Bitcoin price has remained on edge over the past few days and is stuck at a crucial support level as investors await progress on the CLARITY Act in the United States Senate. BTC was trading at $95,300 on Monday morning, and chances are that it will soon have a strong bullish breakout as the odds of a US Strategic Bitcoin Reserve jump.

Strategic Bitcoin Reserve Odds are Rising

Bitcoin price has held steady in the past few days as investors reacted to the stalled progress of the Market Structure Bill in the United States Senate last week. The stall happened after Coinbase withdrew its support, citing several key issues, including the stablecoin rewards program.

On the positive side, there are signs that the Senate will eventually pass the bill in the coming weeks or months. It is common for bills to stall as multiple parties negotiate to reach a good deal.

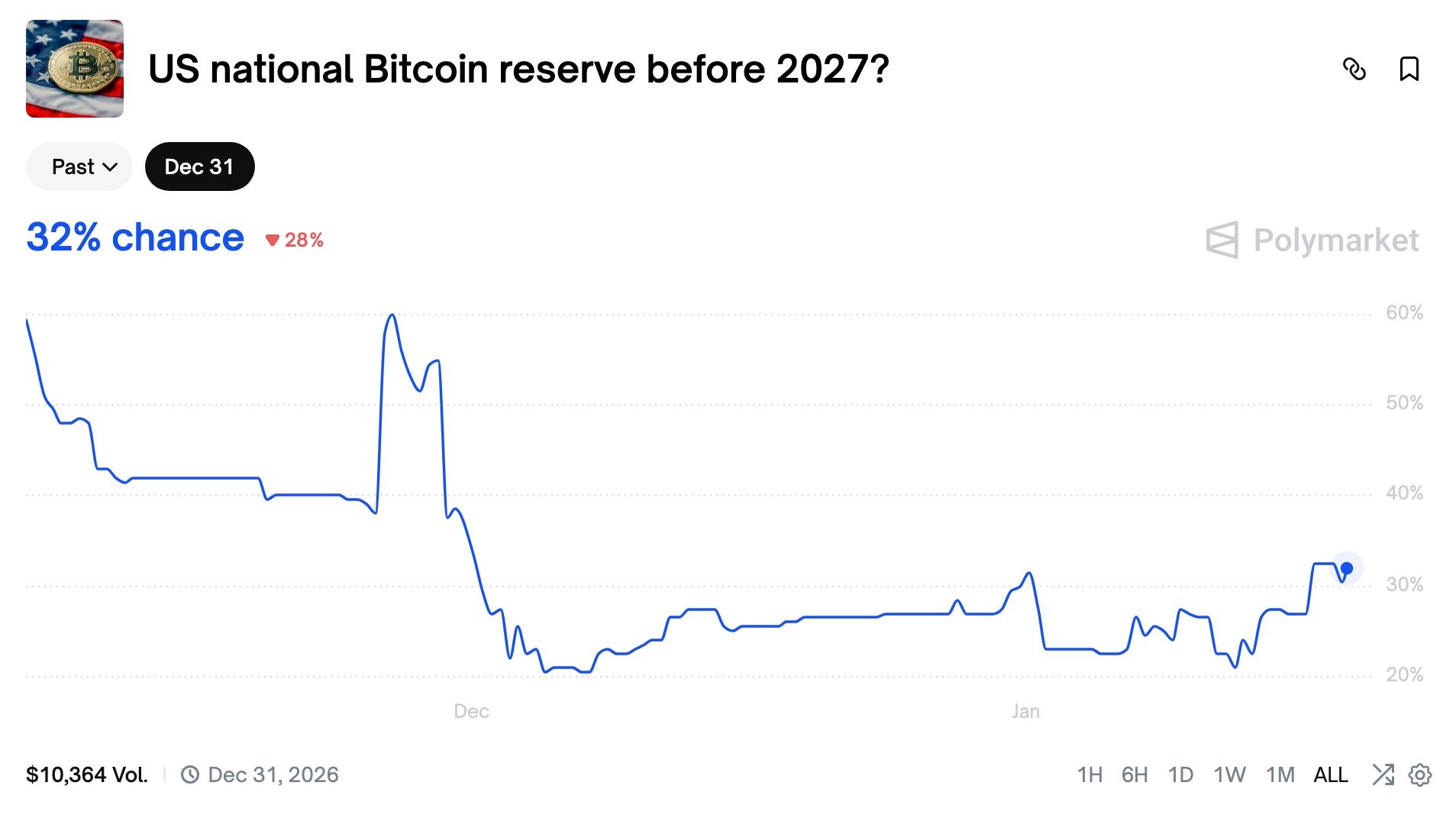

Meanwhile, Polymarket traders are optimistic that the Donald Trump administration will approve a Strategic Bitcoin Reserve. Data on Polymarket shows that the odds of the reserve rose to 32%, up from the year-to-date low of 21%.

One approach for the reserve is to use the seized coins, which total about 328,372, as reserves. In a statement last week, the White House confirmed that Bitcoin seized as part of the Samourai wallet will not be sold and will be added to the Strategic Bitcoin Reserves.

Meanwhile, American states have continued to create strategic reserves. States like Texas, New Hampshire, Arizona, Massachusetts, and Ohio are working to establish these reserves. At the same time, some state treasurers have bought spot Bitcoin ETFs.

Looking ahead, the next key catalysts for the Bitcoin price will be upcoming macro data from the United States, the Supreme Court’s decision on Donald Trump’s tariffs, and any progress on the Market Structure Bill.

Bitcoin Price Technical Analysis

The daily timeframe chart shows that Bitcoin price has rebounded over the past few months, rising from a low of $80,620 in November to a high of $97,917 in min January.

It has moved above the upper boundary of the ascending triangle pattern, shown in red. This pattern consists of a horizontal resistance and a diagonal trendline. It moved above the upper side and has retested it. A break-and-retest is a popular bullish continuation sign.

The coin has moved above the 50-day Exponential Moving Average (EMA) and the Supertrend indicator. Therefore, the most likely BTC price forecast is bullish, with the next key target being at $100,000, which coincides with the Major S&R pivot point of the Murrey Math Lines tool.

READ MORE: Dogecoin Price Forms an Alarming Pattern as DOGE ETF Inflows Dry