Litecoin price increased by over 8% in the last 24 hours, currently trading at $128 after reaching a high near $132, according to CoinMarketCap data.

This increase put Litecoin among today’s top gainers, coming in second after Zcash (ZEC). It also marked a return to the critical $125 level, a price point that has acted as resistance for almost a year.

This positive change comes as traders consider potential growth factors, such as new filings for a spot Litecoin ETF and companies starting to hold Litecoin. This has improved confidence that Litecoin might finally be breaking out of its long-standing trading range.

Spot LTC ETF Filing, On-Chain Growth, and Institutional Interest

ETF momentum appears to be the dominant driver behind Litecoin’s current rally. Bloomberg ETF analyst Eric Balchunas confirmed that Canary Capital’s spot Litecoin ETF filing has reached its “finalized” stage, typically the last step before SEC approval.

The amendment included final tickers (LTCC) and a 0.95% sponsor fee, signaling readiness for launch once regulatory operations resume after the Government shutdown.

Analysts at Polymarket now place approval odds above 90%, citing Litecoin’s CFTC-recognized commodity status and its structural similarity to Bitcoin as key reasons for likely acceptance. Should approval be granted, it could open the door for institutional inflows similar to Bitcoin’s ETF-driven liquidity boom.

On the adoption front, data from the Litecoin Foundation shows the network processed over 3 million transactions in the past two weeks.

CoinGate’s 2025 YTD data revealed that Litecoin transaction volume has grown 52.7% year-over-year, following a 521% surge in 2021, confirming its resilience through multiple market cycles.

Meanwhile, corporate accumulation has re-entered the narrative. MEI Pharma’s rebrand to Lite Strategy, following its $100 million LTC treasury allocation.

Luxxfolio also plans to acquire up to 1 million LTC by 2026. This could significantly lower the amount of LTC available and strengthen its image as “digital silver” for traditional investors.

Litecoin Price Prediction: Can Bulls Sustain Momentum Above $125?

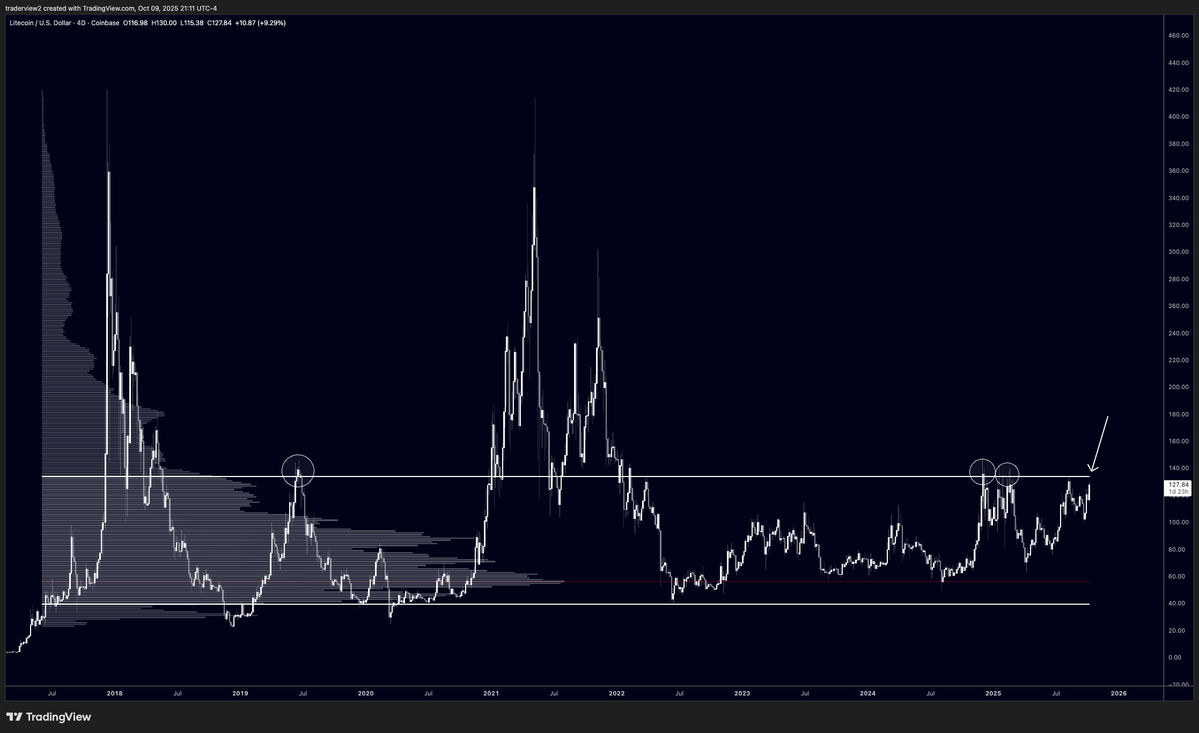

Trader sentiment on X remains cautiously optimistic. Market analyst Dom highlighted that Litecoin is “testing the value area high (VAH) of its eight-year volume profile,” with the $125 zone now acting as major support. Holding this level, he noted, “is the key for a sustained breakout of this multi-year range.”

From a technical standpoint, LTC’s daily RSI has risen sharply but remains below overbought territory, suggesting room for continuation. Volume has spiked by over 130%, confirming strong participation in the breakout.

The next resistance levels are around $138 and $150. Support is between $122 and $125. If the price drops below this support, it could undo the recent breakout, bringing LTC back to the $110–$115 range.

The overall setup points to a short-term bullish bias, supported by renewed demand and structural catalysts. If momentum persists and ETF approval materializes, analysts anticipate a retest of $150–$160, marking the Litecoin price’s highest level since early 2022.

READ MORE: Solana, BNB, and Fetch Top Crypto Social Volume Charts: Santiment