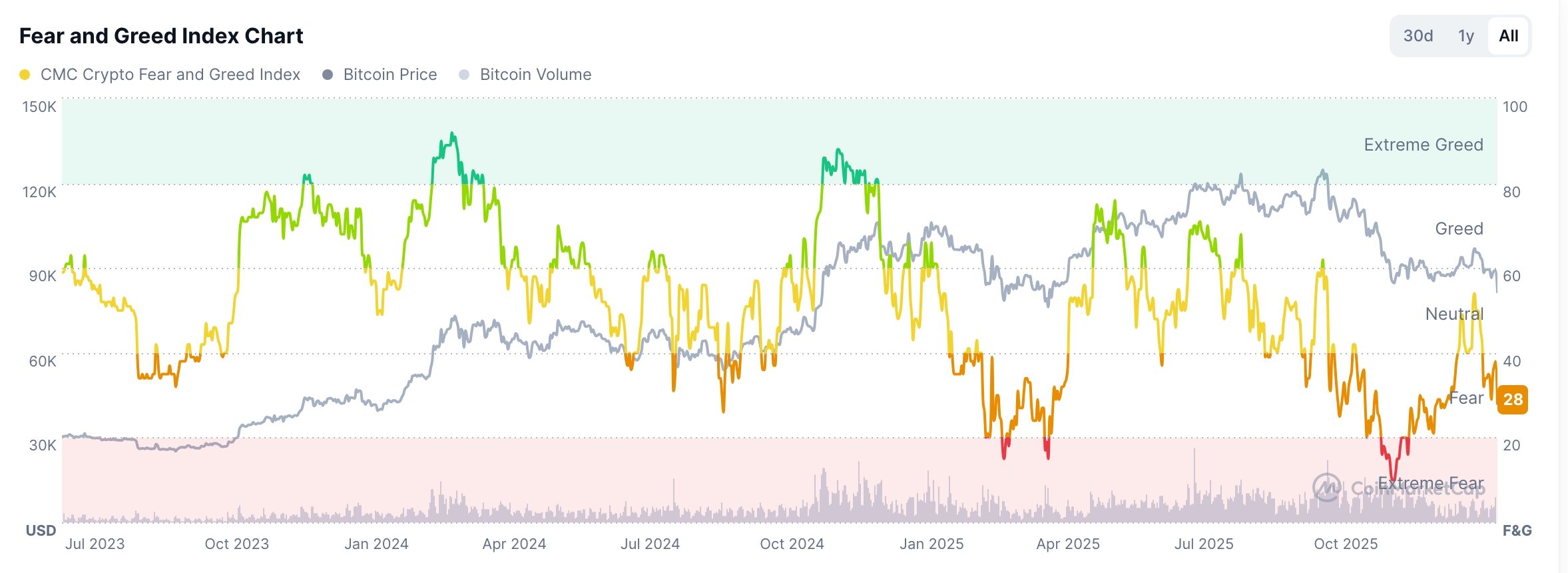

The crypto market crash intensified on Friday, with Bitcoin dropping to $81,000, the market capitalization of all tokens moving to $2.8 trillion, and the Fear and Greed Index moving deep into the fear zone. Will cryptocurrency recover in the near term?

Crypto Fear and Greed Index Slump Continued

Crypto investors are getting fearful as the industry continues to underperform the broader market. Bitcoin price dropped to $81,000 on Friday morning, while top altcoins like River, Worldcoin, Chiliz, Hyperliquid, and Lighter fell by over 12%.

The crypto crash accelerated after Kevin Warsh surged past Rick Rieder on Polymarket. Most traders believe that he now has the highest chance of becoming the next Federal Reserve Chair despite his past criticism of Bitcoin and the broader crypto market.

The crash is also happening as concerns about a potential attack on Iran have risen. Trump has sent an armada to the Middle East, and analysts expect that an attack will be imminent. This explains why crude oil prices have slightly retreated from recent highs, and gold has jumped to a record high.

READ MORE: XRP Price Prediction: Is it a Buy as Ripple Lands at a Key Support?

Meanwhile, the Crypto Fear and Greed Index has plunged to the fear zone of 28, while the Altcoin Season Index has dropped to 33. The Crypto Fear and Greed Index is an important gauge that examines key factors such as Bitcoin dominance, price action, and social media activity.

Cryptocurrency prices remain under pressure as investors rotate into other assets such as gold and silver, which have reached record highs. At the same time, these investors have shifted to other assets, such as the stock market, now that the Dow Jones Industrial Average and the S&P 500 have reached record highs.

Will Crypto Recover?

The question among investors is whether the crypto market will recover anytime soon. While it is hard to predict, history shows that Bitcoin always rebounds from its bear markets.

For example, the coin crashed to $74,500 in April last year when Donald Trump announced his reciprocal tariffs. It then rebounded and hit a record high a month later. Similarly, it fell to $4,000 when the COVID-19 pandemic began and returned to a record high thereafter.

Therefore, there is a likelihood that the crypto market will recover in the coming weeks or months. This recovery will happen as investors shift back from gold and silver to the cryptocurrency market.

However, technical analysis suggests that the recovery might take time. As the weekly chart above shows, Bitcoin price has moved below the bearish flag and rising wedge chart patterns, pointing to more downside, potentially to $74,000 or below.

It is worth noting that cryptocurrencies often rebound when the Fear and Greed Index is in the red. Also, the falling US dollar index and the potential for rate cuts will be bullish for digital assets in the long term.

READ MORE: GME Stock Price Outlook: Reasons GameStop is Soaring and What Next