The iShares Bitcoin Trust (IBIT) ETF is firing on all cylinders as demand from Wall Street investors jumps. It has just crossed the important milestone of $70 billion in assets after its cumulative inflows rose to over $47 billion.

IBIT ETF Inflows are Soaring

IBIT’s $70 billion in assets makes it one of the biggest ETFs on Wall Street. It has even overtaken the popular Schwab US Dividend Equity ETF (SCHD), which has $67 billion in assets.

Most importantly, IBIT’s growth happened at a time when the blue-chip SPDR Gold Trust (GLD) was shedding assets. Data shows that it has shed $4 billion in assets in the last four weeks as gold prices lost momentum. It now has $97 billion in total assets, meaning that IBIT could pass it this year if the trend continues.

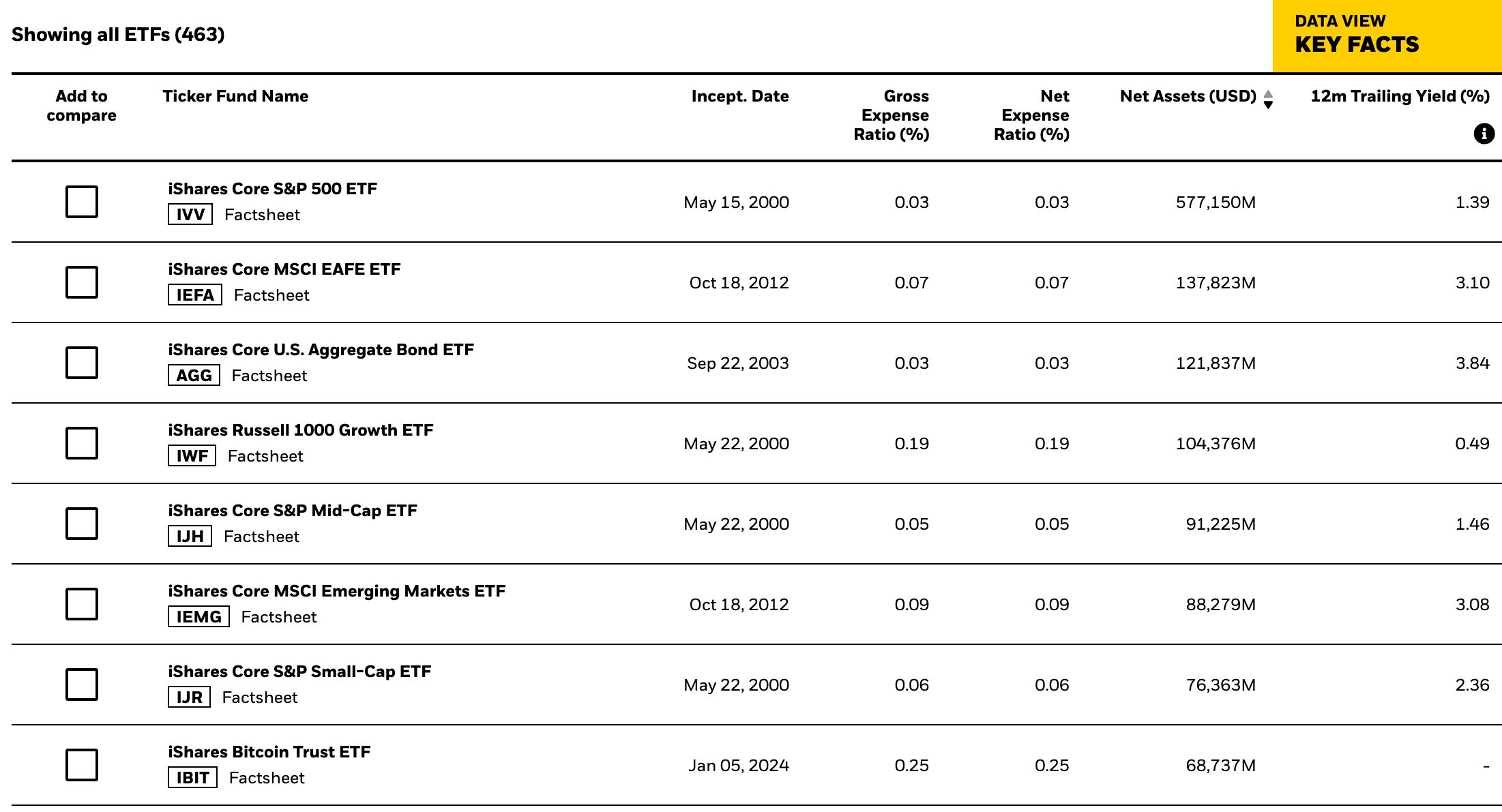

IBIT has become one of the best ETF launches in history. As shown below, it ranks eighth out of 463 of all BlackRock ETFs, even though it was launched less than 18 months ago. It is also in the top 30 of all the biggest ETFs in the US.

Other spot Bitcoin ETFs have done well since their inception in 2024. Fidelity’s FBTC has had cumulative inflows of $11.83 billion and over $21 billion in assets under management. It is the biggest ETF in Fidelity’s ecosystem.

Cathie Wood’s ARKB has $2.79 billion in inflows and $4.7 billion in assets. The other top Bitcoin ETFs are those of companies like Grayscale, Bitwise, VanEck, and Valkyrie.

All spot Bitcoin ETFs have had over $43 billion in inflows and now hold over $130 billion in AUM. Even so, IBIT is the most active one. For example, its daily volume traded on Wednesday was over $66 million, much higher than all the others combined.

Bitcoin Price Gained Momentum

Bitcoin ETFs have gained momentum as the price of Bitcoin continues to rise. On Thursday, the price soared to a record high of $111,900, and Polymarket traders are betting that it will hit $150,000 later this year.

Other analysts are more optimistic than that. BlackRock believes that the Bitcoin price will ultimately jump to over $700,000 in the long term, while Ark Invest sees it rising to $2.4 million by 2030.

The main bullish case for Bitcoin is that its tokenomics position it as a premier asset. It has a fixed supply of 21 million, and 19.8 million have already been mined. Of the mined ones, millions of Bitcoins are irretrievably lost. Many others are held by investors who don’t intend to sell them anytime soon.

As a result, the supply of Bitcoin in exchanges and the over-the-counter market has continued to fall this year. This characteristic has made Bitcoin a safe haven and a store of value.

READ MORE: Bitcoin Market Cap Flipped Google: Can it Flip Apple, Microsoft, NVIDIA?