After dropping below $53k over the weekend, shedding over 3% in 24 hours on Friday, Bitcoin is once again up 1.1% day-on-day on the opening day of the week. Currently, the leading cryptocurrency is trading at $55.1k.

However, with weak U.S. jobs data released last Friday, Bitcoin remains in a trap zone. Despite a swift upward momentum in the last six hours, it has yet to reclaim support at $57k.

Can Bitcoin Drop to $52k This Week?

While Bitcoin’s price action appears bullish on the daily charts, a summary of its daily technical indicators suggests a strong sell.

More importantly, the overall Bitcoin price action is bearish. Looking at Bitcoin’s performance over the past 90 days, it fell 5.3% in the last seven days, down 9.5% in the last 30 days, 5.4% in the last 60 days, and 17.5% over the last 90 days.

Bitcoin has been consistently losing value since it dropped below the $70k mark. The latest 3% drop in Bitcoin price came after the US stocks continued to struggle on Friday.

The Dow Jones Industrial Average fell 410.34 points on Friday, a 1.01% drop to 40,345.4. The S&P 500 was down 94.99 points, representing a 1.73% day-on-day fall. The Nasdaq Composite also fell 436.83 points, a 2.55% day-on-day drop to 16,690.83.

The underlying factors that have consistently driven the BTC price down more than 20% since the $70k level remain unchanged. There is no clarity about the FED rate cuts, which the broader market is anticipating, especially after the weak U.S. jobs data.

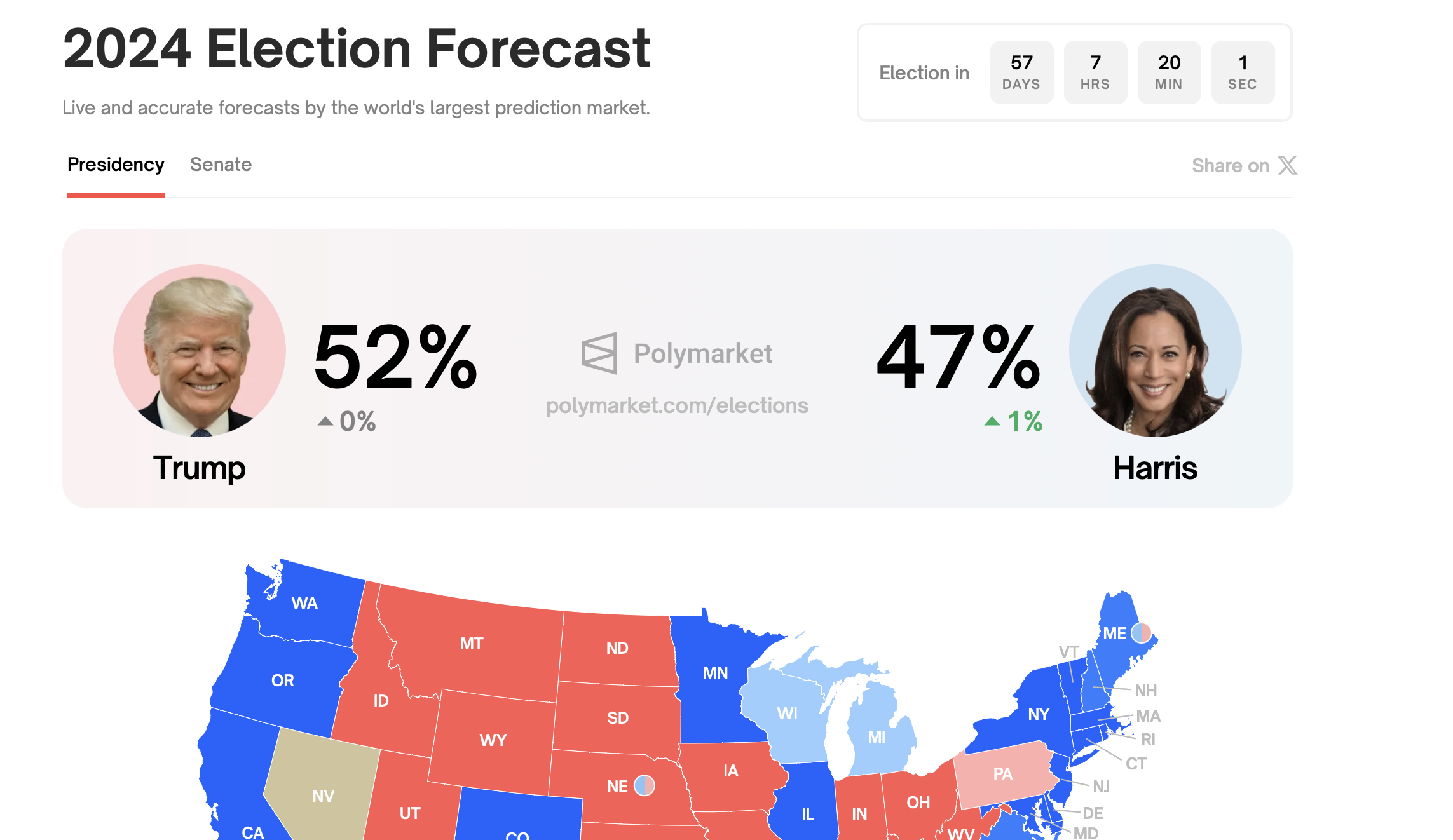

Also, the result of the US presidential elections can impact Bitcoin prices. On Monday, a report released by The Block cites analysts at the brokerage firm, Bernstein. It states that Bitcoin prices may reach $90k, if Donald Trump is elected president.

The former US president has been open about his pro-crypto stance. However, recently there have been controversies surrounding his newly launched crypto project, World Liberty Financial.

Coming to the technical side, Bitcoin has failed to break the strong resistance at the 200-day EMA around $59,300. Coupled with negative investor sentiment due to fears of an impending recession, it is unlikely that Bitcoin will challenge this resistance this week.

As Bitcoin has also lost support at $57k, despite minor intraday bullish momentums, it could drop sharply, with no significant support until $48k.

For intraday, $54k is an important level, which if breached, we can see the leading coin tumble further to test support at $52k.