The Grayscale Bitcoin Covered Call ETF (BTCC), launched in April, provides investors with a way to generate monthly returns from Bitcoin.

What is the BTCC ETF?

BTCC, which uses a similar approach to the $40 billion JPMorgan Premium Equity ETF (JEPI), has gained $35 million in assets under management. It has a dividend yield of 63%, well above that of comparable covered call ETFs like QYLD and JEPQ.

The fund solves three major challenges. First, it gives investors exposure to the Bitcoin price. Second, the fund gives its investors a way to generate a monthly return. And finally, it provides a useful way for market participants to benefit in periods of high volatility.

The BTCC ETF achieves this by using a synthetic covered call strategy that involves the Grayscale Bitcoin Trust (GBTC) and the Grayscale Bitcoin Mini Trust (BTC).

In this, the fund purchases and sells a combination of put and call option contracts that reference these ETFs.

A call option gives a user the right but not the obligation to buy an asset, while a put option gives them the right to sell an asset at a specific price within a set period.

Additionally, the BTCC writes or sells call options of either the BTC or GBTC ETF. By doing this, the fund is entitled to a premium payment, which is what it uses to pay its investors. The premium payment is usually higher when the implied volatility is high.

The main benefit of covered call ETFs like BTCC and JEPI is that they pay a higher dividend yield than traditional assets. For example, JEPI and JEPQ have dividend yields of 7.5% and 10.5%, respectively, which are much higher than those of the S&P 500 and Nasdaq 100.

READ MORE: XRP Price Prediction: Top Catalysts for a Ripple Surge

Covered Call ETFs like JEPI Underperform the Underlying Asset

However, the main limit is that gains on funds are usually limited during a bull market when the strike price is triggered. For example, if the strike price is $100,000 and an asset rises from $90,000 to $120,000, the fund will only benefit from the initial $100,000.

This limitation explains why it is almost impossible for covered call ETFs to beat generic funds like SPY and QQQ, which track the S&P 500 and the Nasdaq 100 Index.

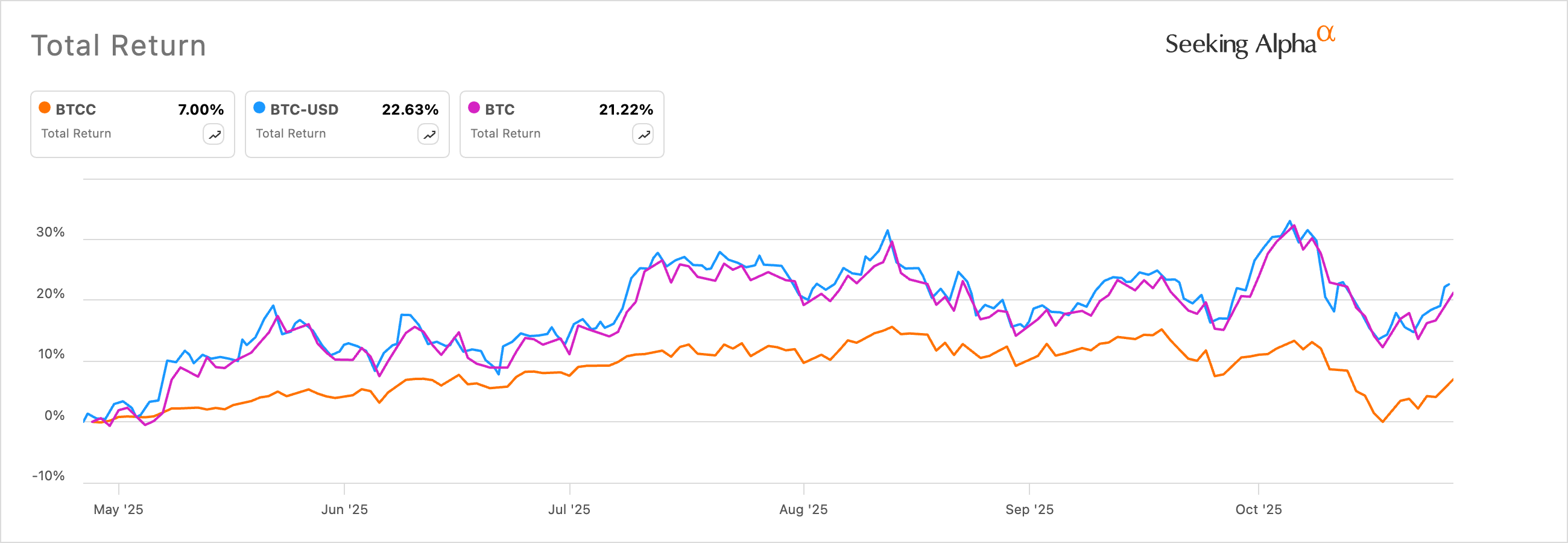

For example, as the chart above shows, Bitcoin and the Grayscale Bitcoin Mini Trust have posted total returns of 22% and 21%, respectively, over the past six months. In contrast, the BTCC ETF has returned just 7%. The same happened across most covered call ETFs.

READ MORE: Is Pi Network Dead Now and Can it be Saved?