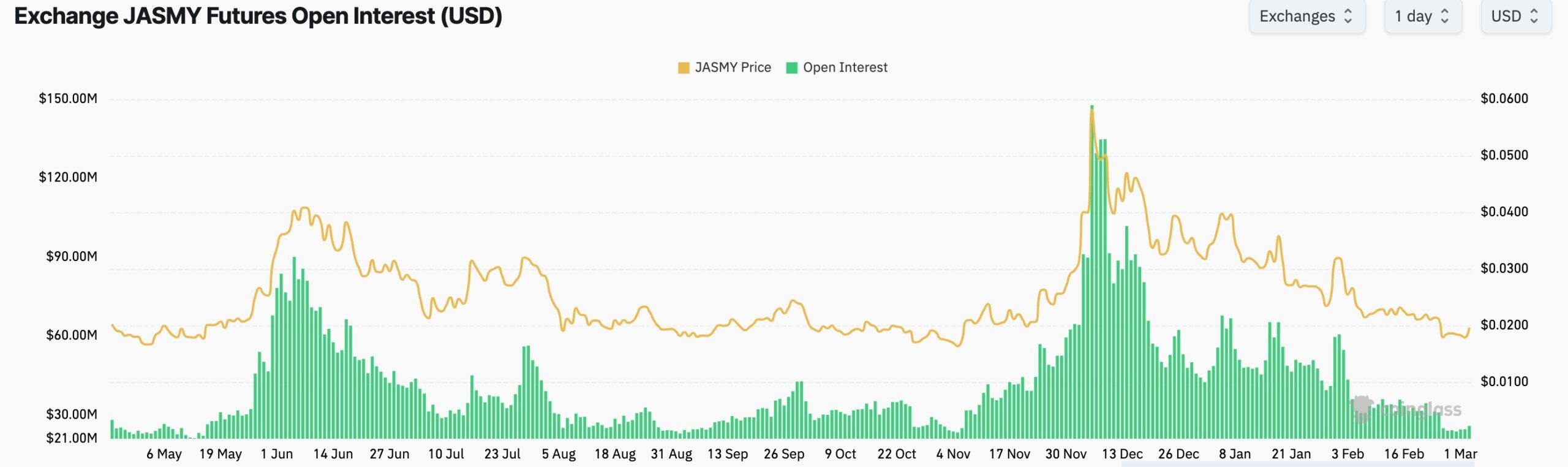

Additional data shows that Jasmy’s future open interest has continued to fall in the past few months, a sign of weak demand among investors. The interest fell to $25.5 million, down from November’s high of $150 million. While falling futures open interest is seen as bearish, historically, data shows that most bullish breakouts occur during periods of low futures interest.

Jasmy Price Technical Analysis

The daily chart shows that the Jasmy price has been on a strong downward trend after peaking at $0.05912 in November and then dropping to a low of $0.01665 in February. It crashed below the key support at $0.04460, which was the highest swing in June.

The coin also formed a death cross pattern as the 200-day and 50-day Exponential Moving Averages (EMA) crossed each other.

On the positive side, the token has formed a falling wedge pattern, which is shown in red in the chart above. This pattern consists of two falling, converging trendlines that are nearing their meeting point.

The Relative Strength Index (RSI) has pointed upwards and moved above the descending trendline. Therefore, the JASMY token will likely bounce back in March, potentially hitting the resistance point at $0.0445, increasing approximately 130% from its current level.

READ MORE: Missed Pepe and Jasmy: Here are the Best Meme Coins to Buy