Jito, a top liquid staking and restaking platform on Solana, and the 14th largest entity in decentralized finance (DeFi) in terms of total value locked (TVL), has become the most profitable entity in the industry this year.

DeFi Llama data shows it has over $3 billion in TVL, much lower than other large entities like AAVE, Lido Finance, Sky, and Uniswap.

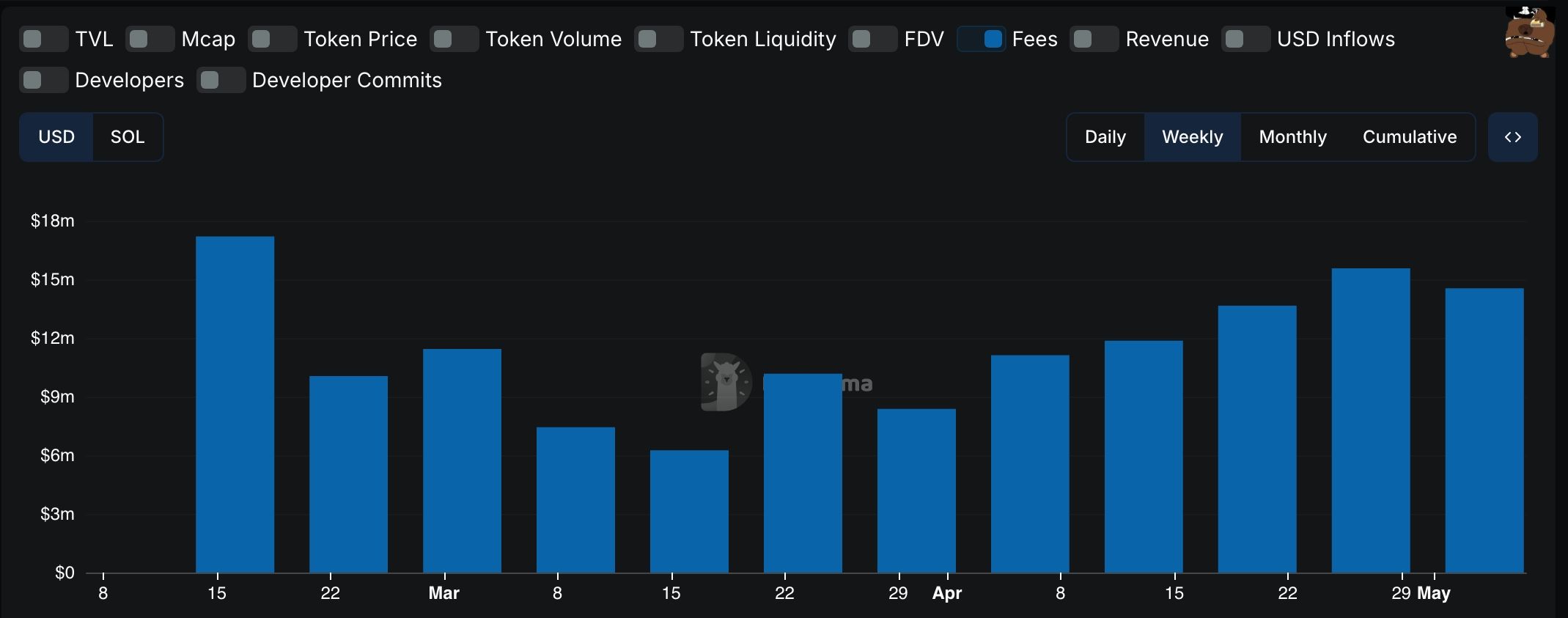

However, it has become a cash generator in terms of fees, regularly generating over $1.9 million a day. TokenTerminal data shows that Jito has made $514 million in fees this year, positioning it as the fourth most profitable entity in the crypto industry after Tether, Tron, and Circle.

In contrast, Lido Finance, the largest liquid staking network in the crypto industry, made $268 million in fees this year despite its $22 billion in assets. Jito also surpasses AAVE, a lending protocol with over $24 billion in assets, making $230 million this year.

READ MORE: Solana Price Prediction: How High Will SOL Go with $6B in ETF Inflows?

Notably, it has outpaced large decentralized exchanges like Uniswap and PancakeSwap, both of which handle billions in daily transactions. Data shows the two handled $55 billion and $38 billion in the last 30 days, respectively.

How Jito Makes Money

Like other top liquid staking platforms, Jito earns money through two main methods: management fees and withdrawal fees. It charges a 4% annual management fee on the total rewards earned by users staking SOL in its pool. It also charges a 0.1% withdrawal fee for users who unstake their SOL through its website.

The fees Jito generates support the network. 2.7% of the fees go to the Jito Treasury, 0.25% to the JitoSOL stakers, and 0.15% to the JTO stakers. The remaining 97% are routed to the validators and stakers in the Jito ecosystem.

Jito’s success is not reflected in its token price, which has plummeted over 61% from its all-time high. This has resulted in a market cap of $668 million and a fully diluted valuation of $2 billion. Despite its substantial fees, Jito is much smaller than Uniswap, which is valued at $4.3 billion, and AAVE, whose token is worth $3.3 billion.

READ MORE: Shiba Inu Price Prediction: Can SHIB Turn $10K Into $1M by 2030?