The MSTR stock price has plunged by over 65% from its 2024 high. It dropped below $200 on Friday, its lowest level since October last year. This crash will likely accelerate as Bitcoin approaches the psychological $90,000 level.

Is MSTY ETF a Better Buy?

The ongoing MSTR stock crash has pushed some investors to move to the Yieldmax MSTR Option Income Strategy ETF (MSTY). MSTY is a top fund with over $2.2 billion in assets under management (AUM) and a gross expense ratio of 0.99%.

This fund gives investors access to Michael Sayor’s Strategy with a twist. While Strategy does not pay investors a dividend, MSTY pays a monthly distribution. Its dividend yield is a whoppin 90%, much higher than what other funds pay.

MSTY ETF achieves this by leveraging a covered call strategy. This is a process in which the fund invests some of its funds in MSTR stock and then writes call options on it.

By writing the call option, it generates a monthly premium, which it returns to investors as a dividend. This premium normally surges when the stock is highly volatile, as it is today.

READ MORE: Will Crypto Recover as Fear and Greed Index Nears Buy Zone?

MSTR vs MSTY Returns

The MSTR stock price has crashed by 31% this year, while the MSTY ET has dropped by 70%. However, a price-return comparison alone is not sufficient for comparing the two assets.

Instead, the best approach is to use the total return, which incorporates MSTY’s dividends. In this case, the MSTR stock price has dropped by 31%, while MSTY’s performance was minus 30%.

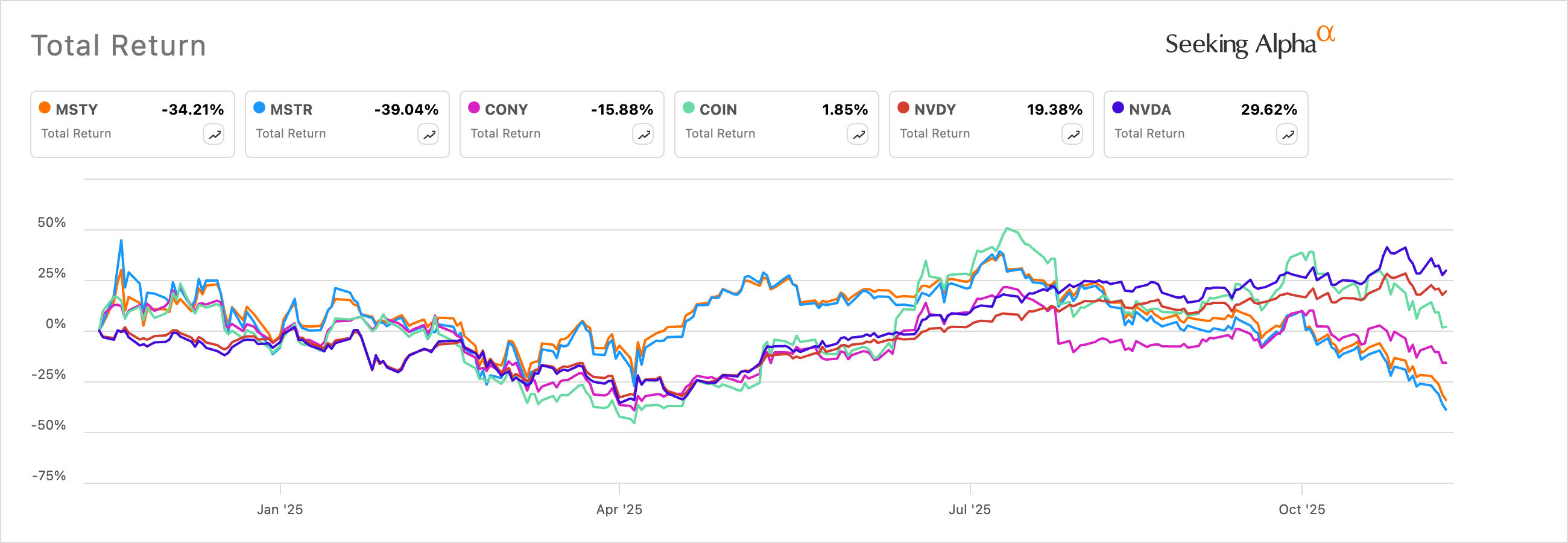

This means that the MSTY ETF has done slightly better than MSTR this year. The same has happened in the last 12 months as the MSTY has dropped by 34%, while the MSTR has dropped by 39%.

Historical data show that covered call ETFs don’t deliver a stronger total return than the underlying asset. As the chart above shows, CONY ETF has dropped by 15%, while COIN stock has risen by 1.85%. Similarly, the NVDY ETF has risen by 20%, while the NVDA stock has risen by 26%.

Therefore, while covered call ETFs offer higher dividends, their total returns are usually not much better than those of the underlying assets.

READ MORE: Will Crypto Recover as Fear and Greed Index Nears Buy Zone?