The MSTR stock price has performed well over the past five years, largely due to its strategy of accumulating as much Bitcoin as possible. It has surged by almost 3,000% in the last five years, helping it to become a $100 billion juggernaut.

Strategy’s success has fueled innovation among fund managers who have launched several exchange-traded funds. Some of these funds are leveraged ones, which aim for daily returns that are twice or three times their performance.

The largest is the T-Rex 2X Long MSTR Daily Target ETF (MSTU), which has $1.6 billion in assets, followed by the Defiance Daily Target 2X Long MSTR ETF (MSTX) with $1.2 billion.

The others are covered call ETFs, which aim to provide a monthly dividend. A covered call ETF achieves this by first investing in the stock directly or through synthetic derivatives and then placing a call option on the stock. The monthly dividend comes from the premium the fund receives after investing in the call option.

The Yieldmax MSTR Option Income Strategy ETF (MSTY) is the biggest MSTR stock ETF with over $4 billion in assets. Investors love it because of its giant 138% dividend yield, which is paid monthly.

Therefore, an investor interested in MSTR has several options. They can invest in the stock directly and benefit from the surge, or amplify their returns using leveraged ETFs. Additionally, they can utilize covered call ETFs to generate a monthly return.

READ MORE: MSTR Stock Analysis: Where Will Strategy Shares Be in 2030?

MSTR vs MSTU, MSTX and MSTY ETFs

The first thing to consider is the fee paid. Investing in MSTR stock is free, while these ETFs charge an annual fee. MSTY has a 0.99% expense ratio, while MSTU and MSTX have 1.05% and 1.29%, respectively.

These fees are high considering that the average expense ratio of stock ETFs is less than 0.20%. Some popular funds, such as the Vanguard and iShares S&P 500, charge an annual fee of 0.03%.

Therefore, the best fund to consider must have returns that are better than investing in MSTR stock directly. Data shows that the Strategy stock has gained 33% this year, while the MSTY’s total return is 26%. MSTU and MSTX have a return of 8.30% and 9.4%, meaning that MSTR is doing better.

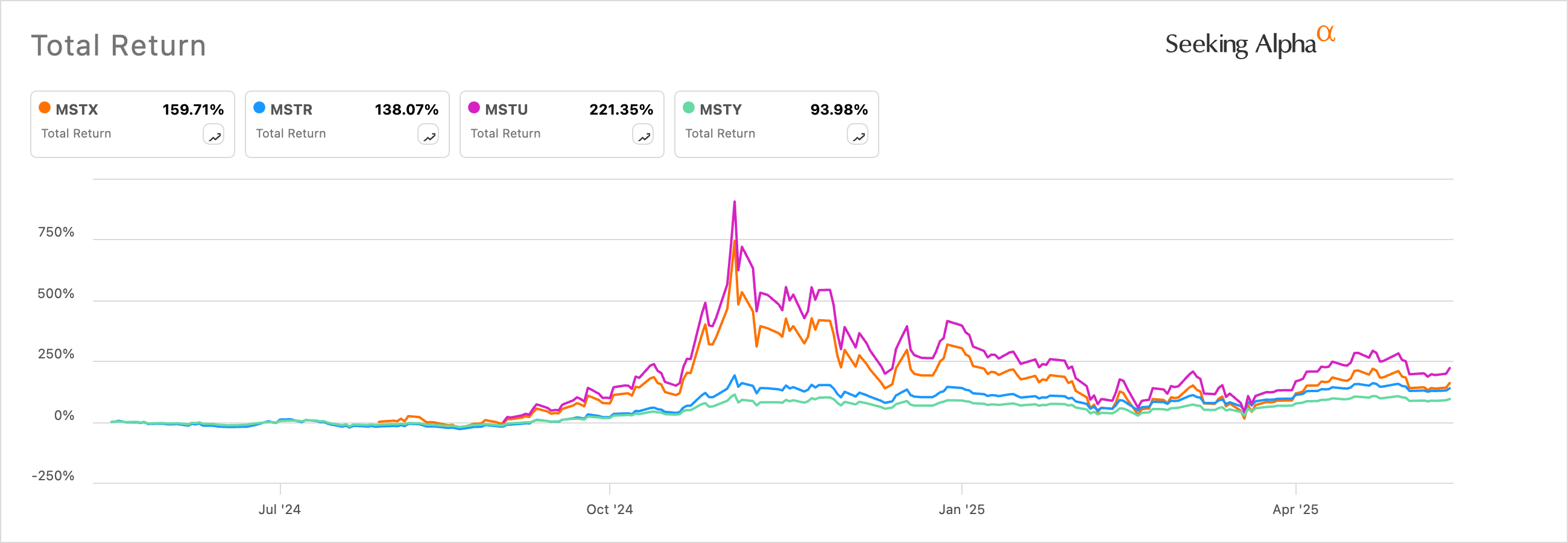

The situation changes when you adjust to the one-year chart. In it, the MSTR stock has jumped by 138%, while MSTU and MSTX have done better, gaining by 220% and 159%, respectively. MSTY has jumped by 98%.

Therefore, one approach for investors bullish on Strategy would be to buy its stock and then allocate some money to leveraged funds. By doing this, they will benefit directly if the stock rises, with the leveraged ones helping to amplify the returns.

A good example is popular leveraged ETFs, such as ProShares UltraPro QQQ and the Daily Semiconductor Bull 3X Shares ETF (SOXL), which have outperformed their benchmarks.

A closer look at several covered call ETFs like JEPI, JEPQ, and QYLD shows that, while they have a higher dividend, their total returns lag behind that of the benchmark assets.