The United Kingdom’s Treasury introduced bold legislation to promote blockchain technology and attract crypto-native companies. On January 9, the Treasury amended key financial legislation to clarify that the collective investment scheme (CIS) regulatory regime does not cover crypto staking.

The amendment order is expected to provide clear guidelines for proof of stake (PoS) networks like Ethereum and Solana. It will allow UK-based staking service providers to operate free from the CIS sector, which keen observers believe is “heavily regulated” by the Financial Conduct Authority (FCA).

UK’s Bold Move to Permit Crypto Staking

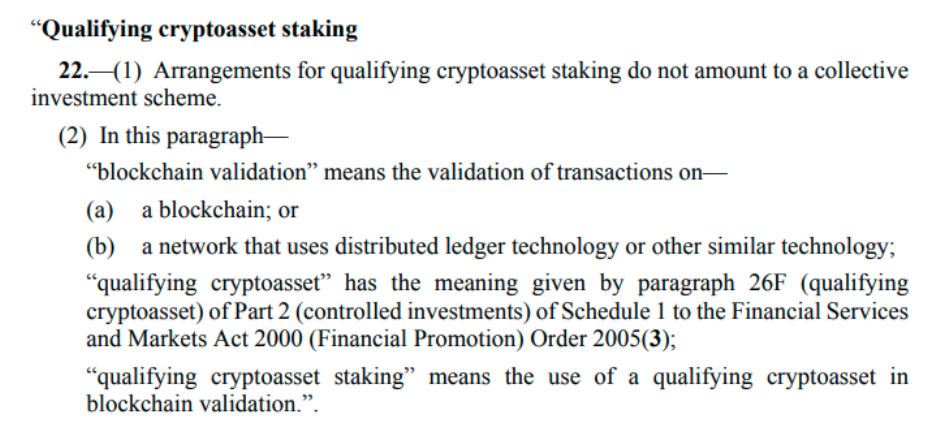

According to the UK amendment order, crypto staking doesn’t fit the definition of a CIS. A CIS scheme usually involves individuals pooling their funds for shared income or profits. CIS investors often buy into popular investment vehicles, such as mutual funds and exchange-traded funds (ETFs).

The move separates digital asset staking from traditional investment models regulated under the Financial Services and Markets Act 2000, exempting the blockchain validation process from the rigid CIS regulatory framework. The previous framework requires registration and authorization by the FCA and imposes ongoing compliance obligations.

The order comes into effect on January 31 and extends to England and Wales, Scotland, and Northern Ireland. The Treasury presented it to parliament on January 9, following a November announcement about crypto-centric regulations focusing on stablecoins and staking to make the UK market “more appealing” to blockchain companies.

Meanwhile, the Law Commission recently published a consultation paper proposing to classify digital assets as personal property. If passed, it would assign legal status to holdings, such as NFTs, RWAs, and virtual currencies. The bill marks one of the first crypto-related initiatives by the Prime Minister Keir Starmer-led Labour government.

READ MORE: Standard Chartered Launches Crypto Services in EU With New Luxembourg License