Bitcoin price surged to a record high this week as demand, especially for spot ETFs, continued soaring. Bitcoin approached the important resistance level of $110,000, making it one of the best-performing assets in the financial market.

A catalyst for the ongoing BTC price surge is the increasing demand for Bitcoin staking through platforms like Coffer Network, Babylon Protocol, and Lombard Finance, which have accumulated billions of dollars.

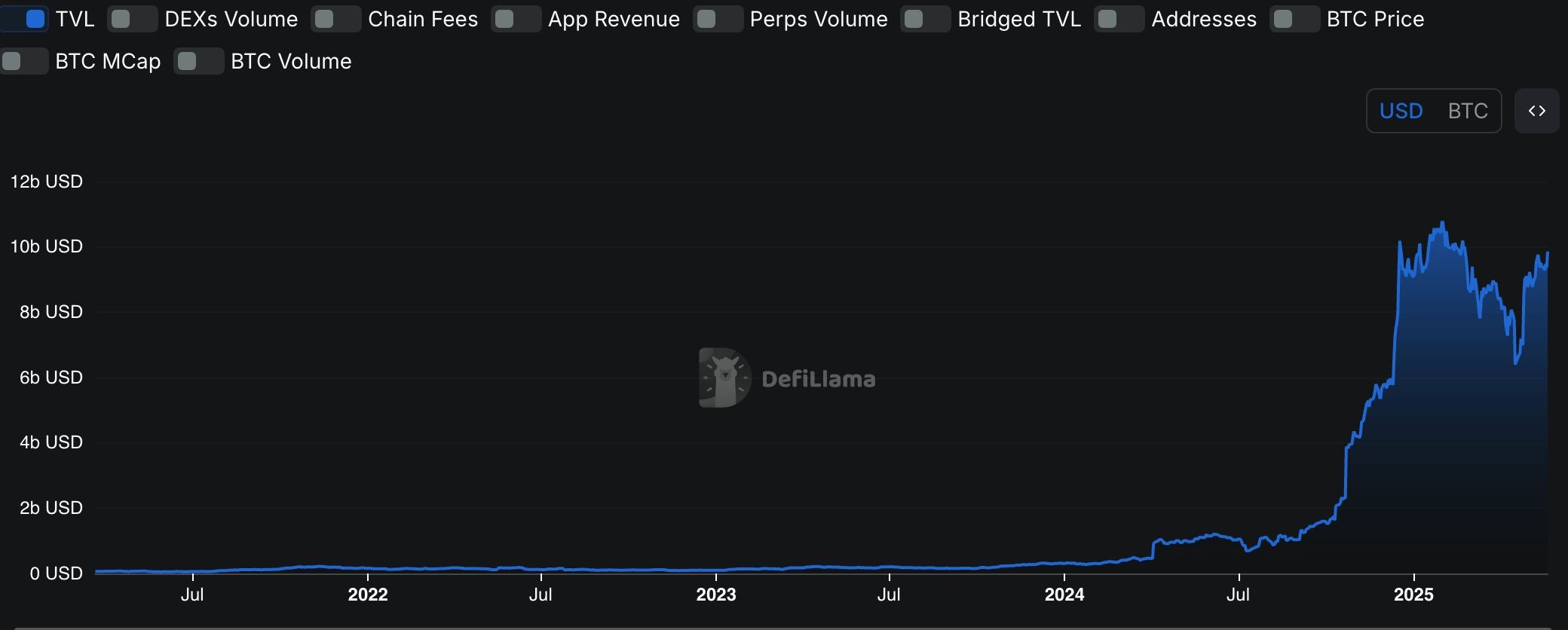

Bitcoin Staking Growth

Bitcoin, despite its popularity, has many limitations such as its slow speed and high transaction costs. Another challenge is that Bitcoin does not have a smart contract feature, meaning that it is not possible to build on top of it.

Also, Bitcoin uses a proof-of-work approach, making it impossible for investors to generate yield. With Polkadot, one can easily earn an APY of over 10%, while Solana offers over 5% in annual returns.

Developers have created solutions to solve the Bitcoin staking challenge, an industry that is seeing strong demand. Data shows that these Bitcoin-related assets now hold over $9 billion in assets, an industry that continues to grow. The sector had less than $1 billion in assets in the same period last year.

Babylon Protocol’s total value locked (TVL) has jumped by 100% in the last 30 days to over $5.4 billion. Similarly, Lombard Finance’s assets have soared by 10% to $2 billion, while Coffer Network has handled over $319 million in assets.

Solv Protocol, which has $471 million in assets, is one of the few platforms that have shed assets in the last 30 days.

READ MORE: BPI and BTCC: Bitcoin’s Answer to JEPI ETF Gets a Lukewarm Debut

How BTC Staking Works

Babylon Protocol, the biggest player in liquid staking, allows Bitcoin holders to stake their coins and earn rewards. BTC holders first lock their coins using a trustless and self-custodial Bitcoin staking script for a certain period in exchange for voting power in an underlying proof-of-stake protocol. It uses companies like Solv and Lombard, which work as finality providers.

Other Bitcoin staking platforms use the wrapping approach, where one deposits Bitcoin and is given an equivalent token, which they can use in decentralized finance (DeFi) and other sectors of the crypto industry.

The Bitcoin staking industry is expected to continue growing since the current assets are a tiny part of it, with a market cap of over $2 trillion.

One of the most anticipated products in this sector is the one being built by Cardano and BitcoinOS. Cardano argues that its approach will be better because it will leverage a technology known as zero-knowledge cryptography, which is safer than the current approaches.

Signs indicate that Bitcoin staking will continue to grow as holders seek to generate yield and participate in other sectors of the crypto industry.

READ MORE: Ethereum Price Prediction: Eyes $4K as BUIDL Nears $3B Milestone