Michael Saylor’s MSTR stock price does not pay a dividend, and odds are that it will never do that. That’s because the company’s software business does not make too much money, and if it did, Saylor would opt to buy Bitcoin instead.

The YieldMax MSTR Option Income Strategy ETF, whose ticker symbol is MSTY, pays a whopping 140% dividend yield, making it ideal for dividend investors or retirees. This article examines how the Strategy ETF operates and whether it is a suitable investment.

What is the MSTY ETF?

The YieldMax MSTR Option Income Strategy is an actively managed fund inspired by the JPMorgan Premium Income ETF (JEPI), which has accumulated almost $40 billion in assets under management.

MSTY is a fund that aims to benefit when the MSTR stock price is rising, while still generating a monthly dividend payout. It does that by investing a portion of its assets into a synthetic Strategy stock, cash, and US Treasuries.

The other portion of the portfolio comes from the options market. In this, the fund sells call options on the MSTR stock. A call option gives an investor the right, but not the obligation, to buy an asset at a certain strike price in a certain period.

MSTY then receives an option premium, which it uses to distribute to its investors in the form of a monthly dividend.

The ETF performs well when MSTR stock is in an uptrend, up to a certain point. If the stock rises sharply, it will miss out since the strike price will be triggered. On the other hand, if the stock crashes, it means that the options trade will become worthless since one can buy it in the open market at a cheaper price. If it remains flat, the MSTY ETF benefits from the options premium.

READ MORE: Shiba Inu Price Prediction: Is it Safe to Buy SHIB as Whales Dump?

Is this MSTR Stock ETF a Good Buy

Covered call options are often pitched as better options than traditional assets because of the dividend return.

However, most covered call ETFs underperform the underlying asset over time. For example, the MSTY stock price has dropped by 18.40% this year, while the MSTR stock has jumped by 25%.

The same trend occurred over the last twelve months, as the MSTY fund declined by 37% and MSTR rose by 128%.

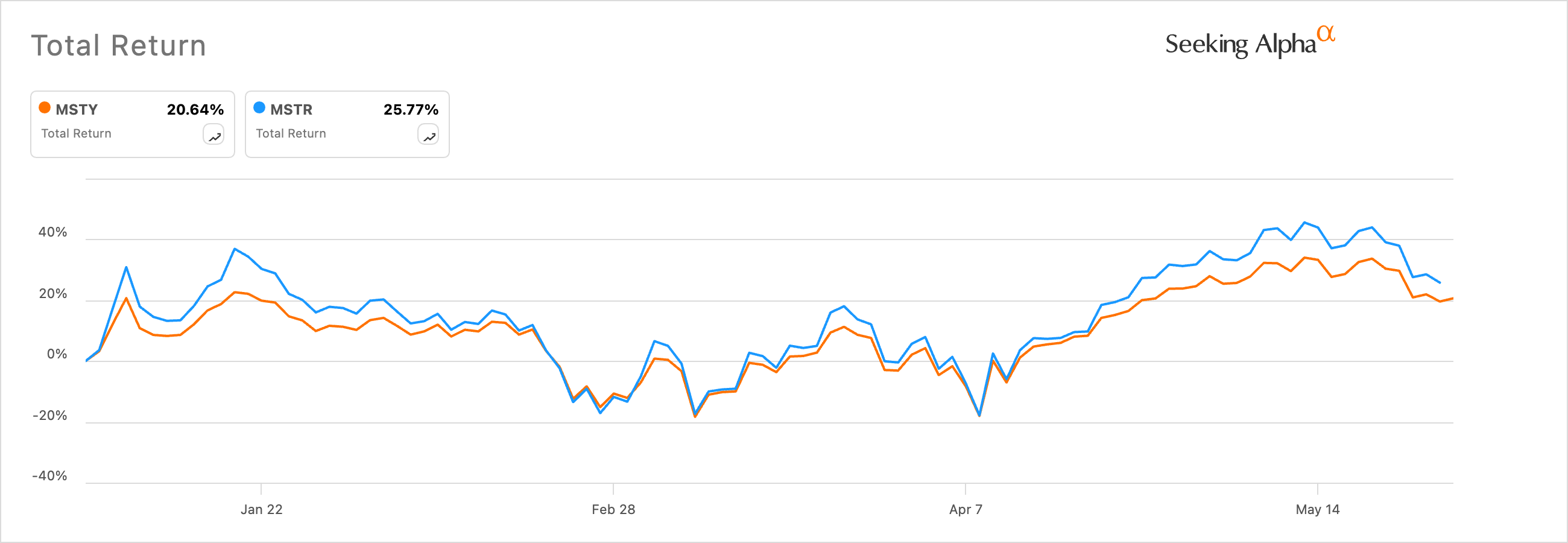

Experts recommend comparing their performance based on the total return. Total return looks at the stock price and any dividends it pays.

Despite its high dividend yield, MSTY also underperforms MSTR stock in terms of total returns. It gained 86% in the last twelve months, while Strategy shares rose by 129%.

As shown above, the MSTY ETF has had a total return of 20.6% this year, while MSTR has risen by 25%.

This performance also happens in other covered call ETFs like JEPI, JEPQ, and QYLD, in that their total returns often lag behind the main asset.

READ MORE: MSTR Stock Analysis: Where Will Strategy Shares Be in 2030?