The XRP price is crashing today even as the market prepares for a series of exchange-traded fund (ETF) approvals, which could happen as soon as today, November 12. Ripple was trading at $2.4, down from this week’s high of $2.5690. It has plunged by 35% from its highest level this year.

XRP Price is Falling Ahead of ETF Listings

There are a few reasons why the XRP price is falling ahead of the upcoming ETF approvals by the Securities and Exchange Commission (SEC), which will happen as soon as today. Canary, a top player in the digital space, has already filed Form 8A, which is the final filing before a fund starts trading.

First, the XRP price is crashing because it’s correlated with Bitcoin and other altcoins, which are also crashing. Even Zcash, which has been on an unstoppable bull run, has crashed by over 20% from its year-high.

Most notably, even Solana, Litecoin, and Hedera, whose ETFs have started trading, have continued to fall over the past few days. They all remain in a deep bear market after falling by more than 20% from their local tops.

Fear of Recent Liquidation Event Remains

Second, traders are afraid to buy XRP and other tokens because of the massive liquidation that occurred a few weeks ago, when 1.6 million traders were wiped out. XRP bulls suffered a $610 million wipeout.

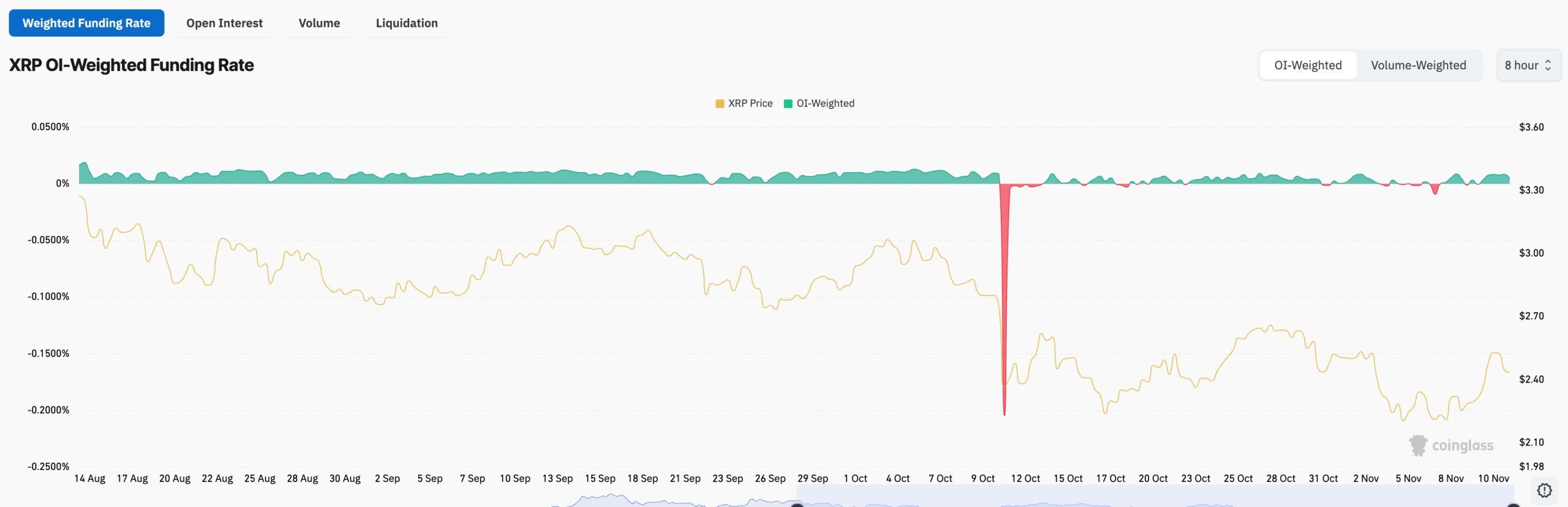

Since then, activity in the futures market has waned substantially, which is notable since this is usually the most active market in crypto. XRP’s futures open interest has plunged to $3.3 billion, down from the July high of over $10.9 billion.

Most importantly, the closely watched funding rate has remained flat over the past few weeks, a sign of how little activity is occurring in the XRP market.

Further, the XRP price is likely to fall as investors sell the news, since the ETF approval was already priced in. These odds rose after the SEC published the minimum listing standards for altcoins. These guidelines noted that tokens with active presence in the regulated futures market, of which XRP met the criteria.

Buy the rumor, sell the news is a common strategy in which an asset rises ahead of a major event and then crashes after it occurs, as investors wait for the next catalyst. It partially explains why Solana and other tokens have fallen after their ETF listings.

READ MORE: Bitcoin Price Prediction: Reasons BTC May Crash Below $90k Soon