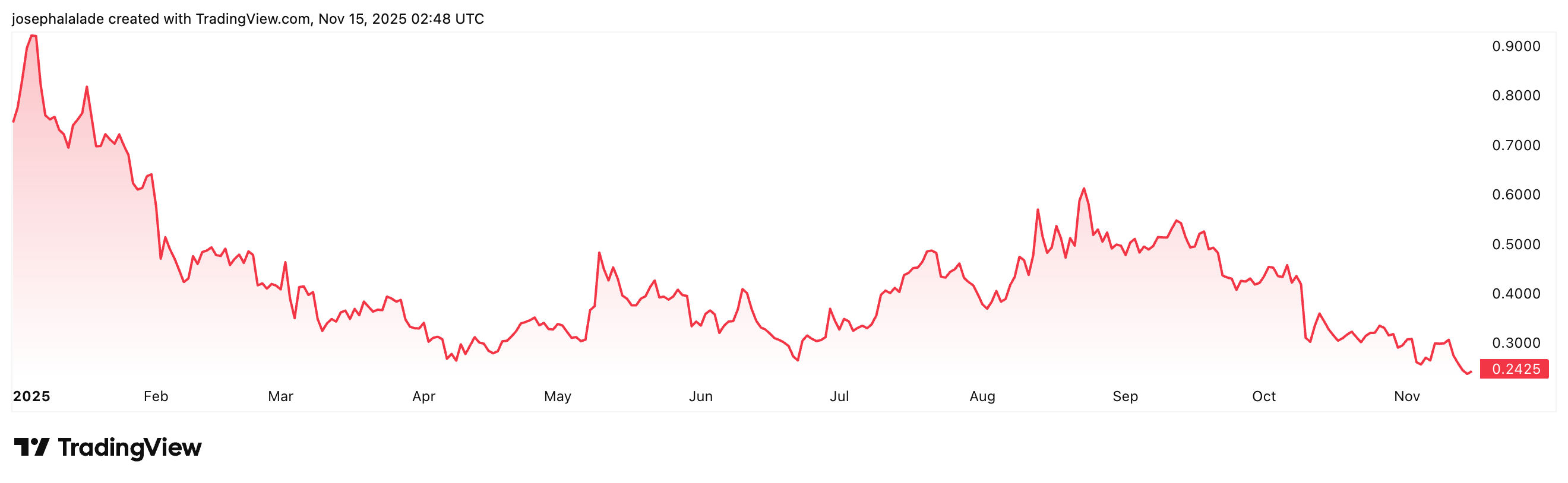

The Arbitrum price is holding near $0.24 after a turbulent week marked by unlock fears, sharp intraday swings, and a growing divide among analysts over whether the token is quietly bottoming or simply stalling before another push lower.

A 92.65 million ARB unlock is scheduled for Nov. 16, releasing roughly $22.35 million worth of new supply into a market still digesting the 8.67% drop seen on Nov. 14.

For now, ARB Coin continues to defend the $0.23–$0.24 area, a level that has become the final buffer between consolidation and a deeper revisit of its Arbitrum price history, including October’s $0.136 low. With the unlock looming, traders are watching to see whether this narrow support band can withstand another wave of sell pressure.

ARB Price Today Lags Behind Its Surging Fundamentals

On the Arbitrum price charts, the picture remains unforgiving. ARB is down nearly 19% on the week, more than 25% on the month, and about 66% year-to-date. Against its Arbitrum highest price of $2.40 in early 2024, the token has shed almost 90% of its value.

Yet, Arbitrum’s fundamentals have strengthened through the downturn. Total value secured has climbed over $16 billion, stablecoin liquidity is nearing $9 billion, and bridge flows have pushed above $800 million over the past 30 days.

Activity remains robust as well: weekly active users hover around 1.1 million, putting Arbitrum behind only opBNB and Base among Layer 2 networks. Protocol revenue has been similarly resilient, ranking the chain second among L2s this month.

None of this momentum is visible in the Arbitrum price today, and that disconnect has become the core of the bullish thesis: a chain expanding while its token trades at depressed levels. To some analysts, this widening gap resembles the early stages of a cyclical reset rather than a continuation of the decline.

Arbitrum Price Prediction Hinges on Friday’s Unlock

Market commentators arguing for accumulation, including Michaël van de Poppe, say a higher-timeframe bullish divergence has been building beneath the recent lows.

He warns the structure will take time to validate, but points to ARB’s relative stability during Bitcoin’s latest pullback as a subtle sign the market may be nearing exhaustion.

Others highlight the execution angle. Several analysts note that key metrics, from stablecoin depth to RWA inflows, have already recovered to pre-correction levels.

Robinhood’s tokenization engine, which runs on Arbitrum rails, has seen its volume accelerate rapidly, reinforcing the view that Arbitrum is emerging as a preferred settlement layer for real-world asset flows.

Still, the next catalyst is not narrative but supply. Friday’s unlock is expected to set the short-term direction. A clean absorption of the new tokens, coupled with the preservation of the $0.23–$0.24 support range, could give ARB room to establish a base and begin grinding higher.

A failure to hold that zone would put the October low back in focus and weaken the divergence pattern that bulls have been watching develop.

Immediate resistance remains near $0.25, with a more meaningful sentiment shift requiring a move into the $0.27–$0.30 area, where the heaviest volume last appeared on the Arbitrum price charts.

READ MORE: Trump Media Has Crashed: Will DJT Rebound or Become a Penny Stock?