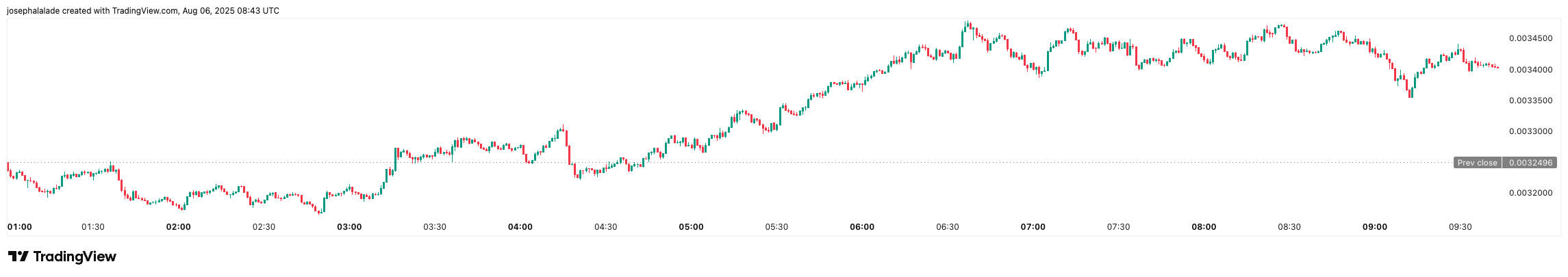

Pump Fun has reclaimed its position as the leading memecoin launchpad, with the PUMP token jumping 7.4% in the last 24 hours. This surge has flipped LetsBonk in total new token launches and pushed its price to $0.00345.

With daily volumes surpassing $500 million and protocol revenue holding steady, investors are watching closely as technical indicators and fundamentals align for another potential breakout.

Pump Fun Overtakes LetsBonk

On August 6, Pump.fun processed 13,690 token launches, edging past LetsBonk’s 13,392 for the first time since June, according to recent data. This comeback signals renewed traction in PUMP’s core utility as the top launchpad for Solana-based memecoins.

The result was an increased platform usage, protocol revenue, and, by extension, direct value accrual for the PUMP token.

Moreover, why this matters is that Pump.fun charges a 1% fee on all token trades. With approximately $210K in daily protocol revenue, 25% is consistently allocated to PUMP buybacks.

Since July 28, over $31.3 million has been spent on repurchasing tokens, creating a bullish feedback loop that reduces sell pressure and signals long-term commitment from the team.

Additionally, 8.74 billion PUMP tokens (roughly 2.5% of circulating supply) have been permanently burned since August 1 using SOL-denominated fees. With 15% of post-ICO tokens now off-market, bulls argue that a supply shock is underway.

Pump Fun Price Prediction: Technicals Show Breakout, But Leverage Risks Remain

The Pump Fun coin just completed a textbook triple-bottom pattern, breaking above the $0.00326 resistance level. It also reclaimed its 7-day simple moving average (SMA) at $0.00284, a key short-term trendline.

According to TradingView’s technical summary, the Pump Fun token’s daily RSI remains near 30.32, approaching oversold territory but leaving room for further upside.

Derivatives data paints a mixed picture. Futures volume surged 73.5% to $1.65B, but the long/short ratio sits at a neutral 1.0056. The average leverage of 5x across exchanges signals elevated liquidation risks if volatility spikes.

However, trading sentiment has turned bullish overall, with most technical indicators showing a “Buy” or “Strong Buy” across major platforms.

In terms of short-term targets, the next resistance is set at $0.00366. This is the level traders might look for as a potential area to secure profits or face selling pressure.

Mid-term, if revenue stays above $200K and memecoin market activity remains hot, PUMP could target $0.00418, Fibonacci R2 levels, or even $0.0050, a level that would represent nearly 50% upside from current prices.

READ MORE: Mantle Surges 215% in Key Metric – Can MNT Hit $5?