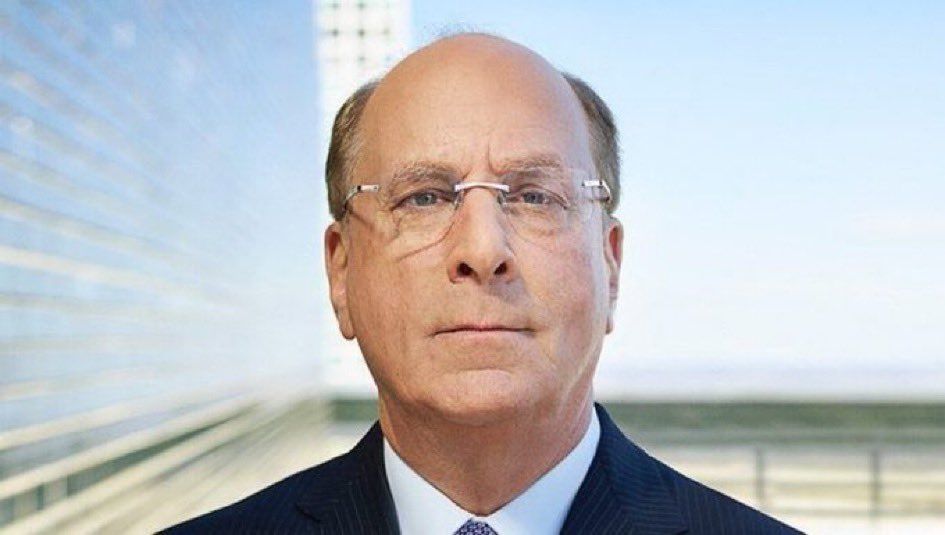

BlackRock has registered a new statutory trust in Delaware for an iShares Staked Ethereum Trust ETF. The filing marks a key step toward launching a staking-enabled Ethereum (ETH) fund that provides investors with yield in addition to price exposure. This development signals BlackRock’s growing initiative to offer institutional-grade crypto investment products with integrated staking features.

BlackRock Trust Registration and Regulatory Process

The new trust was officially filed on November 19, 2025, under the U.S. Securities Act of 1933, a framework requiring detailed disclosures and investor protections before any public offering.

While this registration is a foundational procedural step, BlackRock must still submit a Form S-1 and receive approval from the Securities and Exchange Commission (SEC) to proceed with public sales.

This trust complements BlackRock’s existing ETH ETF (ETHA), launched in July 2024 and currently managing over $13 billion in assets, which does not engage in staking. The staked Ethereum product aims to combine ETH price appreciation with staking rewards, which average 3%-5% annually, according to blockchain analytics.

Strategic Positioning

BlackRock’s move follows a broader market trend in which major institutional players are integrating staking functionality into crypto investment products. Grayscale received SEC approval in October 2025 for staking-enabled Ethereum ETFs, and other asset managers such as Fidelity and Franklin Templeton have also advanced similar offerings.

The introduction of staking into ETFs may attract an estimated $10 to $20 billion of new capital by mid-2026, according to industry analysts and BlackRock’s own digital asset team. Staking-enabled products could influence long-term Ethereum liquidity and supply by locking tokens into secure protocols during staking periods.

BlackRock’s approach, which first focuses on trusted, large-scale assets like Ethereum, highlights a cautious yet robust embrace of crypto yield products. The integration of staking rewards into regulated ETFs is poised to expand crypto adoption among risk-conscious institutional investors, positioning BlackRock as a leader in the professionalization of blockchain asset management.

READ MORE: Pi Network Price Prediction: A Coiled Spring Ready to Pounce?