Pump Fun price traded mostly flat over the past 24 hours, hovering near $0.00276 and down 0.6% on the day. The pause followed several sessions of gains, leaving the token up about 17.34% on the week as price held within a narrow range between $0.002737 and $0.003011.

Trading activity remained heavy, with 24-hour volume of roughly $318 million, even as the PUMP coin price stalled. With momentum cooling, traders have shifted focus to the developing technical structure rather than short-term swings.

BonkFun Fee Cut Fails To Dent Pump.fun Dominance

Pump.fun continued to lead activity across Solana memecoin platforms after rival BonkFun removed creator fees on Jan. 14 in an attempt to regain market share. The response in platform metrics was uneven.

Pump.fun recorded roughly 30,000 new token launches following the announcement, compared with about 2,000 on BonkFun. Daily volume told a similar story, with Pump.fun handling $109 million versus BonkFun’s $8 million.

Traders appeared to read the fee removal as a defensive move rather than a catalyst for growth. Pump.fun’s higher throughput matters directly for PUMP coins demand, as the token is tied to platform fees and buyback mechanics.

READ MORE: Coinbase Warns CLARITY Act Worse Than Status Quo

Broader market conditions also helped. Bitcoin price climbed to a multi-month high near $97,860.60 on January 14, lifting total crypto market capitalization by about $110 billion. PUMP often benefits from altcoin rotations during periods of Bitcoin strength. The Fear & Greed Index at 54 remained neutral, leaving room for positioning to build if sentiment improves.

Pump Fun Price Outlook: Cup-and-Handle Structure Develops

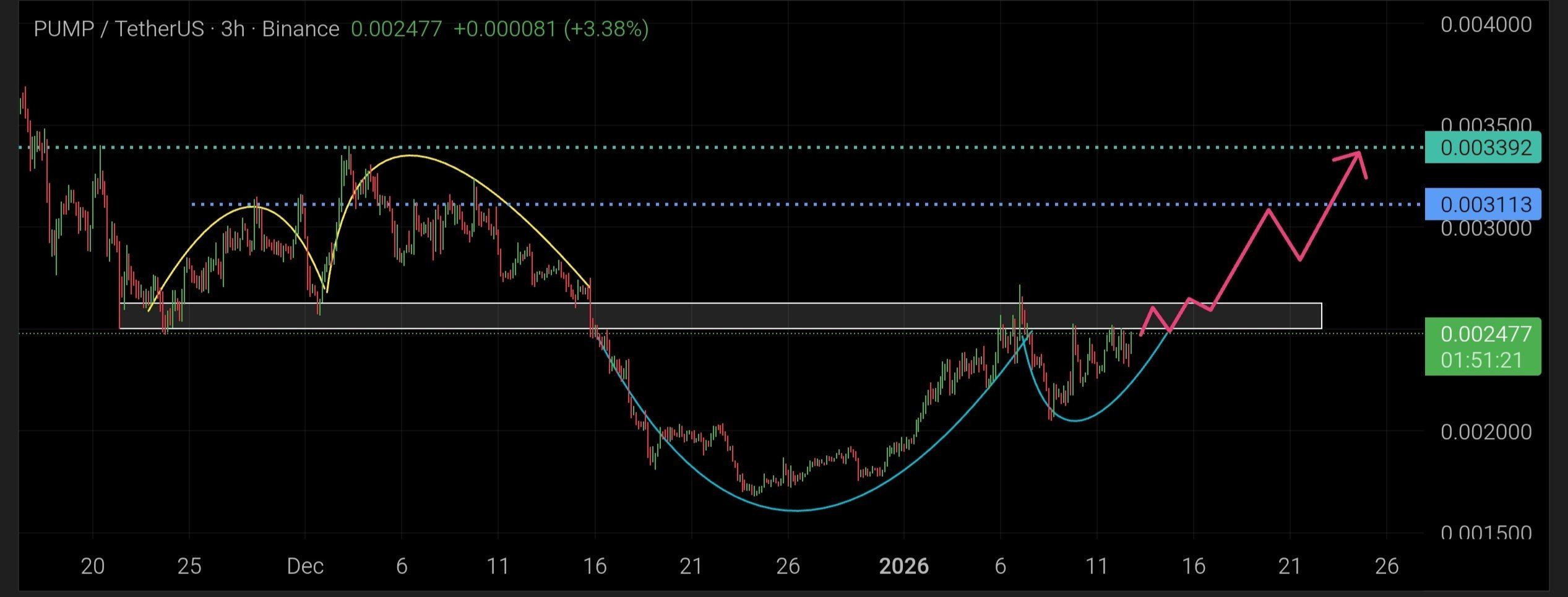

Technical attention has centered on a developing cup-and-handle structure following a prolonged base. Ali Charts flagged a breakout from the pattern, identifying $0.00378 as the measured target if the PUMP price completes the formation. His analysis frames the recent advance as a shift from accumulation into continuation, with the handle forming after Pump Fun reclaimed the $0.00265 area.

Elite Crypto focused on the pattern’s evolution. He noted that PUMP Coin previously formed an inverted cup-and-handle during a sharp selloff, a structure that aligned with heavy distribution and accelerating downside. That bearish setup has since given way to a broader base and a standard cup-and-handle, which is typically constructive when it follows capitulation rather than exhaustion.

Both chartists point to the same tactical zone. Buyers have repeatedly stepped in around $0.00247–$0.00265, establishing near-term support as the handle develops just above it. Resistance remains layered near $0.00311 and $0.00339, where supply previously capped advances.

Price behavior remains the key signal. Pullbacks have been shallow, volume has stayed elevated, and the market has paused rather than reversed. Momentum has cooled from recent highs but has not turned lower, keeping the structure intact. For now, traders are watching whether the Pump Fun price can hold support long enough to apply pressure on the upper range rather than slip back into distribution.

READ MORE: ICP Price Prediction: Here’s Why Internet Computer is Soaring