The Bitcoin supply on exchanges is at risk of vanishing over the next decade as accumulation by retail, institutional, and sovereign investors increases. This, in turn, could lead to a surge in the BTC price, possibly reaching over $1 million.

Bitcoin Supply on Exchange is Falling

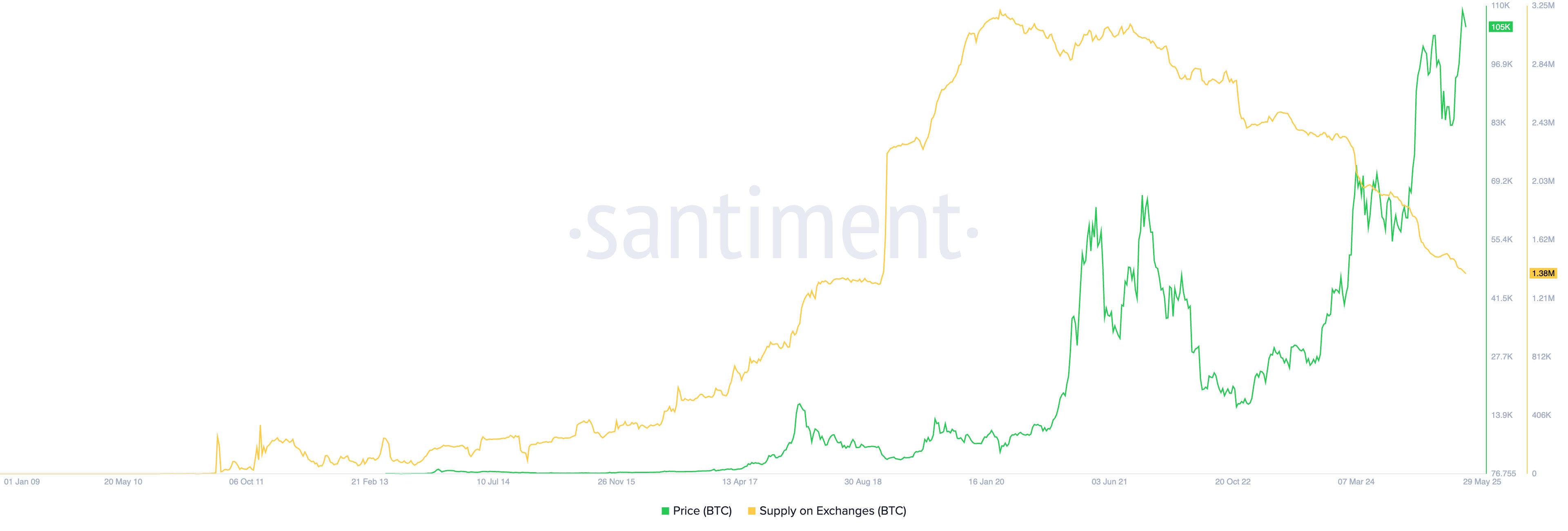

Santiment data shows that the Bitcoin supply on exchanges has continued to decline this year. There are now 1.38 million coins on exchanges, the lowest level since November 2018. At the current price, these coins are worth over $148 billion, which is significantly lower than the total market cap of over $2.15 trillion.

CoinMarketCap data shows that Bitcoin has a circulating supply of over 19.8 million coins. This means that millions more coins are currently in self-custody. Many more have been lost and will never be recovered.

While 1.38 million coins is a considerable number, the reality is that there were 3.21 million coins in March 2020. This means that in five years, investors have moved over 1.83 million coins, or 58%, into self-custody.

Odds are that the downtrend will continue at a faster pace in the next few years. That’s because, for the most part, the removal of Bitcoin supply from exchanges was driven by retail investors because of the lack of regulatory clarity.

READ MORE: Bitcoin Price Analysis: Chart Shows Why BTC Will Explode as Supply Crashes

Bitcoin Accumulation to Continue

Institutions and governments will drive the next phase of accumulation. Many companies are now working to emulate Strategy’s success by buying BTC. Additionally, Strategy has grown from a market capitalization of $1 billion in 2020 to $100 billion. This includes companies like Trump Media and GameStop.

The challenge is that, due to halving, the number of Bitcoin entries on exchanges from miners has decreased. For example, approximately 450 coins are mined each day, or 3,150 a week, and the number is expected to drop after the next halving. In contrast, Strategy buys over 4,000 coins a week, and exchange inflows are rising.

Therefore, it is likely that the Bitcoin supply on exchanges will plunge below 1 million by 2025 or the following year. The trend is expected to continue until only a handful of coins remain in exchanges.

Falling exchange balances and soaring demand indicate that the Bitcoin price is likely to continue surging in the long term. As we wrote this week, Michael Saylor has predicted that the coin’s market cap could hit $100 trillion in the long term.

READ MORE: MSTR Stock Analysis: Where Will Strategy Shares Be in 2030?