Bitcoin price had a great performance in 2024, helped by several key catalysts like the Donald Trump election, Federal Reserve cuts, spot ETF approvals and the inflows that followed, and MicroStrategy purchases. BTC soared by over 120%, beating the Nasdaq 100 and S&P 500 indices. So, will the Bitcoin price soar to $200k or crash to $50k in 2025?

The case for Bitcoin price hitting $200k

There are several reasons why Bitcoin price may jump to $200k in 2025. First, the supply and demand dynamics are highly favorable to BTC today. Data shows that supply has fallen sharply, with balances held in exchanges falling to the lowest level in years. That is a sign that Bitcoin holders are having a long-term view.

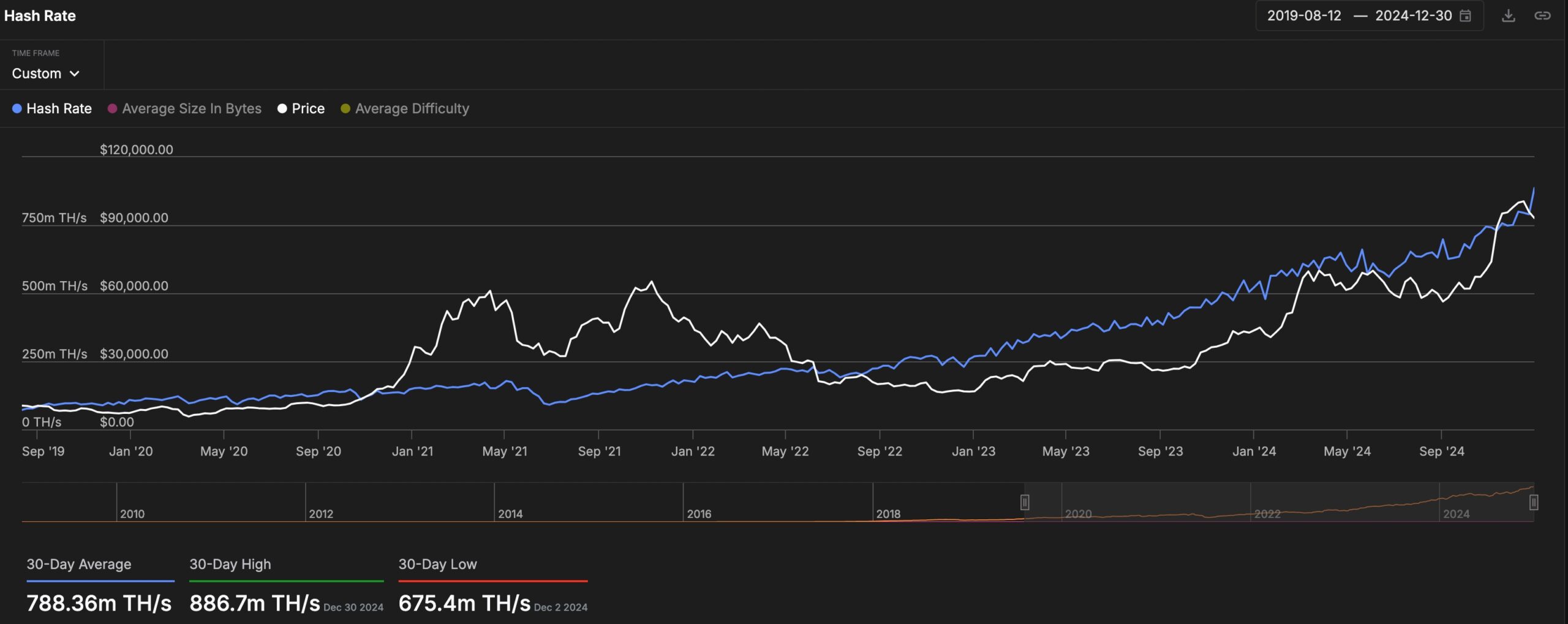

Second, Bitcoin’s halving event reduced block rewards by half, substantially increasing mining difficulty. As shown below, Bitcoin’s hash rate has soared to a record high, a trend that will continue in the near term. Bitcoin miner rewards have also continued moving downwards in the past few months.

On the demand side, there are signs that investors are still interested in Bitcoin. MicroStrategy is buying thousands of coins a week, while inflows into spot ETFs have continued soaring as more companies buy.

Therefore, a combination of falling supplies and rising demand indicates that the coin could jump, possibly to $200k this year.

On top of that, the FTX Estate is expected to make payments worth $16 billion in Q1. Some of the recipients of these funds will likely move them to cryptocurrencies like Bitcoin. Also, there are signs that the Securities and Exchange Commission (SEC) will be more friendly to the crypto industry this year.

BTC price may drop to $50,000

Still, there are risks that, despite its strong fundamentals, Bitcoin may drop to $50,000 in 2025. The biggest threat to Bitcoin’s performance is the bond market, which has continued its sell-off, generating substantial yields. The ten-year, five-year, and thirty-year yields have all jumped to the highest level in months.

These yields may keep rising if inflation continues rising, especially because of Donald Trump’s policies like tax cuts and tariffs. If this happens, the Fed may delay its interest rate cuts, which will lead to higher yields. Investors often move from risky assets like Bitcoin to money market funds when the Fed is hawkish, as happened in 2022.

The other risk is that Donald Trump’s SEC may not be as friendly to the industry as he suggested. There are signs that Trump is changing his tune on some of his top campaign pledges, like immigration and foreign policy. Also, hopes that the SEC will be friendly have already been priced.

Further, Trump’s trade war could impact the stock market, which will then affect Bitcoin and other cryptocurrencies.

Bitcoin price forecast

The most likely scenario is that Bitcoin surges to $200,000 in 2025. The weekly chart shows that the coin formed a cup and handle chart pattern, a popular continuation sign. This pattern was completed in November, and the coin remains above the 50-week and 200-week moving averages.

Bitcoin has consolidated near the key point at $100,000, a common occurrence when it hits a key resistance level. Therefore, the coin will likely rise to $122,000 initially, then pull back in the second quarter and zoom to $200k in the fourth quarter. $122k is a notable level because it is the target shown by the C&H pattern.