Toncoin (TON) has risen above $3.40, thanks to a mix of strong technical signals, increased trading activity, and noteworthy developments in its ecosystem.

Currently, Toncoin price is changing hands for $3.43, rising 1.38% in the last 24 hours. Trading volume has jumped over 51% to $435 million, indicating more interest from both small and large investors.

TON Ecosystem Sees Surge in Activities

A major catalyst behind the current Toncoin price rally is a viral story circulating within the Telegram ecosystem: the @crypto username, originally purchased for $350,000 in 2023, allegedly received a $25 million bid this week, representing a 70x return.

The offer reignited investor interest in Telegram’s TON-powered identity layer, where usernames, channels, and digital assets are secured on-chain via smart contracts.

Telegram’s CEO, Pavel Durov, and TON Foundation members have repeatedly emphasized user sovereignty, and this sale narrative validated that vision.

READ MORE: Spark Crypto Price Prediction as SPK Staking Inflow Surges

It also arrived just days after the TON Wallet’s U.S. launch, which now supports Apple/Google Pay crypto purchases and NFT management for 87 million U.S. users.

Furthermore, backing the price move is a healthy uptick in Toncoin’s network activity. TON Stat data indicates that daily transactions are holding steady at 2M+, with on-chain wallet activations averaging 19,600. Total wallets have also surged to 159.7 million, with 45 million actively used.

Toncoin Price Clears $3.37 Resistance, Eyes $6.93

The Toncoin price has broken out of a multi-month falling wedge pattern on the weekly chart, a structure often associated with bullish reversals.

As pointed out by popular crypto analyst Carl Moon, the pattern’s breakout target points toward $6.93, a major resistance level that hasn’t been touched since 2024.

On the daily chart, TON price recently cleared a key oblique resistance at $3.37, flipping it into support. Price is now hugging the upper Bollinger Band, with the next upside targets at $3.47 (local high) and $3.60–$3.65 if momentum continues.

A clean break past these levels would open the door to the $4 zone, where the falling wedge measured move begins to play out.

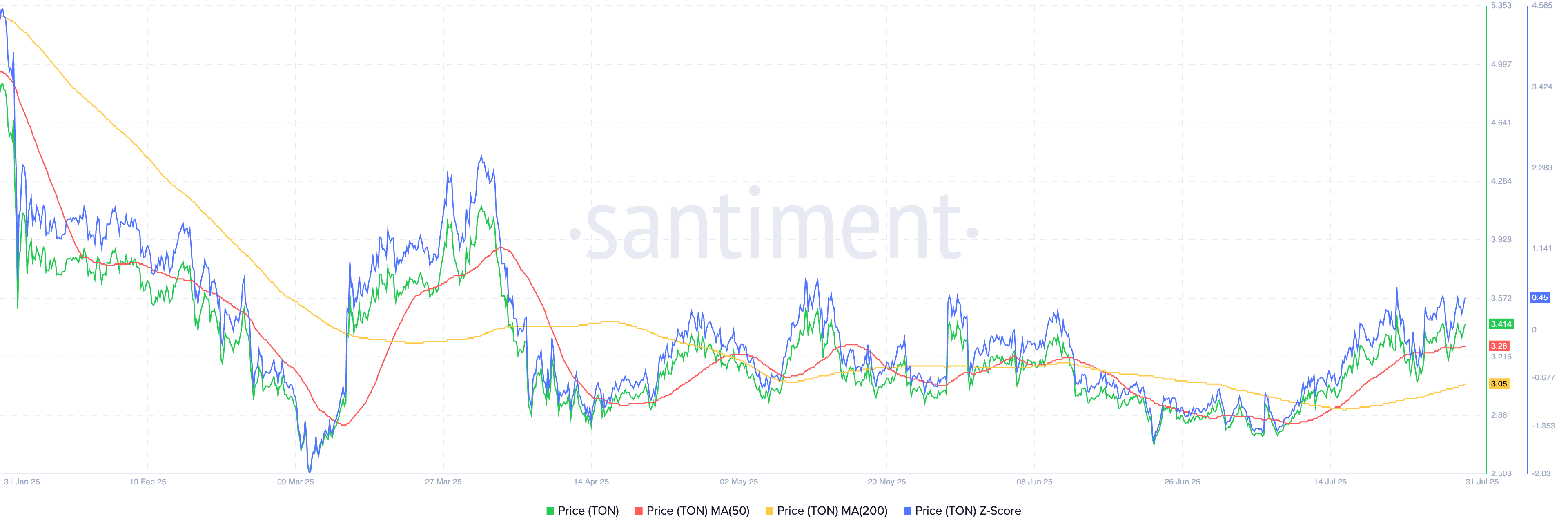

Short-term momentum indicators are also confirming strength. RSI (14) is around 62.6, which shows bullish control without being overbought. The MACD is neutral-bullish, and the price is above both the 50-day SMA ($3.28) and the 100-day SMA ($3.05).

TradingView’s technical summary shows 9 buy signals out of 17, with longer moving averages turning bullish for the first time in weeks, suggesting a possible trend reversal for TON.

However, if buyers can’t maintain support, watch for dips to the $3.28–$3.30 range, where the 50-SMA and Bollinger mid-line meet.

READ MORE: Treehouse Crypto Price Has Crashed: Will TREE Rebound?