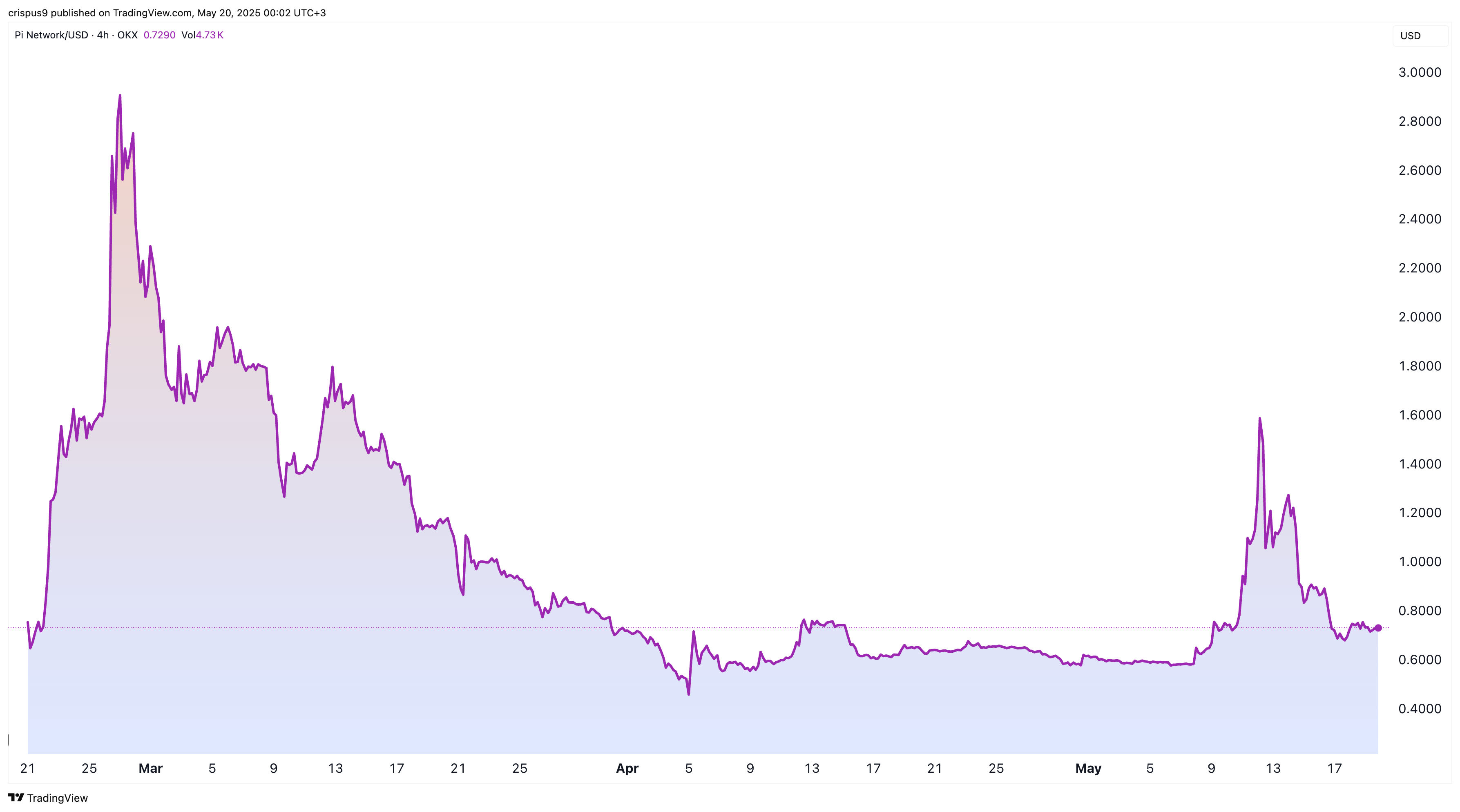

The Pi Network’s price continues to languish near its April lows as the odds of exchange listings by top companies like Coinbase, Binance, and Upbit remain slim. The Pi Coin token was trading at $0.7280 on Tuesday, down over 57% from its monthly high.

Why Tier-1 Exchanges Won’t List Pi Network

Pi Network ranks among the largest cryptocurrencies, with a diluted market capitalization exceeding $70 billion. Additionally, it is one of the most popular coins, boasting over 20 million verified users in its ecosystem.

Therefore, it is a big surprise that most tier-1 and tier-2 crypto exchanges have yet to list it, a move that would immediately earn them millions of dollars in fees.

The most likely reason why these exchanges have not listed Pi Network is that it is a highly centralized cryptocurrency whose activities are controlled by an obscure organization known as the Pi Foundation.

The Pi Core team has not disclosed much about the Pi Foundation, including its location. It has also not mentioned whether a major accounting company like Deloitte or PWC audits the foundation.

This transparency is crucial for three primary reasons. First, Pi Foundation holds over 90 billion of the unlocked Pi Coins in thousands of wallets. The only public wallets you can see PiScan hold 72 billion Pi coins valued at over $53 billion. The remaining 20 billion tokens are held in untraceable wallets.

Therefore, exchanges like Coinbase, Binance, Kraken, and Upbit are unlikely to list Pi Network until the developers agree to decentralize the project. Another option is to appoint a respected auditor to oversee these wallets and update the community whenever the Pi Foundation conducts transactions.

Recently, there have been accusations that the Pi Core Team and the Pi Foundation executed a rug pull scam. In this, they created speculation about an important news event and then sold tokens when the price surged.

Pi Coin Faces Ecosystem Challenges

Another reason top-tier 1 exchanges might avoid listing Pi Network is its status as a ghost chain. A ghost chain is a blockchain network with no developer activity.

One of the three key things that needed to happen before the mainnet launch was to have at least 100 mainnet-ready applications. The challenge has been that none of these applications has become popular.

To address this crisis, management has launched a $100 million ecosystem fund to support startups leveraging its technology. However, as we have seen with other chains with ecosystem funds, the risk is that many apps don’t become popular. Also, the network will take more than a year to have meaningful applications.

To be clear, some tier one exchanges may list Pi Network without an active ecosystem or utility. However, the initial pop after listing will likely be short-lived.