The MSTR stock price has stumbled this year, even as Bitcoin has jumped to a record high. Strategy was trading at $390 on Monday, down by over 15% from its highest point this year and 28% below the 2024 highs.

Why MSTR Stock Price is Wavering

Strategy stock price has moved sideways as Bitcoin has jumped to a record high of $123,2000. The ongoing performance is likely because it has become a highly shorted stock, including by Jim Chanos.

MSTR has a short interest of nearly 10% as these short-sellers doubt its business model. It is common for heavily shorted stocks to drop, especially when selling pressure is rising.

Strategy’s share price has also remained in a tight range as the Bitcoin Treasury industry becomes highly concentrated. There are now over 100 companies that have started to accumulate Bitcoins. Some of the top names are XXI, which holds over 43,000 coins, Metaplanet, MicroCloud Hologram, and Empery Digital.

The rising competition means that investors have options to choose from. This explains why the NAV multiple of the MSTR stock price has narrowed substantially in the past few years. It now has a NAV multiple of 1.52, down from over 3 in 2024.

MSTR stock price has also come under pressure as the number of outstanding shares has jumped to over 261 million, up from 76 million in 2020. This means that original investors have been diluted by 243%.

READ MORE: XLM Price Prediction: The Bullish Case for the XRP ‘Cousin’

Is MSTY ETF a Better Buy?

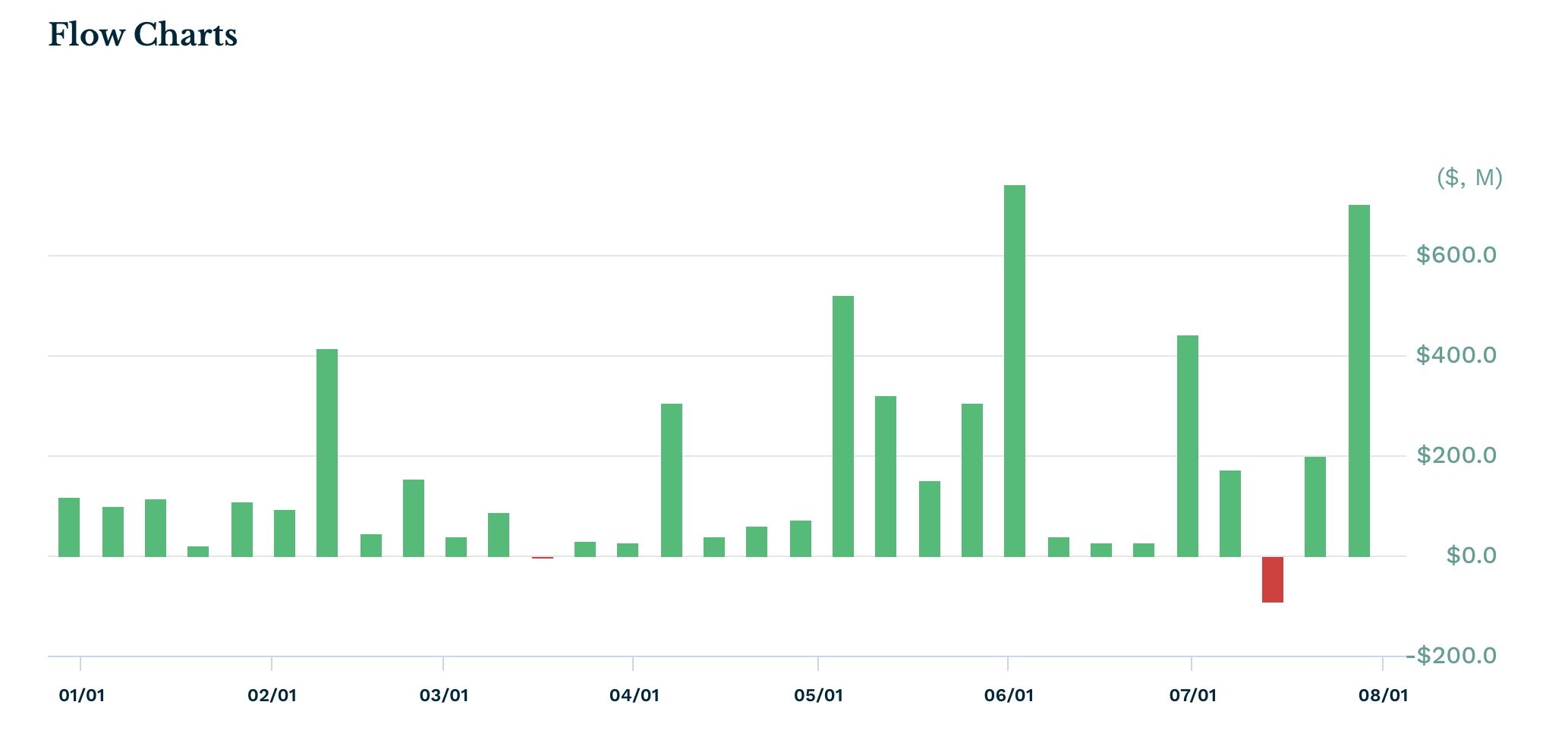

With the MSTR stock price wavering, there are signs that investors are moving to the YieldMax MSTR Option Income Strategy (MSTY). As the chart below shows, the MSTY inflows have been rising in the past few months.

The MSTY fund added over $704 million last week, up from $200 million in the previous week. Its total inflows have jumped by over $5.3 billion, making it one of the biggest Strategy funds.

Investors love the MSTY ETF because of its substantial yield, which stands at 160%. It generates this yield by using the covered call strategy, where it initially buys synthetic assets that give a long exposure to MSTR.

It does this by buying MSTR call options and simultaneously selling MSTR put options. These options have a strike price ranging from one to six months, equal to the MSTR stock.

In the next stage, the fund writes or sells call options on the MSTR stock to generate income. It does this through the premium it receives after selling the call option on the stock.

The benefit of buying the MSTY ETF now is that it offers a safe monthly dividend, offsetting the sideways movement of the MSTR stock.

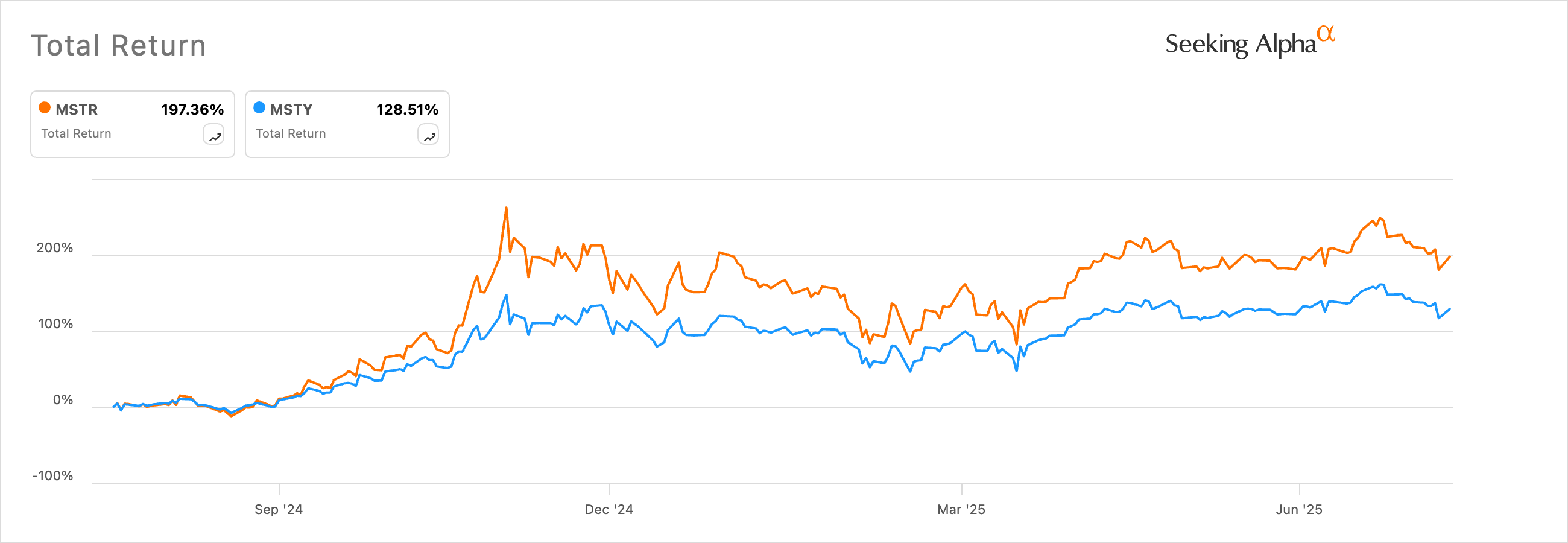

However, in the long term, the MSTR stock price has been a superior investment to MSTY. Its total return was 128% in the last 12 months, much smaller than MSTR’s 197%.

A similar trend is observed among most covered call ETFs, which underperform the underlying core asset. For example, the JEPQ ETF has always lagged behind the Nasdaq 100 Index in terms of the total return.

Therefore, analysts recommend a strategy of buying both assets. In this, the MSTR stock will provide growth in good times, while the MSTY ETF will give regular income.

READ MORE: SYRUP Price Prediction: What Next For the Maple Finance Crypto?