Ethereum Classic (ETC) is under heavy pressure, with technical analysts sounding the alarm. The coin is currently clinging to a fragile support zone around $14.30, and should that level break, the token might face a potential freefall toward $8.

As bearish momentum grows and trading volumes decline, market watchers are warning that the Ethereum Classic price is dangerously close to a major breakdown.

At the time of writing, ETC is trading at $14.82, down over 2% today. Market data from CoinMarketCap indicates its market cap has dropped to $2.24 billion, while 24-hour volume has dipped to just above $80 million, falling more than 12%. These figures show weaker demand for the asset, as traders appear more hesitant to invest at current prices.

Breakdown Could Send Ethereum Classic Toward $8

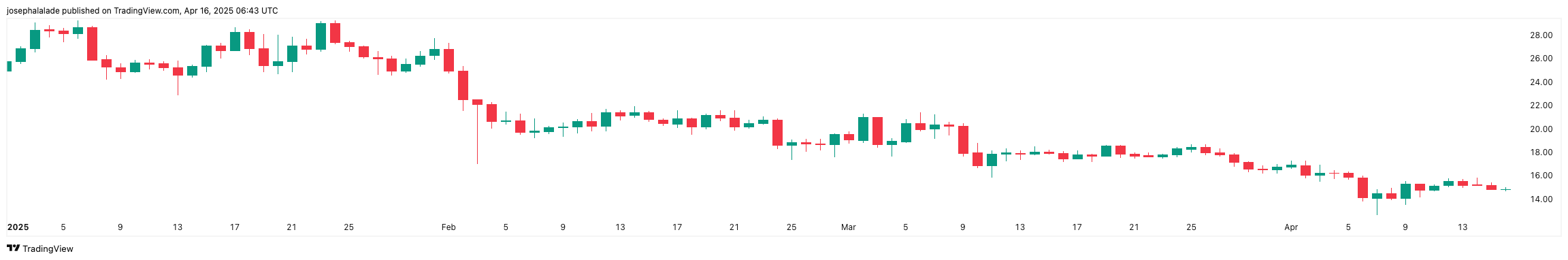

The bigger concern lies in the chart. On April 16, popular crypto analyst Ali posted a stark warning: the Ethereum Classic price is testing the critical $14.30 support, and a break below this level could open a path all the way down to $8.

His TradingView chart, which outlines a clear downward channel, points to a vacuum zone between $14 and $8—a range with little historical support to cushion a fall. The price action shows repeated failures to establish higher highs, confirming a long-term downtrend that began over a year ago.

Looking at performance metrics, the outlook for ETC has been grim. Ethereum Classic has fallen by more than 15% in the past month alone. Over the last six months, it has lost more than 22% of its value. The year-to-date chart paints an even darker picture, showing a decline of over 40%. When viewed over the full year, ETC has dropped nearly 44%. These sustained losses place the coin among this year’s worst-performing top 50 assets in the crypto market.

From a technical perspective, the picture isn’t much better. TradingView’s technical summary on the daily chart currently signals a “Sell” for Ethereum Classic. Of the 26 indicators analyzed, 14 are flashing sell signals, 10 remain neutral, and only 2 suggest a possible buy. These readings confirm that ETC is still locked in a strong downtrend with minimal signs of reversal.

To prevent a further crash, Ethereum Classic bulls must defend the $14.30 level resolutely. A strong bounce from here, ideally with rising volume and a move back above $16, could reset short-term momentum. However, with bearish indicators mounting and sentiment weakening, that scenario seems increasingly unlikely without a fundamental catalyst.

READ MORE: XRP Price Prediction: Will it Surge as the SEC vs Ripple Case Ends?