The Bitcoin price has staged a strong rally this month, pushing it to its all-time high and making it one of the best-performing assets ever. BTC peaked at $123,288 this week and then pulled back to $120,000 today, July 15. This article examines why the coin is likely to pull back to $110,000 and then resume its bullish trend.

Bitcoin Price Technical Analysis Points to a Crash

The daily chart shows that the Bitcoin price staged a strong comeback, in line with our previous predictions here and here. This surge pushed it from the April low to a high of $123,288 this week.

It happened after the coin formed three unique chart patterns: a golden cross, a bullish flag, and a cup-and-handle pattern. By measuring the cup’s depth and the flagpole’s height, we estimate that the Bitcoin price will surge to $150,000 in this cycle.

However, as BTC has proven before, its surges are never linear, and it always has some pullbacks as investors take profits.

There are three main technical reasons why the coin may crash to $110,000 soon. First, there is a concept known as a break-and-retest pattern. This is a situation where an asset makes a bullish breakout and moves above a crucial resistance level, and then retests it. This retest is one of the most bullish patterns in technical analysis.

READ MORE: Bitcoin Price if it Hits a $100 Trillion Market Cap as Saylor Predicts

Second, the Bitcoin price is likely to retreat due to the concept of mean reversion. This is a situation where an asset drops so that it can move to the historical averages. In this case, with BTC trading at $120,000, it is significantly higher than the 50-day and 100-day moving averages, which are at $103,280 and $107,800, respectively.

Third, BTC price remains significantly overvalued, with the Relative Strength Index (RSI) being at 76. In most cases, an overbought asset tends to drop as the RSI moves down from overbought levels.

BTC Crash Will be Bullish

The Bitcoin price still has strong fundamentals, as its demand and supply metrics have improved. Bitcoin’s demand continues to exceed its supply. For example, 450 coins are mined each day, or 3,150 a week. Companies like Strategy and Metaplanet, as well as ETFs, are buying more than those mined each day.

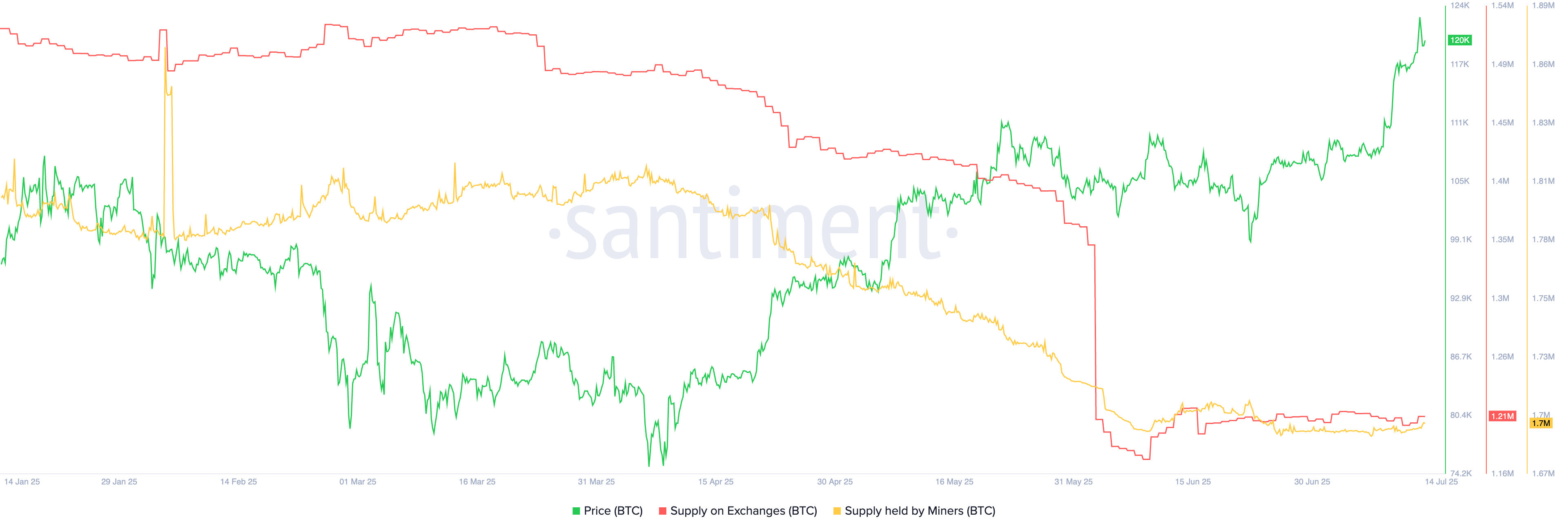

At the same time, the Bitcoin supply remains limited, as the amount held by exchanges and miners continues to decline. As the chart below shows, miners hold 1.7 million coins, down from 1.85 million in January. Those held in exchanges have dropped from over 1.5 million to 1.21 million today.

Bitcoin price is also set to benefit as the US public debt surges and as threats to the Federal Reserve’s independence rise. Donald Trump is working to replace or undermine Jerome Powell in a bid to cut interest rates. Even if Powell remains, there are odds that the Fed will maintain a highly dovish monetary policy framework.

READ MORE: HBAR Price Analysis After Bullish Hedera Hashgraph News